Stocks rallied on Tuesday, as the PPI number came in cooler than expected, with the S&P rising .87%. Asia markets closed lower overnight while Europe indexes are mixed this morning,. U.S. futures are pointing to a lower open as I write this, the Dollar, Yields, and Oil are lower while Gold is higher.

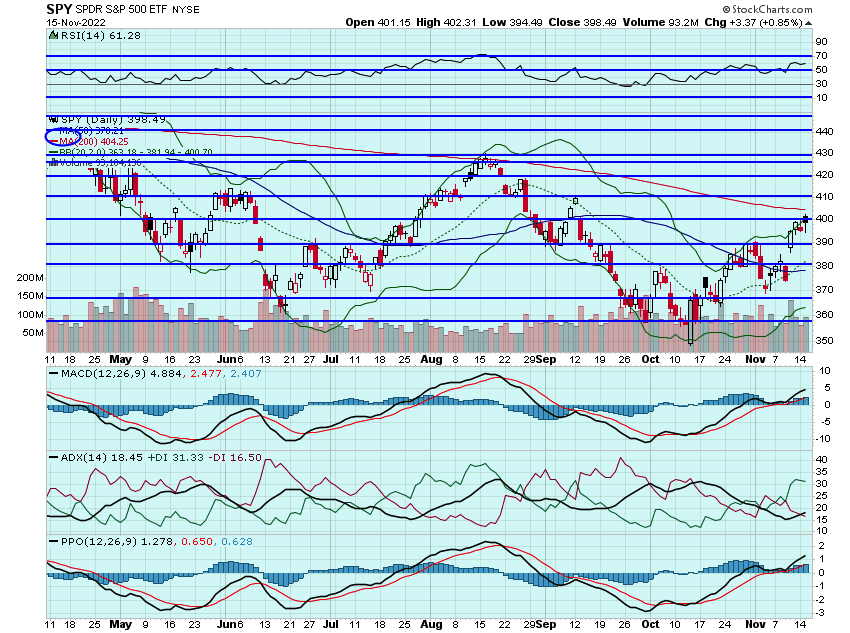

Markets rallied yesterday in a choppy session, with the S&P adding .87%, but the SPY failed to hold the $400 handle. An errant missile killed two in Poland and pushed markets off their highs yesterday, though it looks like it was from Ukraine. Today futures are slightly lower, as earnings from TGT weighed. Would like to see that $400 handle hold on the SPY today or tomorrow and think it will bode well for the eventual move to $405+. As I keep mentioning, there is not much in the way of catalysts and think most of the bad news is priced into the market already:

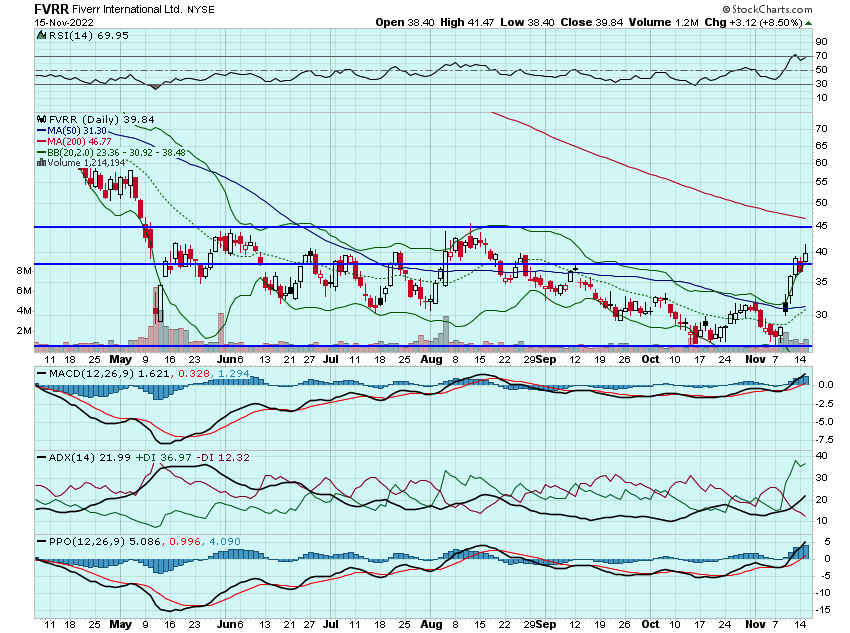

FVRR crossed into the $40s yesterday and I took some more of my calls off for over 800%. I still hold a few and will look to close them out today or tomorrow using the $39 handle as a stop. May actually look to add some December strikes as I think FVRR can find its way into the $50s in the coming weeks:

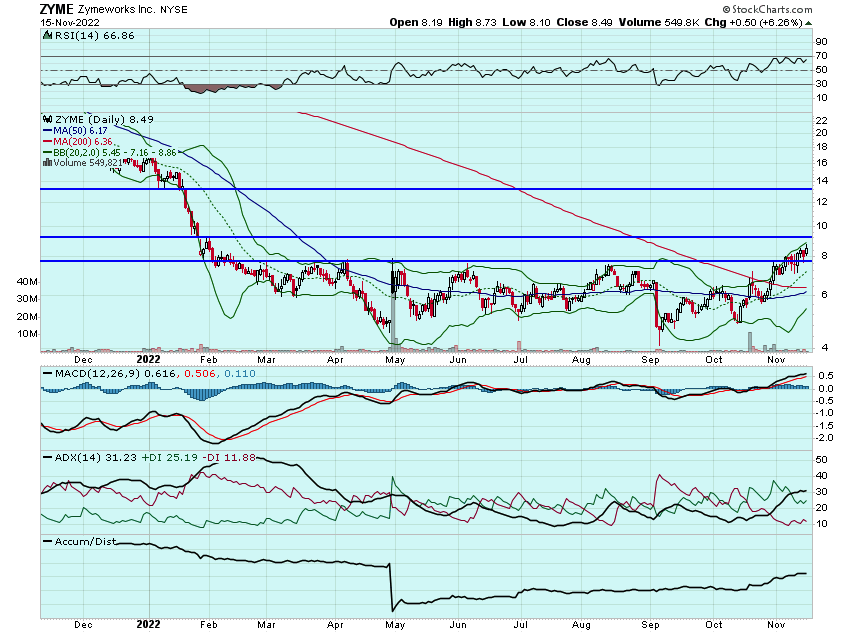

It was another strong session for ZYME, closing at 52 week highs and right at the $8.50 level. Still looking to close the last of my November strikes and possibly add some December calls for the eventual move into the double-digits:

Thankfully I passed on adding any TGT calls yesterday. The stock is getting pummeled this morning. WMT is down this morning as well after the TGT report and could offer a decent bounce opportunity. May look to add some speculative calls today for a move into the $150s:

Also still eyeing ROKU, NFLX, and possibly SPOT for some calls into the end of the week.

Here are the analyst changes of note for today:

| Block price target raised to $69 from $57 at Mizuho |

| Mizuho analyst Dan Dolev raised the firm's price target on Block to $69 from $57 and keeps a Neutral rating on the shares. The analyst says payday lending is increasingly meaningful to Cash App gross profit growth. Payday lending is a near-term boost to inflows, but it may ultimately pressure Block's multiple as delinquencies across consumer lending continue to rise, Dolev tells investors in a research note. This is particularly concerning given Cash App's skew towards lower-income households, says the analyst |

| Planet Fitness price target raised to $92 from $84 at Raymond James |

| Raymond James analyst Joseph Altobello raised the firm's price target on Planet Fitness to $92 from $84 and keeps a Strong Buy rating on the shares. Altobello came away from the company's Investor Day meeting with greater confidence in both Planet Fitness's ability to execute on its business model and its competitive positioning, and tells investors in a research note that the company introduced "ambitious y et achievable" three-year financial targets, including low-to-mid teens revenue growth |

| Zoom Video price target lowered to $72 from $76 at Citi |

| Citi analyst Tyler Radke lowered the firm's price target on Zoom Video Communications to $72 from $76 and keeps a Sell rating on the shares. Zoom's post-COVID recovery may continue to falter in Q3 as tightening IT budgets and a weaker macro outlook keep new customer acquisitions low and churn elevated, Radke tells investors in a research note. The analyst sees the company's "hurdles" from last quarter holding, with rising competition, macro-related weakness, and further margin risk from mix shift. Though Phone is gaining traction, headwinds will more than offset new product strength and create downside risk to guidance and consensus estimates post Q3, contends Radke |

| Estee Lauder price target raised to $245 from $230 at Oppenheimer |

| Oppenheimer analyst Rupesh Parikh raised the firm's price target on Estee Lauder to $245 from $230 and keeps an Outperform rating on the shares. The analyst notes the company announced an agreement to acquire the TOM FORD brand. He overall looks favorably upon this transaction as it protects Estee's longer-term interest in TOM FORD BEAUTY and all its associated intellectual property |

| Home Depot price target lowered to $323 from $327 at Piper Sandler |

| Piper Sandler analyst Peter Keith lowered the firm's price target on Home Depot to $323 from $327 and keeps a Neutral rating on the shares. The analyst views the company's Q3 results as "solid." While macro metrics on the housing market have been unfavorable, Home Depot's sales trends are holding steady on a three-year basis, as Pro spending remains strong and numerous project-based categories posted double-digit comp growth, Keith tells investors in a research note |

And here is what I am watching today: WMT, ZYME, FVRR, ROKU, NFLX, SPOT, U, BIIB, YOU, DPZ, WING, BIIB, CMG, and AXON.

Let's have a great day!

-JB