Markets closed mixed on Tuesday, with the S&P and Nasdaq closing slightly in the red while the Dow closed higher. Asia markets rallied overnight while Europe indexes are in the green this morning. U.S. futures are pointing to a bounce, the Dollar and Yields are lower while Oil and Gold are higher.

And this is what UPB is reading this morning: https://www.optionmillionaires.com/morning-reads-150/

It was a choppy session for stocks on Tuesday, with the SPY selling off in the mid-morning but failing to regain the losses into the close. The SPY and that 200dma seem like oil and vinegar. Going to need to see that level broken soon or fear we may have more selling pressure. Today there is a Powell speech at the Brookings institute which may move markets a bit, certainly something to be aware of. Outside of that, there is not much in the way of market catalysts until mid-december. Still think $415 0r so is coming on the SPY in the coming weeks outside of any surprise negative catalyst:

U rallied yesterday morning before giving back its gains. I was able to close some of my calls out for 50%. Certainly looks like a bull-flag is playing out. Think a move into the $40s is coming and make look to add some strikes into next week today:

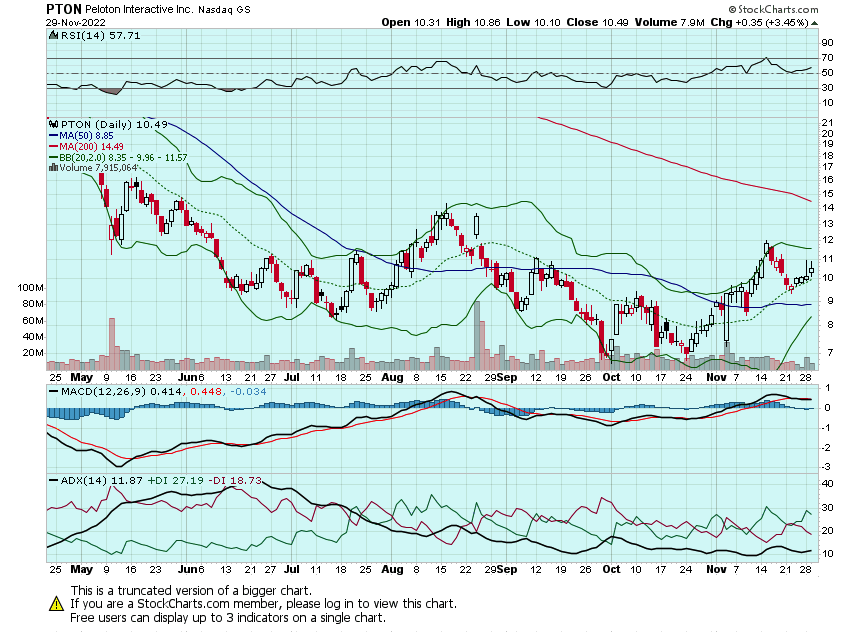

This PTON chart is setting up nicely as well. A break above $12 should send it to $14+. May look to add some more strikes to play for that move:

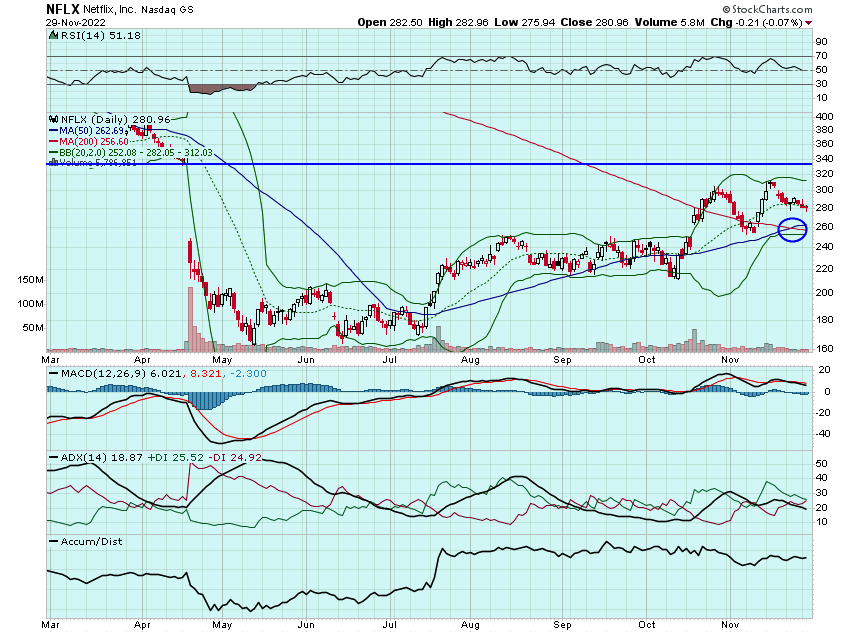

I have been watching SAM and NFLX for higher moves after their Golden-crosses. Both have struggled. Will be watching both again today. If they get bid, will be looking to0 add calls.

