Markets rallied on Tuesday, with the S&P adding 1.36%. Asia markets closed higher overnight while Europe indexes are mixed this morning. U.S. futures are pointing to a green open, the Dollar is higher while Yields, Oil, and Gold are all lower.

And this is what UPB is reading this morning : https://www.optionmillionaires.com/morning-reads-147/

And a great chart scan from UPB : https://www.optionmillionaires.com/exclusive-chart-scan-2/

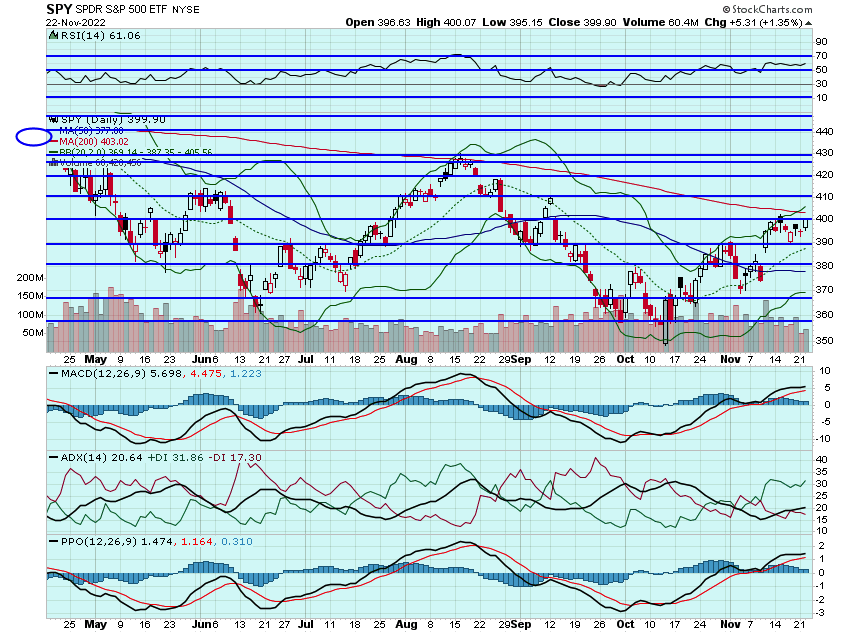

Markets opened higher yesterday, and then melted up for the rest of the session, with the SPY closing right near that key $400 handle - a spot that has provided resistance this month. Stocks are trying to gap over that handle this morning. As I have been saying, think the next stop is the 200dma. If it can break that $403 spot, think $415 is next:

Today we get the Fed minutes, which is one of the few catalyst we have this week. Any type of dovish tone and could provide a lift. Hints of more .75% hikes on the table and maybe stocks see some pressure. Friday there will be chatter around the black-friday sales data and traffic which could also provide a catalyst. Have to think there is already pessimism around the numbers so anything that is inline could provide a relief to markets. Certainly something to watch.

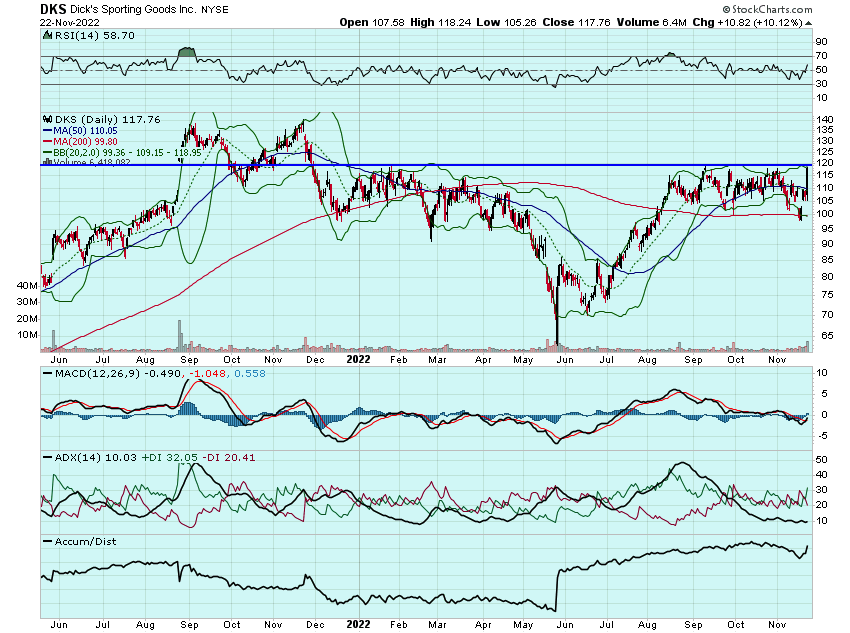

DKS reported a great earnings report yesterday but the stock was barely up in the pre-market. I figured it would rally so I went and added calls after the open. I was able to close most out for 100% and nearly 500% and held some into today. Think DKS can trade up over $118 so will hold the last for that outcome while using $116.50 as a stop:

I was watching BURL at the open, as outlined on yesterday watchlist. The stock gapped higher and I almost added some calls but the premiums were tough and strikes were only up to $300. The stock closed up 20% on the day but any entries after the open were red. The stock is getting upgrades this morning. May revisit calls for a possible move into the low $200s in the coming days:

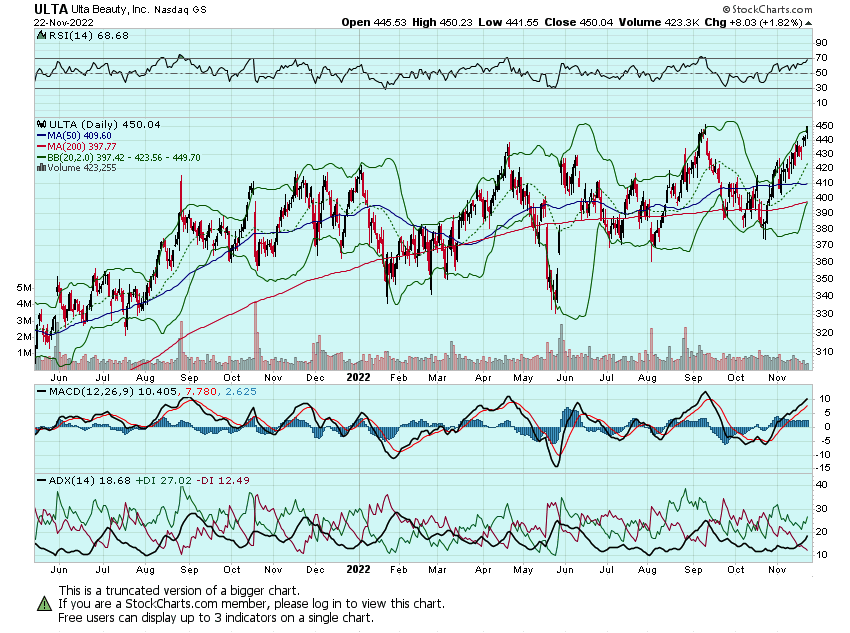

Also was eyeing ULTA but the stock was stuck for most of the day before staging a late afternoon rally to close up nearly 2%. They report earnings next week and calls could offer a decent risk/reward for some premium build into their report a week from tomorrow. Still eyeing some calls:

The irony that these brick 'n mortar names are performing well as of late while tech and online names are still getting pummeled. Seems like just yesterday everyone was saying these names going bankrupt.

Still eyeing ROKU and SPOT for some potential weekly spec calls today as I think both could rally into the end of the week.

Don't forget markets are closed tomorrow and open for a half-day on Friday. Half-days are one of my favorite sessions...

Here are the analyst changes of note for today:

| Dick's Sporting price target raised to $112 from $100 at Stifel |

| Stifel analyst Jim Duffy raised the firm's price target on Dick's Sporting to $112 from $100 and keeps a Hold rating on the shares. Inventory is elevated, but "better than feared" and management said its objective is to enter 2023 with clean inventories, noted Duffy following the company's Q3 report. While he is raising his estimates for FY22 and FY23 to reflect Q3 upside and inventory management, he views consensus FY23 margins assumptions as "too aggressive" considering the macro backdrop and category inventory glut, Duffy tells investors |

| Approval of CSL's Hemgenix positive for BioMarin, says Morgan Stanley |

| After CSL (CSLLY) announced the FDA approved Hemgenix for the treatment of adults with Hemophilia B with a "clean" label with no black box warning or restrictions on certain patient groups, Morgan Stanley analyst Matthew Harrison said he views the approval as "a clear sentiment positive" for BioMarin given investor concern around FDA approvals of gene therapy products and potential risks related to Roctavian. The analyst, who expects the Hemgenix news to drive BioMarin higher, has an Overweight rating and $113 price target on BioMarin shares |

| Evercore sticking with In Line rating on HP Inc. as company takes 'right steps' |

| Evercore ISI analyst Amit Daryanani said HP's guidance for FY23 implies headwinds are likely to get worse and to offset these issues HP is implementing a headcount reduction that should at scale yield $1.4B in gross savings. While his take is that HP is "taking the right steps to ensure they can defend profits/margins despite a weaker revenue environment" and that this could set-up the story "rather attractively" for the second half of 2023 and FY24, for now Daryanani is sticking with an In Line rating and $33 price target on HP Inc. shares |

| Dick's Sporting price target raised to $155 from $150 at Cowen |

| Cowen analyst John Kernan raised the firm's price target on Dick's Sporting to $155 from $150 and keeps an Outperform rating on the shares. The analyst raised his estimates farther above consensus as he believes consensus is underestimating the durability of the company's margin structure |

And here is what I am watching today: DKS, BURL, ULTA, ROKU, U, SPOT, TWLO, WING, CMG, and ZYME.

Let's have a great day!

-JB