Finally some follow through. Yesterdays session had the bulls on edge as the market tried and succeeded in pulling back from session highs.

This mornings continuation of a rally that started at the lows on Monday is setting the market up for higher prices in the short term.

Some great perspective from JB on the morning watchlist.

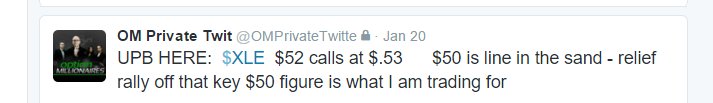

Better to be a little early. The $XLE calls early in the week are working out to near perfection. That $50 test worked wonders for an energy bounce. Every dog has its day. And regardless where $XLE and the market head in the weeks ahead, we have our move this week and right now that is all that matter.

Look at the support levels on some of the morning charts.

Quite impressive - Morning Charts

I joked this week namely during the massive reversal off the lows that this was the shortest recession on record. We've seen over the last few years a manic market. Up one day, down the next. We are on the cusp of the next recession and in a nasty bear market Monday, on Tuesday stocks are a great value and the stock market is ready to make a move to fresh record highs.

The short term action has been nothing short of spectacular. When trading options keep the trades small, because when these stocks move, they have been doing it in a dynamic fashion.

Key support levels have been reclaimed save one. And I think we will reclaim $190 for $SPY later today. That sets the market up for at least a short term bottom.

$IWM $100 $QQQ $100 $SPY $190 $XLE $50 VIX UNDER 30

For $SPY to reclaim $190 S&P500 futures will need to break 1900.

Which would also break this dreadful downtrend to start 2016.

A few trades I am looking for today.

Some $SBUX calls of the dip for a relief rally today.

Some $AXP calls for a bounce off the lows this morning.

Stop on by the om.com chat room today

We are in the temp room for one day only - its open for everyone.

Have a great weekend.

-UPB