Markets closed lower last week, with the S&P finishing down .52%, giving back some of the previous weeks gains. Asia markets closed mixed overnight while Europe indexes are mostly lower this morning. U.S. futures are pointing to a red open, the Dollar is higher while Yields, Oil, and Gold are all lower.

And this is what UPB is reading this morning: https://www.optionmillionaires.com/morning-reads-145/

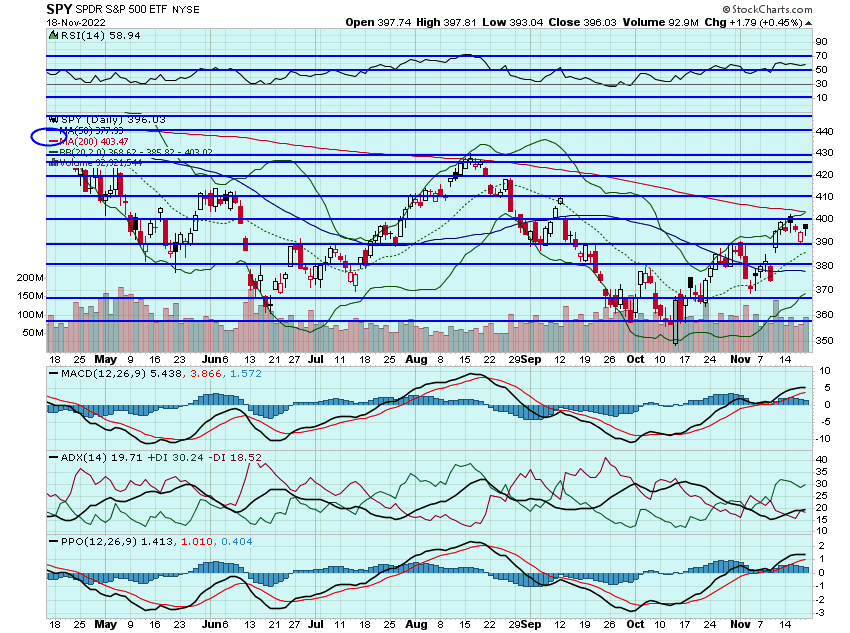

Last week was choppy for stocks as they looked to continue the previous weeks rally. I still think the path of least resistance is to the upside, with no true catalysts to speak of until mid-December's Fed meeting, although we do get minutes from the last Fed Meeting on Wednesday. Not saying the next bull market is coming, just think there will more opportunities in calls then puts. It is a holiday shortened week with markets closed Thursday and a half-day on Friday. Retail names and product lines will be in the limelight on Friday and next week, so certainly will be an area to watch. That 200dma is still looming and think that breaks soon and a possible test of $415 or so on the SPY before the next Fed meeting in mid-december:

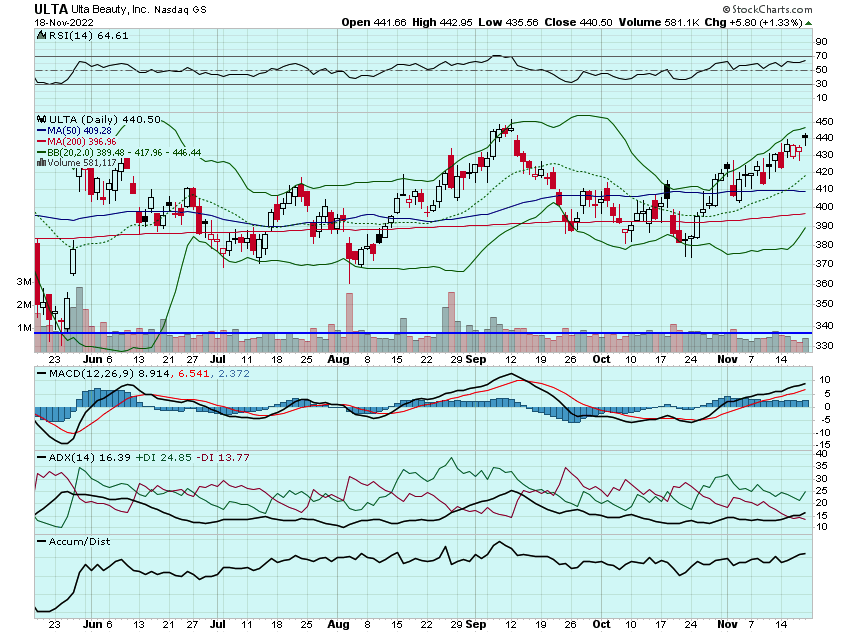

Some of these retail names have been showing some strength. Names like ULTA, BURL, ELF, WMT, ect. Even TGT reversed some of its losses form last week. I like ULTA again here with earnings on December 1st. May look to add some December monthly strikes for a move above $470 in the coming weeks:

BURL is a name I have traded on and off for the past few years. I think this can trade higher this week with a possible test of $185 or so. They report earnings tomorrow morning so could provide a catalyst. May look at some speculative calls today:

ROKU tried and failed to hold its 50dma last week. If it can break and hold that 57.50 area think a move into the mid-60s comes quick. Will be watching today for some possible call opportunities :

And lastly, still eyeing the usual names like U, SPOT, TWLO, WING, CMG, and ZYME.

Here are the analyst changes of note for today:

Ambarella price target lowered to $96 from $104 at Jefferies |

| Jefferies analyst David Kelley lowered the firm's price target on Ambarella to $96 from $104 and keeps a Buy rating on the shares. Ahead of the company's Q3 earnings report, he maintains his Q3 sales estimate of $83M, but cut his EPS forecast to 21c from 23c, and said he expects Q4 guidance to track below the Street view given likely continued customer inventory digestion. His FY24 sales and EPS estimates are below consensus, but he continues to see signs of CV momentum and blended average selling price expansion, Kelley added in his earnings preview note |

| Avadel Pharmaceuticals price target raised to $9 from $8 at Needham |

| Needham analyst Ami Fadia raised the firm's price target on Avadel Pharmaceuticals (AVDL) to $9 from $8 and keeps a Buy rating on the shares. The analyst cites Friday's opinion by the Delaware District Court granting the company's motion to delist Jazz Pharmaceuticals (JAZZ) '963 Xyrem REMS patent, stating that the final approval of Lumryz should no longer be gated by patent expiry. Fadia is updating her model and now sees Q3 of 2023 as the most likely timeframe for full launch vs. Q4 previously |

| Mobileye initiated with an Equal Weight at Morgan Stanley |

| Morgan Stanley analyst Adam Jonas initiated coverage of Mobileye with an Equal Weight rating and $32 price target. He values the core advanced driver assistance systems, or ADAS, business, which includes current System-on-Chip solutions and next-gen products like SuperVision and Consumer AV, at $29 per share and thinks the market may be underestimating the resiliency of the core ADAS business in the face of competition and potential commoditization, Jonas tells investors. However, he also thinks the market may be overestimating how quickly the longer-tailed future AMaaS, or "Autonomous Mobility as a Service," or robotaxi business can be monetized and he values this at $3 per share |

| Discover initiated with a Neutral at UBS |

| UBS analyst Erika Najarian initiated coverage of Discover with a Neutral rating and $120 price target as part of a broader research note on U.S. Consumer & Specialty Finance names. These companies are very sensitive to the shifting views on consumer spending and the eventual "consumer credit deterioration", the analyst tells investors in a research note, stating that she expects the stocks to be confined to a "volatile range" by the macro outlook for now. Najarian adds that while Discover may be an "underappreciated franchise", the near-term backdrop precludes consumer finance stocks from "breaking out" as a 2023 mild recession appears to be in base case investor expectations |

| Williams-Sonoma downgraded to Equal Weight from Overweight at Barclays |

| Barclays analyst Adrienne Yih downgraded Williams-Sonoma to Equal Weight from Overweight with a price target of $114, down from $192. The analyst downgraded both Williams-Sonoma and RH on a weakening housing cycle that she believes will have a "trickle-down impact" on home furnishing spending over the next 12 to 24 months and high-end wallet pressure. Rising inventory positions will worsen over the next several quarters along with a deceleration in demand, driving potentially negative comps and deleverage of the business models, Yih tells investors in a research note |

| Chewy price target raised to $50 from $40 at Deutsche Bank |

| Deutsche Bank analyst Lee Horowitz raised the firm's price target on Chewy to $50 from $40 and keeps a Buy rating on the shares ahead of the Q3 results on December 8. CPI data for the pet category grew 14% year-over-year in the quarter, up from 10% in the prior quarter, indicating "likely strong NSPAC growth for Chewy in the quarter," Horowitz tells investors in a research note |

And here is what I am watching today: ULTA, BURL, ELF, U, SPOT, TWLO, WING, CMG, FVRR, ZYME, and ZYME

Let's have a great day!

-JB