SAM for a move to $390+:

And NFLX for a move to $320:

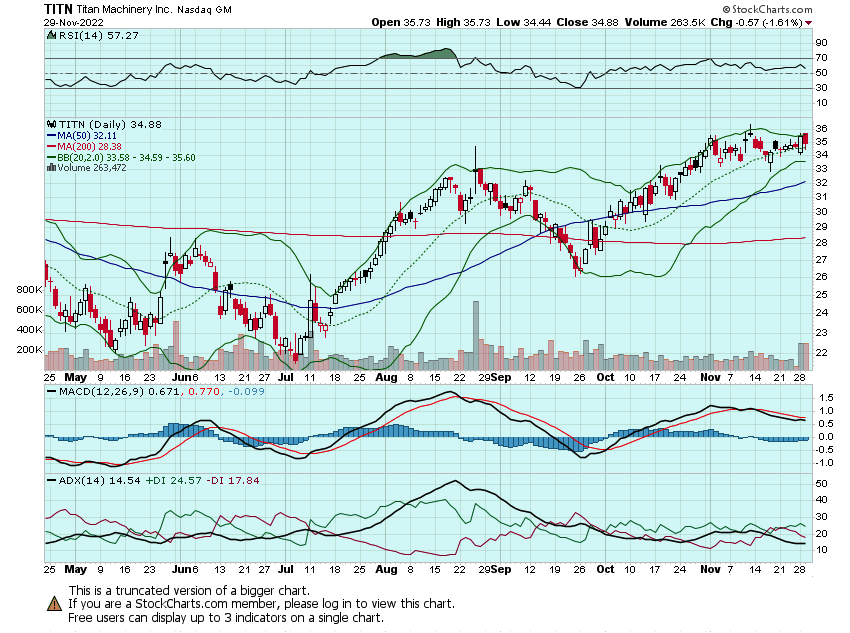

TITN is a name I had on my top 5 stocks years ago. It looks to be breaking out and just reported a monster quarter with a beat and raise. May look for some calls to play for a move into the $40s:

And lastly, still eyeing ULTA into earnings.

Heree are the analyst changes of note for today:

| Mizuho says Biogen not mentioned in 90 minute lecanemab presentation |

| Mizuho analyst Salim Syed points out that the name "Biogen" was not mentioned during last night's 90 minute presentation on the detailed Phase 3 results for lecanemab. Biogen (BIIB) is clearly a partner to Eisai (ESLAY) in the lecanemab program, but no where during the presentation was "Biogen" uttered, Syed tells investors in a research note. "I do wonder if this alone will put pressure on Biogen stock today, and whether it signals a growing possibility of an oncoming litigation between the partners," writes the analyst. Syed adds that the presentation was as expected, "meaning the data overall continued to look great, and any 'holes' were in the subgroup analyses." He believes none of these are likely to tank the thesis that the drug will get approved and used, assuming reimbursement. Syed has a Buy rating on Biogen with a $325 price target. The stock in premarket trading is up 3% to $300.15 |

| Crowdstrike price target lowered to $145 from $235 at DA Davidson |

| DA Davidson analyst Rudy Kessinger lowered the firm's price target on Crowdstrike to $145 from $235 but keeps a Buy rating on the shares. The company's Q3 net new ARR was "very light", and its FY24 outlook will put downward pressure on forward consensus estimates, the analyst tells investors in a research note. Kessinger adds that while cybersecurity demand remains resilient and budgets are not seeing cuts, new deal cycles are "lengthening". The analyst still sees Crowdstrike as "one of the highest quality names in security" however |

| izuho says Biogen not mentioned in 90 minute lecanemab presentation |

| Mizuho analyst Salim Syed points out that the name "Biogen" was not mentioned during last night's 90 minute presentation on the detailed Phase 3 results for lecanemab. Biogen (BIIB) is clearly a partner to Eisai (ESLAY) in the lecanemab program, but no where during the presentation was "Biogen" uttered, Syed tells investors in a research note. "I do wonder if this alone will put pressure on Biogen stock today, and whether it signals a growing possibility of an oncoming litigation between the partners," writes the analyst. Syed adds that the presentation was as expected, "meaning the data overall continued to look great, and any 'holes' were in the subgroup analyses." He believes none of these are likely to tank the thesis that the drug will get approved and used, assuming reimbursement. Syed has a Buy rating on Biogen with a $325 price target. The stock in premarket trading is up 3% to $300.15 |

| Biogen price target raised to $350 from $325 at Jefferies |

| Jefferies analyst Michael Yee raised the firm's price target on Biogen (BIIB) to $350 from $325 and keeps a Buy rating on the shares after the company and partner Eisai (ESALY) presented the full Phase 3 lecanemab data at CTAD. The presentations at CTAD "showed clear positive efficacy and no major concerns on safety," according to Yee, who came away from the presentation with "comfort the data are clean, and importantly any major risk is removed and the overhang shall now pass." Given his view that long-term investors are "more likely to become bullish and get involved" following the presentations, Yee contends that Biogen's stock "can go higher" from here |

Intuit price target lowered to $475 from $525 at Wells Fargo |

| Wells Fargo analyst Michael Turrin lowered the firm's price target on Intuit to $475 from $525 and keeps an Overweight rating on the shares. The analyst notes Intuit's Q1 results were above guidance, in line with the prior pre-announce provided earlier this month. The SBSE segment continues to drive outperformance, with growth +19%, offset by Credit Karma-related headwinds - which led to just 2% growth, Turrin adds. Post print, he expects Intuit's shares will go quieter into year end, with the tax season discussion early next year presenting the next likely catalyst |

| Medtronic price target lowered to $77 from $82 at Wells Fargo |

| Wells Fargo analyst Larry Biegelsen lowered the firm's price target on Medtronic to $77 from $82 and keeps an Equal Weight rating on the shares. The analyst is updating his 2024 and forward EPS forecast for Medtronic, as he corrects for the company's expected FX impact on EPS |

And here is what I am watching today: ULTA, TITN, SAM, NFLX, PTON, U, BIIB, RARE, ROKU, DKS, BURL SPOT, TWLO, WING, CMG, and DPZ.

Let's have a great day!

-JB