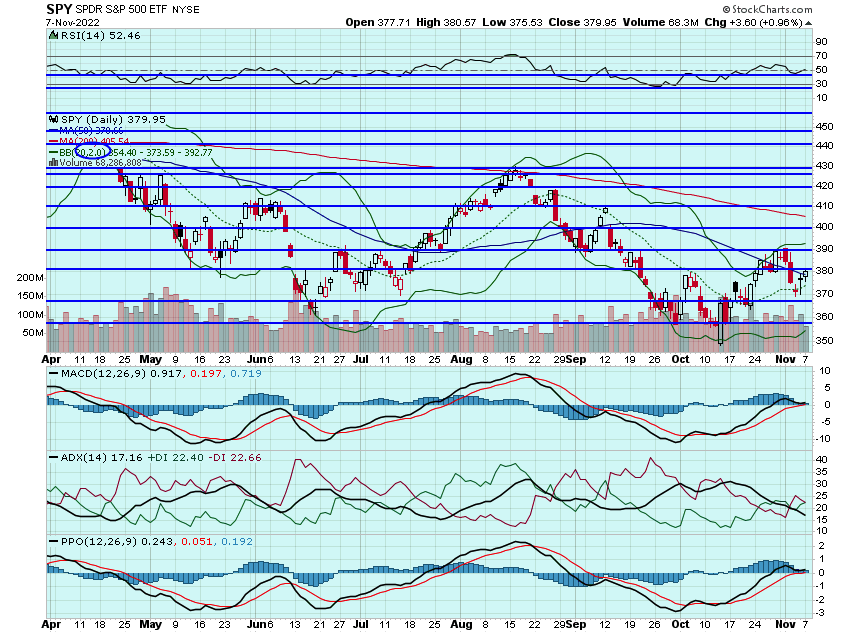

Markets closed higher to start the week, with the S&P adding .96% on Monday, with an afternoon surge helping to pad gains. Asia markets closed mostly higher overnight while Europe indexes are mixed this morning. U.S. futures are pointing to a higher open, the Dollar is higher while Oil, Gold, and Yields are all lower.

Futures are pointing to a third session in a row of gains ahead of the mid-term elections today. A great stat from Marketwatch, 'in the 19 midterm elections since WWII, the S&P 500 has always been higher one year after the vote.' Certainty is typically good for stocks and we will get that today. A split of power also can be construed as a net positive as it is harder to pass new legislation and creates more checks and balances... time will tell. The SPY closed back over that 50dma. That holds today, think $390 comes before the next possible pull. Don't forget we get CPI data Thursday:

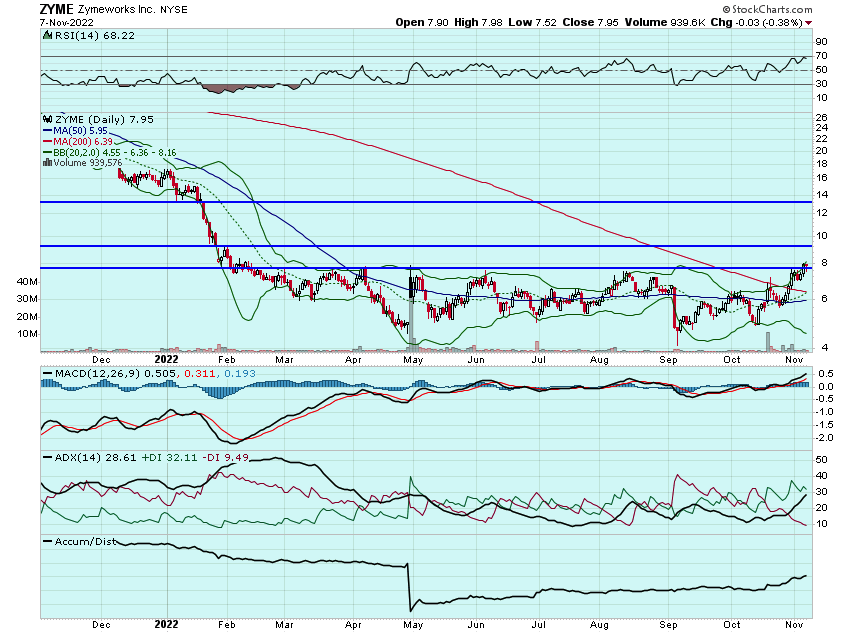

ZYME reversed morning losses to close flat on Monday. I used the move to close some of my calls out to cover costs. It held that key $7.75 handle and truly think this can come and test the double-digits in the coming weeks:

U reports earnings after the close tomorrow. The stock hit multi-year lows yesterday. Once the $24 handle held I went and added some weekly strikes. If I am able to get some premium build before the close tomorrow I will look to close some/all. If not, I will likely close the position and revisit. As much as I think there is an opportunity for a decent quarter and for the stock to rally, seeing names like TWLO and its post earnings reaction give me some pause:

I am still eyeing WING for some calls for the eventual move into the $160s and $170s. The stock was weak at the open yesterday so I passed... sure enough it reverses course to close higher. On watch again today:

SPOT finally closed green yesterday after 5 down sessions on the heels of their earnings report that was mixed... they beat on revenues and growth but margins were an issue. Think there is a playable bounce here back into the $80s. May look at some weekly lotto calls today:

NFLX has fallen for 8 sessions in a row and closed the earnings gap. Could be a nice bounce play into the end of the week for a move to $280 or so:

And lastly, still eyeing DPZ and ROKU.

Here are the analyst changes of note for today:

LendingTree price target lowered to $35 from $55 at Oppenheimer |

| Oppenheimer analyst Jed Kelly lowered the firm's price target on LendingTree to $35 from $55 and keeps an Outperform rating on the shares on Q4 likely representing trough-earnings. Following the $25M cost-savings, his 2023 EBITDA remains largely unchanged at $95M, and his 2023 forecast implies insurance recovering the quickest from inflationary pressures, consumer growing low-single digits, and Homes -20% year-over-year versus -50% in the second half of 2022. Fundamentally, Credit Cards -10% year-over-year on search marketing competition is largest non-Macro worry, and a stark contrast to public comps posting strong growth, Kelly argues |

| DigitalOcean price target lowered to $37 from $45 at Barclays |

| Barclays analyst Raimo Lenschow lowered the firm's price target on DigitalOcean to $37 from $45 and keeps an Overweight rating on the shares. The company's Q3 results positively showed average revenue per user will continue to be the most influential driver for growth, Lenschow tells investors in a research note. DigitalOcean has several levers to pull after its broad-based price increase, but the shares will remain volatile near-term as investors question how the company will get to its fiscal 2024 $1B revenue growth target, says the analyst |

| Palantir price target lowered to $7 from $8 at Deutsche Bank |

| Deutsche Bank analyst Brad Zelnick lowered the firm's price target on Palantir to $7 from $8 and keeps a Sell rating on the shares. While the company's Q3 results came in ahead of guidance, this was within the context of slowing sales growth against easier comps and significant non-GAAP operating margin contraction, Zelnick tells investors in a research note |

| Electronic Arts remains top pick in video games at Deutsche Bank |

| Deutsche Bank analyst Benjamin Soff lowered the firm's price target on Electronic Arts to $157 from $160 and keeps a Buy rating on the shares post the fiscal Q2 results. EA remains the analyst's top pick in video games this year. The company has strong underlying growth for its core franchises, a "fairly robust" release slate for the balance of fiscal 2023 and an "underappreciated multiyear development pipeline," Soff tells investors in a research note. He says the shares are trading at an attractive valuation, near the low end of its recent historical range |

| SolarEdge price target lowered to $370 from $377 at B. Riley |

| B. Riley analyst Christopher Souther lowered the firm's price target on SolarEdge (SEDG) to $370 from $377 and keeps a Buy rating on the shares. The analyst views the Q3 results as "solid" and says the shares are trading at a discount to the company's closest peer Enphase Energy (ENPH) |

And here is what I am watching today: DPZ, ROKU, WING, CMG, NFLX, U, SPOT, ISRG, AXNX, HUM, CI, and PZZA.

Let's have a great day!

-JB