Hope everyone had a great Thanksgiving. Futures are pointing to a mixed open on this holiday shortened trading session. Asia markets closed mostly lower overnight while Europe stocks are in the green this morning. The US dollar, Yields, Oil, and Gold are all higher this morning.

And this is what UPB is reading this morning: https://www.optionmillionaires.com/morning-reads-148/

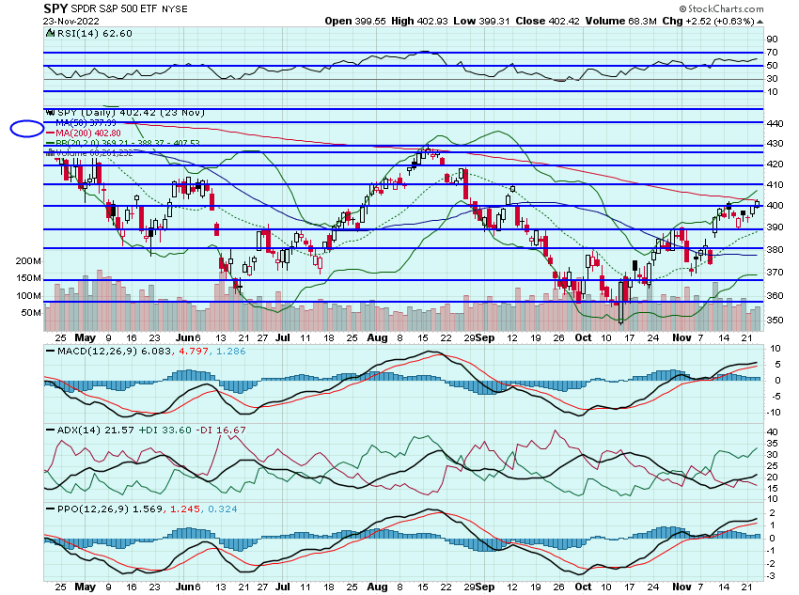

Stocks closed higher on Wednesday, with the S&P adding .83%, as the Fed minutes painted a picture of a Fed ready to start slowing down the pace of their rate hikes. The SPY broke and held that $400 handle and is nearing the 200dma this morning, a key point of resistance:

As I have been mentioning on the past few watchlist's, think if that 200dma can be broken and held, $415 or so can come quickly. Earnings are winding down and the next batch of market catalysts are not until mid-december with the Fed decision on December 14th and the November CPI number the day before on December 13th. There will be a lot of chatter around Black Friday sales numbers and Cyber Monday in the coming days, but think these numbers have become less relevant as a sales benchmark over the past few years as deals have been spread out over the entire Holiday Season. And quite honestly, think any strong numbers will be met with more selling, as folks worry the Fed will remain on a hawkish path. Would really like to see a close above that $402.80 today:

I closed the last of my DKS calls for nearly 600% on Wednesday. The stock was over the upper Bollinger band and has a history of struggling to find gains above that level. May revisit but will wait for a pull-back:

I added some ROKU calls on Wednesday, with the stock trading right near its 50dma. The stock found some buyers in the afternoon and I was able to close some of my calls for 50%. If it fails to hold $56 in the morning, will look to close the rest out and revisit. If it does find some support, think it can trade up near $59:

BURL traded up again on Wednesday and now looks poised to enter the $200s. I may look at some spec $200 calls today and/or some strikes into next week. Think it is possible this head back to $230 or so in the coming weeks:

