Markets fell for the second session in a row on Thursday, with the S&P losing .31%. Asia markets closed mostly lower overnight while Europe indexes are in the green this morning. U.S. futures are pointing to a bounce, the Dollar, Yields, and Gold are higher while Oil is lower.

And this is what UPB is reading this morning: https://www.optionmillionaires.com/morning-reads-144/

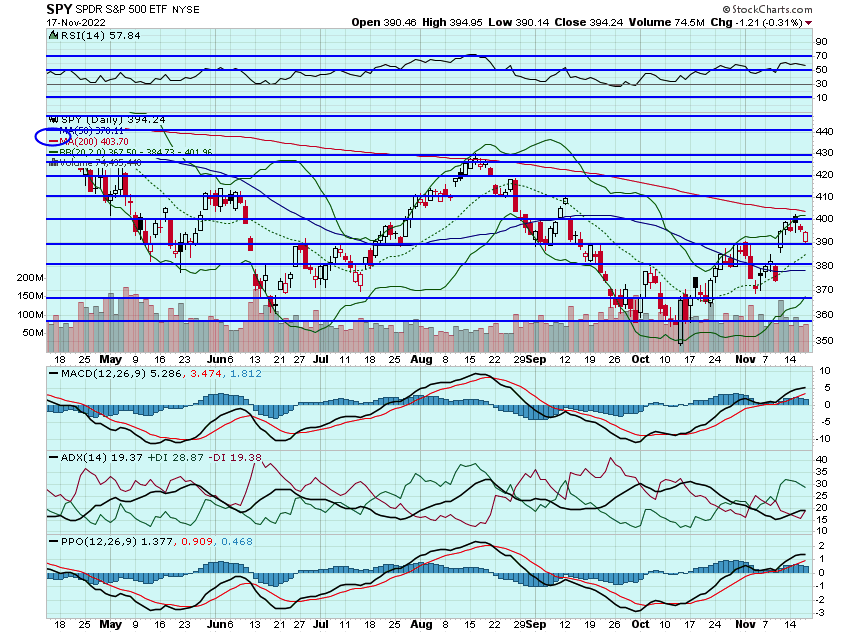

It was a choppy, premium eroding session for markets yesterday. The SPY tested $390 before bouncing and that level now looks like key support. Still think that 200dma is going to come into play in the coming days and will be important resistance at $404. Most of the market catalysts are out of the way, so outside of any crazy news event, think that will be tested soon. If that breaks, $415 or so will come next:

Yesterdays choppy session does not bode well for option premiums. I was eyeing positions in ROKU, SPOT, BIIB, NTES, WMT, TGT, and NFLX but couldn't find any decent risk/reward entries and thankful to have sat on my hands. Still eyeing those names for some potential speculative entries today.

The last of my ZYME calls expire today. Will look to lock the rest in and possibly add some later dated strikes for the eventual move into the double-digits:

Really like this NTES setup after its earnings and recent positive commentary around US/China relations and regulations. May look to add some calls into next week today for a move into the mid-high $70s:

And of course, still watching WING, CMG, DPZ, SPOT, ROKU, and others.

Here are the analyst changes of note for today:

| Generic guidance for Bausch Health's Xifaxan 'not a surprise,' says BofA |

| BofA analyst Jason Gerberry notes that the FDA published a revision to product specific generic bioequivalence guidance for Xifaxan, Bausch's brand for GI disorders, yesterday, stating that the "update doesn't come as a surprise" given Bausch Health's prior press release in July post patent ruling that the FDA would "add an in-vivo bioequivalency study" to the rifaximin product specific guidance. "What the FDA effectively did was to remove a waiver on conducting BE work on the 550mg dose strength," said Gerberry, who understands why shares "traded with strength" since Xifaxan contributes about $1B or more of EBITDA. However, he doesn't see "any fundamental change around the theoretical Xifaxan generic risk" and reiterates an Underperform rating on Bausch shares. |

