It's a holiday shortened trading week coming up. We have a jobs report coming on Friday, more U.S. Canada trade talks, and more earnings reports.

Earnings have been better than good....

80% of $SPX companies have beaten EPS estimates for Q2 to date, the highest percentage of companies reporting positive EPS surprises since we began tracking this data in 2008. https://t.co/mywCwPAYAb pic.twitter.com/CqqZW2aen0

— FactSet (@FactSet) August 31, 2018

72% of $SPX companies have beaten sales estimates to date for Q2, well above the 5-year average (58%). https://t.co/mywCwPAYAb pic.twitter.com/sHoncR41oh

— FactSet (@FactSet) September 2, 2018

we've seen $LULU type spikes as well as significant pull backs... think $NFLX and $FB. And no.. the Facebook collapse did not signal the end to this bull market as the Nasdaq, S&P500 and Russell 2000 all hit new all time record highs last week!

How about that! It was the Tuesday after Memorial day when futures were getting clocked! Down over 1.5% was the S&P500 at one point that session.

The $SPY was at $269 at the close that day... Italy was going to end the bull market once and for all..........

and then we had Turkey taking markets down a few weeks ago. The $SPY was trading just over $280, and the bears were willing to bet that the bulls were going to get turned into ham sandwiches.........

It turns out the Italy and Turkey pull backs were buy the dip opportunities... go figure.....

On Friday the $SPY closed the week higher than its ever closed a week before... over $290.

The named sell offs continue to offer great buy the dip opportunities....amazing....

of course its something I've been saying for 5+ years now...

A great read this weekend on all the doom and gloom:

You can go through every year and find most of those gloom and doomers talking about how ripe the market is for a crash. At some point they will get it right.

My thoughts are, when this market is ready for the drop, there will be time to trade for it. One of the signs that the market is about to see a prolonged move lower would be this:

Trading for that eventual move lower, that 20-50% correction that the doom and gloomers keep calling for.... its fighting the current. It's fighting the trend. The trend remains up.

With that said, here are some stocks I'm watching into this week. Many are names I continue to hold positions in. Note that I've been going out a little longer in time this year as these intra-day tweets have killed many a nice call option. Look no further than this past week when Trade Talks tweets and China $200 billion news took the market back down.

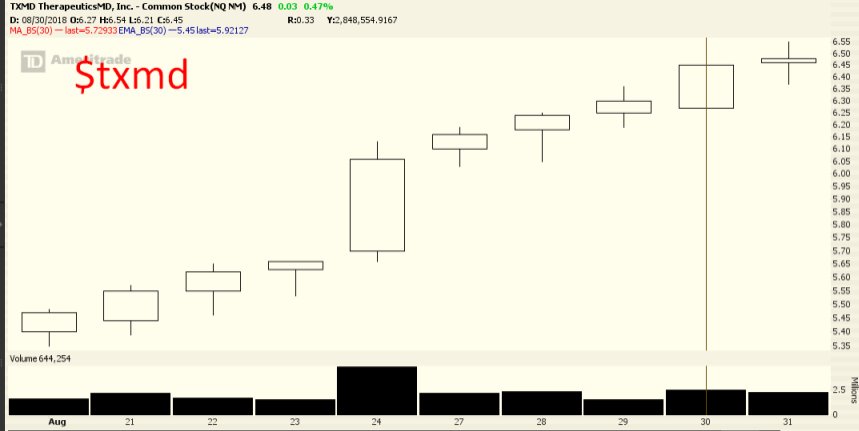

$TXMD

$TXMD closed higher Friday for the 10th consecutive session!