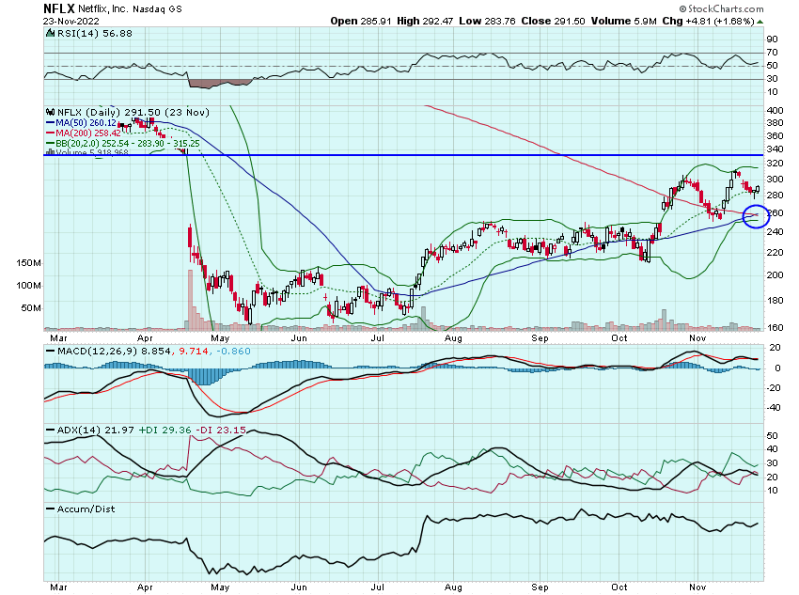

There has been quite a bit of chatter over the past few days around Golden-crosses setting up in some names. That is where the 50dma crosses the 200dma, with the premise being that finally the long-term downtrend in a stock is over and buyers have come back in. NFLX is one example. The stock is already well off its July lows but maybe a possible gap fill coming up near $330 or so. May look to add some calls for that outcome:

SAM is another name sporting a Golden-cross. The stock rallied after its earnings in October but has given back most of the games. I think most of the bad news with their hard-seltzer is priced in and the stock can rally up near $400. May look to add some calls there as well:

These. half-days tend to be low volume sessions but there can be some opportunities as stocks find air pockets of buyers(and seller).

Here are the analyst changes of note for today:

Silvergate Capital price target lowered to $24 from $37 at Morgan Stanley |

| Morgan Stanley analyst Manan Gosalia lowered the firm's price target on Silvergate Capital to $24 from $37 and keeps an Equal Weight rating on the shares. Gosalia took EPS estimates down further following Silvergate's disclosure that its digital deposits declined from $11.9B on September 30 on an end-of-period basis to $9.8B on November 15 on an average-QTD-excluding-FTX basis. There is "a wide range of outcomes and risks from the FTX collapse," said Gosalia, who said that is reflected in the firm's lowered base case range of $14-$40 for Silvergate shares. |

| Lyft price target lowered to $17 from $41 at Argus |

| Argus analyst Jim Kelleher lowered the firm's price target on Lyft to $17 from $41 to reflect the recent selloff in the stock but keeps a Buy rating on the shares. The company has announced its second round of layoffs this year and issued disappointing Q4 revenue guidance, though he expects its current challenges to be temporary and believes that its long-term prospects remain strong, the analyst tells investors in a research note. Kelleher adds that despite rising costs, Lyft posted substantially higher year-over-year earnings in Q3, with growth in both active riders and revenue per active rider |

| Redfin price target lowered to $5.50 from $9.50 at DA Davidson |

| DA Davidson analyst Tom White lowered the firm's price target on Redfin to $5.50 from $9.50 and keeps a Neutral rating on the shares. The analyst is citing the company's decision to exit its RedfinNow iBuying business as well as the broader housing market headwinds on Redfin's core and legacy businesses. White is also cutting his FY23 revenue view on Redfin to $1.05B from $2.48B |

| Sarepta 'M&A Buy' thesis may be 'more ripe currently,' says Oppenheimer |

| Oppenheimer analyst Hartaj Singh does not believe he is "positing a unique M&A viewpoint" on Sarepta, which "has often been cited as a top-tier Biotech acquisition target," but the analyst contends that the timing for a "M&A Buy" thesis for Sarepta "might be (more) ripe currently," Singh tells investors. The optics for a Sarepta takeout are "easy," given that it is a leader in gene therapy, a leader in muscular dystrophies, has a fairly diverse pipeline and has "a strong financial backdrop to achieve its objective to be a leader in genetic medicines in rare diseases," argues Singh, who has an Outperform rating and $150 price target on Sarepta shares |

| Deere price target raised to $522 from $424 at Morgan Stanley |

| Morgan Stanley analyst Dillon Cumming raised the firm's price target on Deere to $522 from $424 and keeps an Overweight rating on the shares, citing the view that a strong quarter and above consensus guidance initiation "reflects an increasingly clean story for the shares entering FY23" given both incremental supply chain and price/cost stabilization and ongoing Ag Equipment market durability |

And this is what I am watching today: NFLX, SAM, ROKU, DKS, BURL, ULTA,, U, SPOT, TWLO, WING, CMG, and DPZ.

Let's have a great day!

-JB