Stocks closed higher for the third session in a row on Tuesday, with the S&P adding .56% in a choppy trade. Asia markets closed lower overnight while Europe indexes are mostly in the red so far this morning. U.S. futures are pointing to a lower open, the Dollar and Yields are higher while Oil and Gold are lower.

And this is what UPB is reading this morning: https://www.optionmillionaires.com/morning-reads-137/

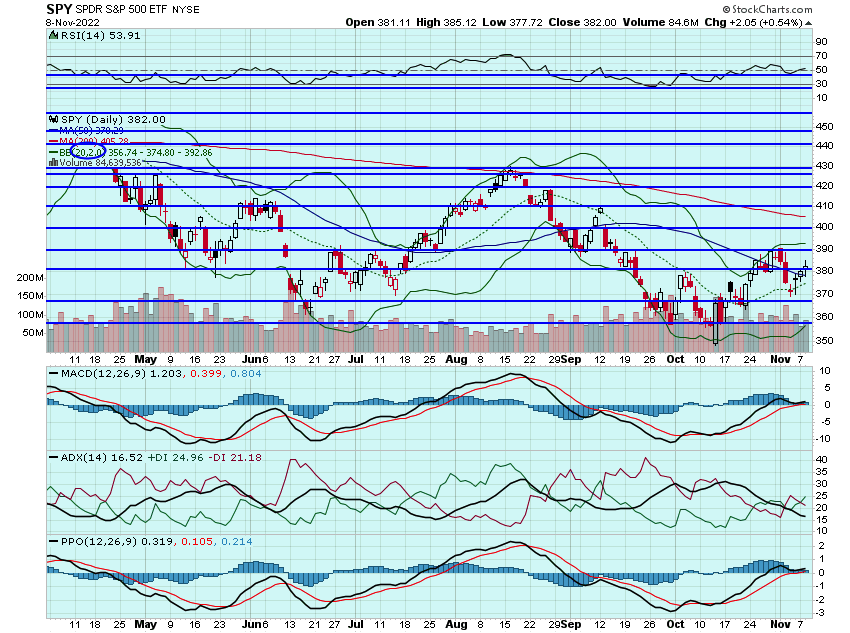

Markets are pointing to a lower open this morning, looking to give back some of its 3-day rally. Tomorrow we get the much anticipated CPI numbers. Any higher than expected print and markets will likely give back most/all of the recent gains. There are now folks saying that the Fed may be forced to take rates over 6% next year, a hotter number and that argument may start gaining steam. I think the CPI will come in below expectations - good news has been bad news lately so will be interesting to see how the market reacts. The SPY closed over the 50dma for the second session in a row yesterday and seemed to find support right around that $379 area. So will be watching that today:

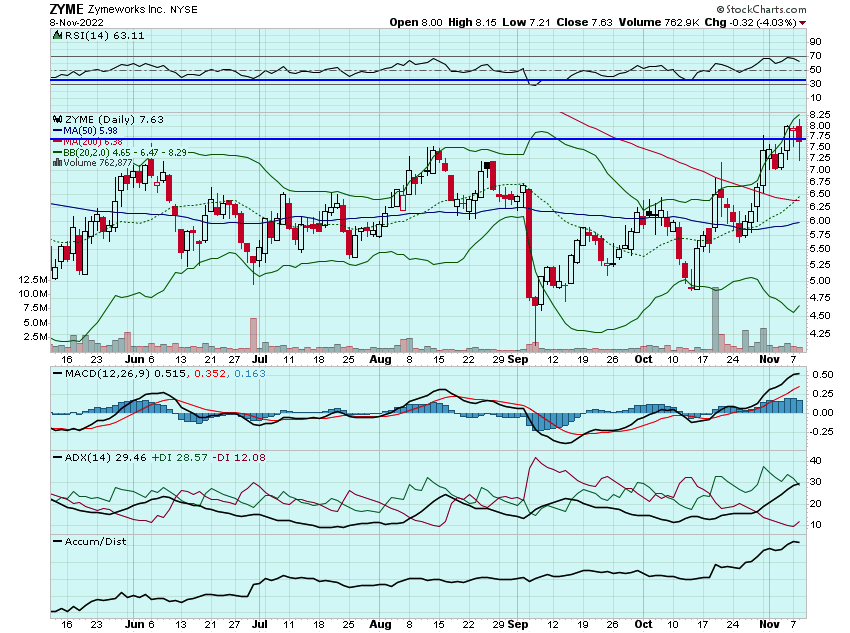

ZYME closed lower yesterday ahead their earnings after the bell. ZYME is not really an earnings story as its still an early stage bio, so the corporate update means much more.. ie. how much cash they have, how long will the cash last, and will they need to raise more capital. I think the report was positive on that aspect and their recent deal with JAZZ bodes well for the future. Still think this can look to test double-digit in the coming weeks but will use the $7 handle as a stop and revisit if there is weakness today:

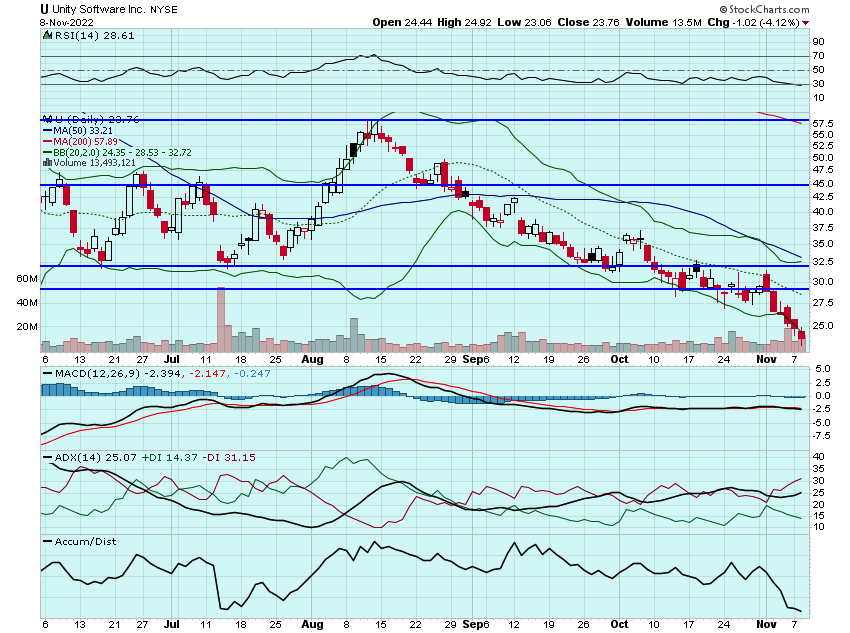

It was a rough day for U, closing lower for the 6th session in a row and failing to find any decent bid. The plan was to be able to close some/all of my calls out before the close today for profit. That does not look like it will be the case pending any crazy move today. I may cut the position for a loss at some point today and revisit:

DPZ came right down to test its 50dma yesterday before bouncing. If that holds, could be ready to bounce up near $370 or so. Still eyeing calls but will wait for some strength:

3 tight sessions in a row for WING and could finally be ready to break into the $160s and then over $170. Still eyeing some calls, likely $175s:

AXON is a name I have traded in the past and its back on my radar after a monster earnings report yesterday after the close. In a nutshell their main business is body cameras for law enforcement and other departments. They continue to grow at an over 20%+ clip and this could be a name that continues to perform well even if the market remains pressured. May look to add some calls today for a potential move back over $190 in the coming weeks:

Here are the analyst changes of note for today:

| xon price target raised to $160 from $140 at Northland |

| Northland analyst Michael Latimore raised the firm's price target on Axon to $160 from $140 and keeps an Outperform rating on the shares after the company "handily beat" Q3 estimates. Axon also increased FY22 guidance and he is raising his own FY22 and FY23 estimates following the report given the company's "leading technologies and market tailwinds," Latimore tells investor |

| Axon price target raised to $152 from $142 at Credit Suisse |

| Credit Suisse analyst Sami Badri raised the firm's price target on Axon to $152 from $142 and keeps an Outperform rating on the shares. The company reported another solid quarter, posting revenues/Adjusted EBITDA of $311.8M/$67.8M, well above his estimates of $286.3M/$49.3M, achieving solid top-line growth along with margin expansion. Additionally, management raised the full year 2022 guidance again, revising up revenues guidance to $1.15B-$1.16B, representing a 34% year-over-year at mid-point, the fourth beat-raise since Q4, demonstrating how resilient Axon is amid economic slowdown concerns, Badri adds |

| PubMatic price target lowered to $19 from $24 at Lake Street |

| Lake Street analyst Eric Martinuzzi lowered the firm's price target on PubMatic to $19 from $24 and keeps a Buy rating on the shares following a Q3 revenue shortfall due to weakened demand in all geographies amid growing economic uncertainty. While he has lowered his estimates, he likes the fact that PubMatic has scale, cash, and cash flow and believes the company will take share during the downturn, the analyst said |

| Home Depot price target lowered to $312 from $330 at MKM Partners |

| MKM Partners analyst David Bellinger lowered the firm's price target on Home Depot to $312 from $330 and keeps a Neutral rating on the shares as part of a broader research note on Home Improvement names. Mixed signals across the housing spectrum put into question the forward demand outlook, although Q3 comps are likely to have held largely firm for both Home Depot and Lowe's, the analyst tells investors in a research note |

| Nasdaq price target raised to $71 from $65 at Oppenheimer |

| Oppenheimer analyst Owen Lau raised the firm's price target on Nasdaq to $71 from $65 and keeps an Outperform rating on the shares following the company's Investor Day. The day began with a strategic overview and a look at how CEO Adena Friedman sees the growth drivers to elevate Nasdaq's potential, followed by discussions on growth initiatives from major business heads and a panel conversation, the analyst notes. Lau highlights several key incremental points, namely increasing medium-term organic revenue growth outlook of Solutions businesses to 7%-10%; addition of 50%-plus SaaS % ARR by Q4 2027; disclosures of segment medium-term organic revenue and organic non-GAAP expense growth outlook; and Enterprise ESG revenue should more than double in 2027 |

And here is what I am watching today: DPZ, WING, AXON. CMG, NFLX, U, SPOT, ISRG, AXNX, HUM, CI, and PZZA.

Let's have a great day!

-JB