| Palo Alto Networks price target raised to $225 from $218 at BMO Capital |

| BMO Capital analyst Keith Bachman raised the firm's price target on Palo Alto Networks to $225 from $218 and keeps an Outperform rating on the shares. The analyst cites the company's "strong quarter" and affirmation of previously established long-term targets, which place Palo Alto Networks in an "enviable but lonely position" relative to his coverage universe that is being impacted by deteriorating macro. Bachman adds that the stock's valuation is attractive relative to its growth potential as he maintains his Top Pick designation on the nam |

| BJ's Wholesale price target raised to $67 from $63 at MKM Partners |

| MKM Partners analyst Bill Kirk raised the firm's price target on BJ's Wholesale to $67 from $63 after its Q3 earnings beat but keeps a Neutral rating on the shares. The stock's largest source of valuation multiple in excess of traditional Food Retailers is its membership income stream, but without a membership price increase on the horizon, the value created from the membership stream at BJ's will likely be stagnant, the analyst tells investors in a research note. Kirk is also cutting his FY23 EPS view on the stock to $3.87 from $4.01 while noting that its premium valuation limits its upside potential |

Applied Materials price target raised to $120 from $90 at Needham |

| Needham analyst N. Quinn Bolton raised the firm's price target on Applied Materials to $120 from $90 and keeps a Buy rating on the shares after its Q4 earnings beat driven by continued supply chain improvements. As supply improvements enable demand to catch up, Applied Materials is set up for a strong first half of FY23, followed by a sharp decline in the second half and a likely down year in FY24, the analyst tells investors in a research note. Bolton further states that he has increased confidence that the company's annualized earnings should trough near $6.00 in this downcycle, though he also believes that investors should be willing to pay a higher multiple as earnings estimates approach trough levels |

Applied Materials price target raised to $126 from $95 at Craig-Hallum |

| Craig-Hallum analyst Christian Schwab raised the firm's price target on Applied Materials to $126 from $95 and keeps a Buy rating on the shares. The company reported Q4 results ahead of their pre-release, and was impacted less than expected by recent U.S. trade restrictions on China and outperformed on supply chain and logistics, Schwab tells investors in a research note. Schwab believes a stronger exposure to the more robust foundry/logic markets as well as a significant backlog of $19B provide the company resilience heading into next year |

| Editas' EDIT-101 setback 'not the end of the story,' says BofA |

| BofA analyst Greg Harrison lowered the firm's price target on Editas Medicine to $15 from $18 and keeps a Neutral rating on the shares, stating that deprioritization of the EDIT-101 program in LCA10 was "not a completely unanticipated setback," while adding that it only impacts "a small portion" of his valuation. Though the data are not sufficient for program continuation, it has still demonstrated Editas' ability to apply its gene editing technology to an ocular indication, according to Harrison, who views the EDIT-301 data in sickle cell disease expected in December as "significantly more important given the larger patient population and derisked treatment strategy." The analyst, who removed the EDIT-101 program from his model as a result of the data, added that the 101 setback is "not the end of the story |

Generic guidance for Bausch Health's Xifaxan 'not a surprise,' says BofA |

| BofA analyst Jason Gerberry notes that the FDA published a revision to product specific generic bioequivalence guidance for Xifaxan, Bausch's brand for GI disorders, yesterday, stating that the "update doesn't come as a surprise" given Bausch Health's prior press release in July post patent ruling that the FDA would "add an in-vivo bioequivalency study" to the rifaximin product specific guidance. "What the FDA effectively did was to remove a waiver on conducting BE work on the 550mg dose strength," said Gerberry, who understands why shares "traded with strength" since Xifaxan contributes about $1B or more of EBITDA. However, he doesn't see "any fundamental change around the theoretical Xifaxan generic risk" and reiterates an Underperform rating on Bausch shares |

And here is what I am watching today: NTES, ZYME. FVRR, WING, CMG, DPZ, SPOT, ROKU. BIIB, WMT, ROKU, NFLX, and TGT.

Let's have a great day!

-JB