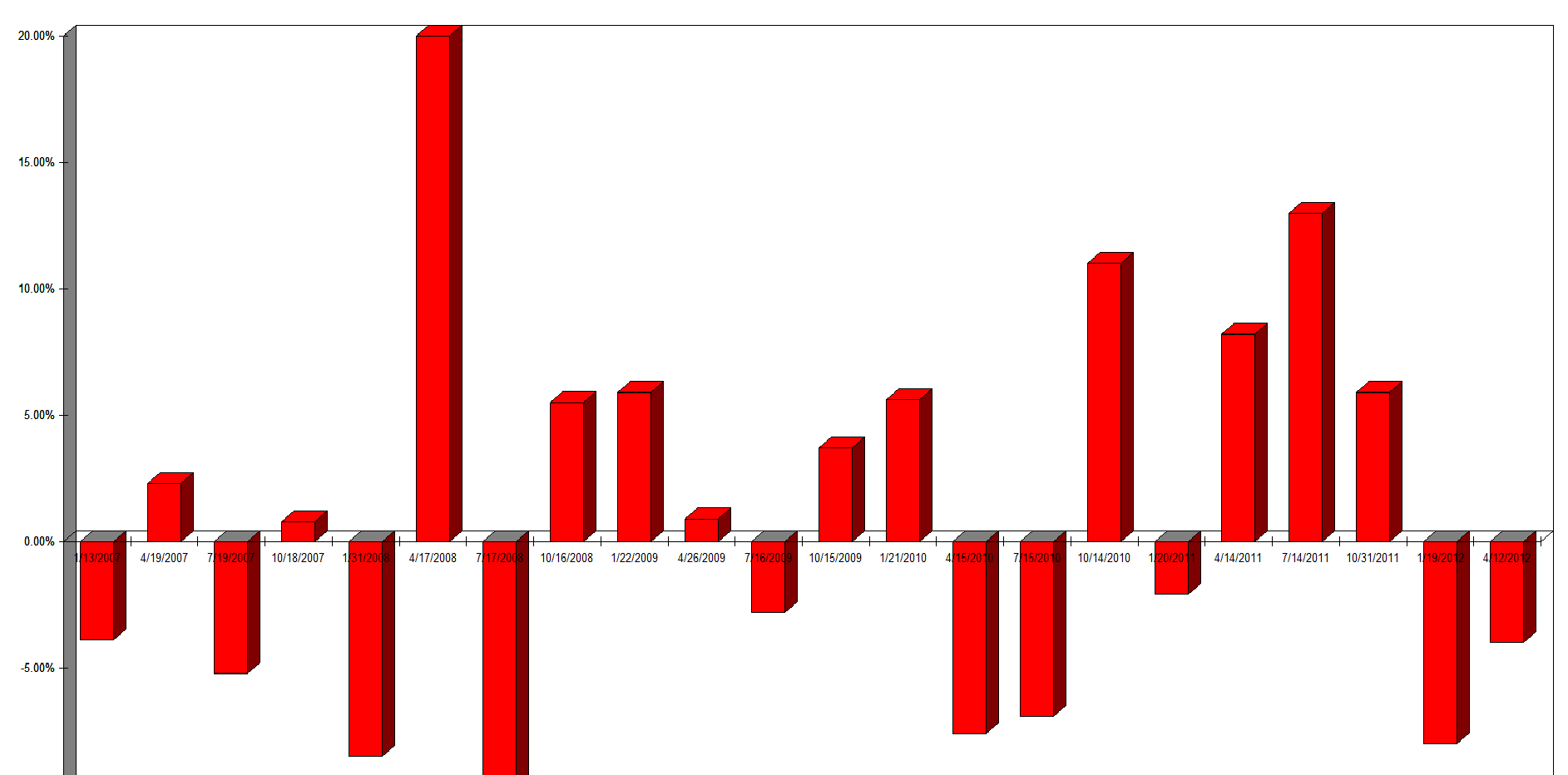

It seems like just yesterday when the world thought Europe's financial system was going to collapse on the weight of its severe debt issues. We posted this in june : https://www.optionmillionaires.com/2012/the-bizzaro-jerry/ . Fast forward 3 months and we are now over 4 year highs. Amazing! Are we better off now? Hard to say, but i guess the market thinks we are.

We had the August job numbers this morning. Unemployment dropped to 8.1% but less jobs were created then expected. Either way I think we ramp on these numbers. We are in a HEADS Bulls win TAILS bears lose environment.

I think we have some laggards follow through today, although I wouldnt call a 1%+ move being a laggard, but they did trail the indices. AAPL and PCLN are both on my early morning lotto radar for some calls today. PCLN was upgraded to buy and should see a 3-5%+ move. AAPL needs to break $680, then i think it flies to $690... Will look for $625/630 calls on PCLN and $685/690 on AAPL - PURE LOTTO PLAYS!

Others on watch today : CRM for the 150 break.

Still holding CMG calls and will add $310 calls on $305 break for lotto.

ISRG is another lotto. Will watch $500 calls for lotto.

Thats all for now. Lets finish the week GREEN!!!

- JImmybob