Futures are pointing to a red start to the week, with the S&P set to open .71% lower as I write this. Asia markets sold off overnight while Europe indexes are in the red this morning. The US dollar, Yields, and Oil are lower while Gold is higher.

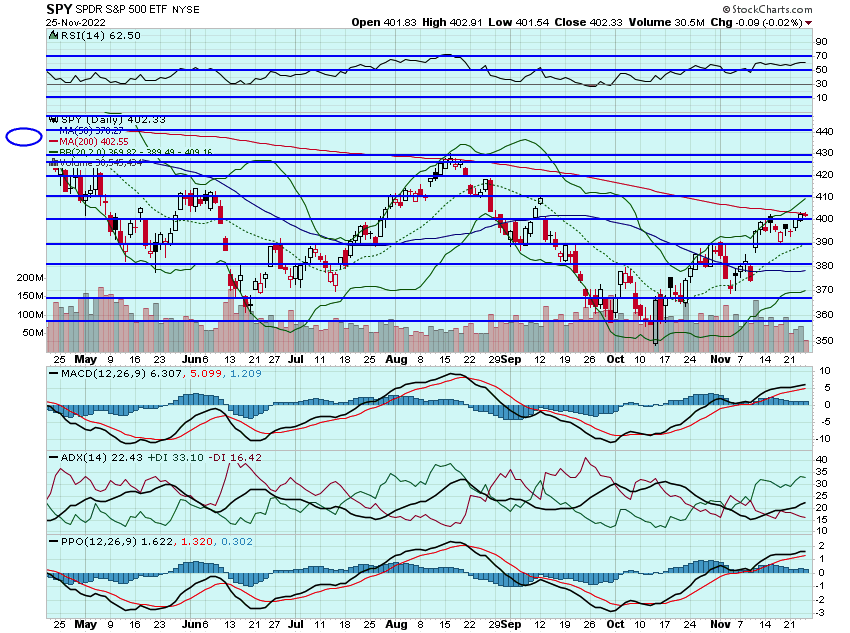

Markets are pointing to a lower start to the week as Covid protests in China weighed. Markets are also looking to consolidate their recent rally. The SPY tried, and failed, to close above that 200dma. Would bode well for more highs if it can find a bid and close above that in the next day or two. Today will be all about the Black Friday sales numbers and speculation on Cyber Monday results. There are also still plenty of earnings reports, I will have the implied moves up later today. ULTA is still a name I will be watching into earnings:

I added some RARE calls on Friday with the stock running on no news to speak of. I haven't traded this stock in years but do love the company and their pipeline. Think some of these bigger bio names could find it attractive as a buyout candidate and they also present at the Piper Healthcare conference this week. Think a move over $40 is coming soon. Will look to lock some of my calls in to cover costs and ride the rest:

Retail has been on fire the past few weeks. I was able to trade DKS for some nice profits though watched it traded into the $120s on Friday, missing out on a 1200% gain. Think ULTA can provide a nice opportunity with earnings on Thursday. May look to add some calls today for premium build and think it can trade near $490 or so on a beat and raise:

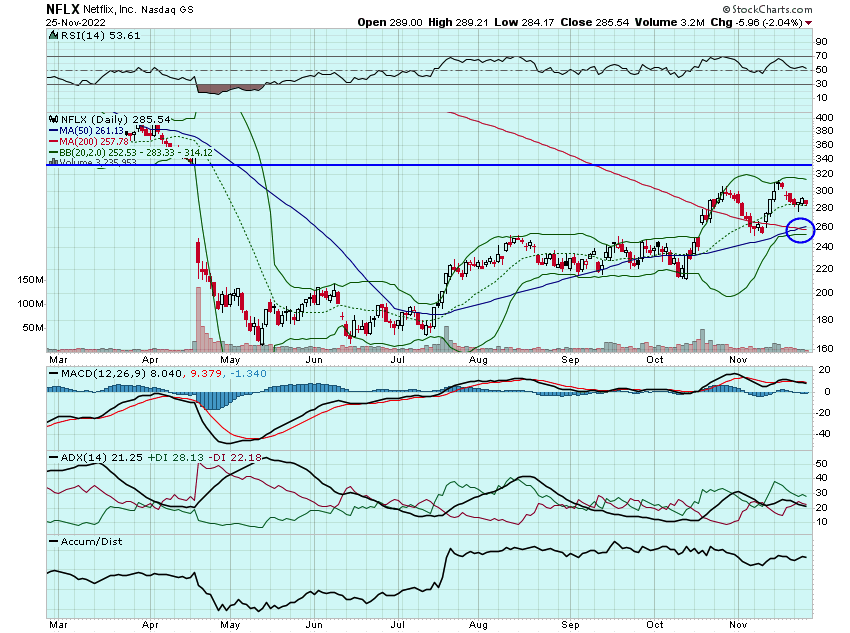

SAM and NFLX are still my favorite golden-cross plays. SAM was treading water on Friday only to find a late day bid to close solidly in the green Can see SAM heading to $400+ in the coming days so will be looking t0o add some calls:

NFLX still looks great here and think a move to $320 or so is coming soon. Will be looking at some calls here today:

ROKU failed to cooperate for the last of my calls on Friday. Still like this one to rally into the $60s at some point so still on watch.

We have a few weeks until the CPI numbers and Fed meeting, so outside of any crazy catalyst, think markets can melt higher.

Here are the analyst changes of note for today:

Zscaler price target lowered to $190 from $225 at MKM Partners |

| MKM Partners analyst Catharine Trebnick lowered the firm's price target on Zscaler to $190 from $225 and keeps a Buy rating on the shares. Despite the current macro backdrop, the firm's conversations with eight partners and CISO contacts indicated resilient demand for Zscalar's role in the adoption of Zero Trust platforms, Trebnick tells investors in a research note. The analyst says she l |

| Nio assumed with a Hold at Jefferies |

| Jefferies analyst Johnson Wan assumed coverage of Nio with a Hold rating with a price target of $11.26, down from $42.30. The analyst expects a "challenging year" for China's automakers - citing the "honeymoon stage of early NEV adoption" coming to an end, an intensified competition under a price war led by Tesla (TSLA), and the removal of EV subsidies and rising lithium prices. Until deliveries pick up, high fixed costs from R&D and SG&A will "continue to derail" Nio's path to profitability, Wan contends |

| Deere price target raised to $520 from $445 at DA Davidson |

| DA Davidson analyst Michael Shlisky raised the firm's price target on Deere to $520 from $445 and keeps a Buy rating on the shares following the Q4 results. There is a great deal to like at this point, with management essentially agreeing with the firm's "stronger for longer" thesis, Shlisky tells investors in a research note |

| Raytheon Technologies a Best Idea for 2023, says Cowen |

| Cowen analyst Cai von Rumohr Called Raytheon Technologies a Best Idea for 2023 as he believes investors don't fully appreciate the likely aftermarket recovery in 2023 or defense lift in 2024-25. He said the company has the highest estimated adjusted EPS growth of the A&D big caps. von Rumohr Reiterated his Outperform rating and $120 price target on Raytheon Technologies shares |

| Apple iPhone shortages build into holiday season, says Wedbush |

| Wedbush analyst Daniel Ives says that with the "head scratching" zero COVID policy in China now reaching a tipping point and protests across the country, Apple is essentially caught in the cross-fire heading into the all-important Christmas time period. He estimates that Apple now has significant iPhone shortages that could take off roughly at least 5% of units in the quarter and potentially up to 10% depending on the next few weeks in China around Foxconn production and protests. In many Apple stores, the analyst is seeing major iPhone 14 Pro shortages of up to 35%/40% of typical inventory heading into December with online channels pushing deliveries into early January in many cases depending on model/storage/color. Ives has an Outperform rating and a price target of $200 on the shares. |

| Black Friday winners Include Best Buy, losers include Pets, says Wedbush |

| After completing channel checks, reviewing industry data, and analyzing retailers' promotions over Black Friday weekend, Wedbush analyst Seth Basham notes consumers were chasing deals, with discounting up year-over-year across most retailers, but promotions were not extreme for most hardlines retailers under coverage. Overall, consumers appear to be returning to more normal holiday shopping timing after pulling forward many sales to October last year due to supply chain headlines, possibly indicating that this Black Friday period did not live up to expectations, Basham adds. He sees hardlines retailers with strong omnichannel capabilities and disciplined promotion strategies best positioned near-term, with Dick's Sporting (DKS), Academy Sports (ASO), Best Buy (BBY) and Tempur Sealy (TPX) at the top of his shopping list. In contrast, the analyst found much higher promotions year-over-year at Bed, Bath & Beyond (BBBY), Chewy (CHWY), Petco (WOOF) and direct-to-consumer mattress retailers |

And here is what I am watching today: ULTA, NFLX, SAM, ROKU, DKS, BURL,, U, SPOT, TWLO, WING, CMG, and DPZ.

Let's have a great day!

-JB