The so called 'January effect' is making it's way around Social Media and financial sites after today's rally - not so much because the S&P rose .85%, but more about which stocks rose. Some the the underperforming names into the end of the year like FitBit ($FIT), Valeant Pharmaceuticals ($VRX) , Sears Holdings ($SHLD), and Stratasys ($SSYS) all soared. The thought is that tax loss selling artificially pressures some names into the end of the year, only to see bargain hunters bidding them up to start the new year. You also have big holiday bonus money coming into the market.

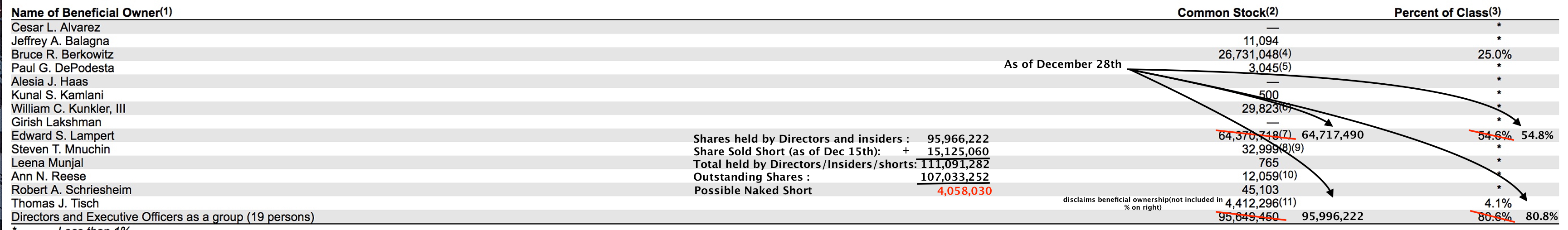

I added some Sears Holdings ($SHLD) calls in the afternoon on that premise, as the stock reversed early morning loses to close up over 4% on strong volume. By no means do I trade Sears Holdings ($SHLD) for it's sound fundamentals or for a possible turnaround story. I trade Sears Holdings ($SHLD) for it's historic volatility, tight float, high short interest, and that fact that the CEO owns over 50% of the outstanding shares. While everyone was out plotting Sears Holdings ($SHLD) pending Bankruptcy and delisting, I was busy analyzing the share structure. Sears Holdings ($SHLD) may enjoy little consumer demand but they certainly seems to have no issue with demand when it comes to their stock. At last check, it looks like there is a possible naked short of 4 million shares:

Any further buying pressure could bring some short covering. There is also the possibility of an update from the company around their Kenmore and Craftsman brands - news that would likely push the stock up 10-15%+.

As I mentioned before, I am not trading for the company turnaround, but for a short term move. Think the stock can move to the $12-13 area in the next two weeks, where I will re-evaluate the trade. The $10 level would be a key break, which could come tomorrow:

Happy Trading!

-JB