What a wild session yesterday. Anyone who traded those dips and spikes to perfection needs to have their balls checked for proper inflation (BTW the Patriots did win last night with balls inflated to government regulations).

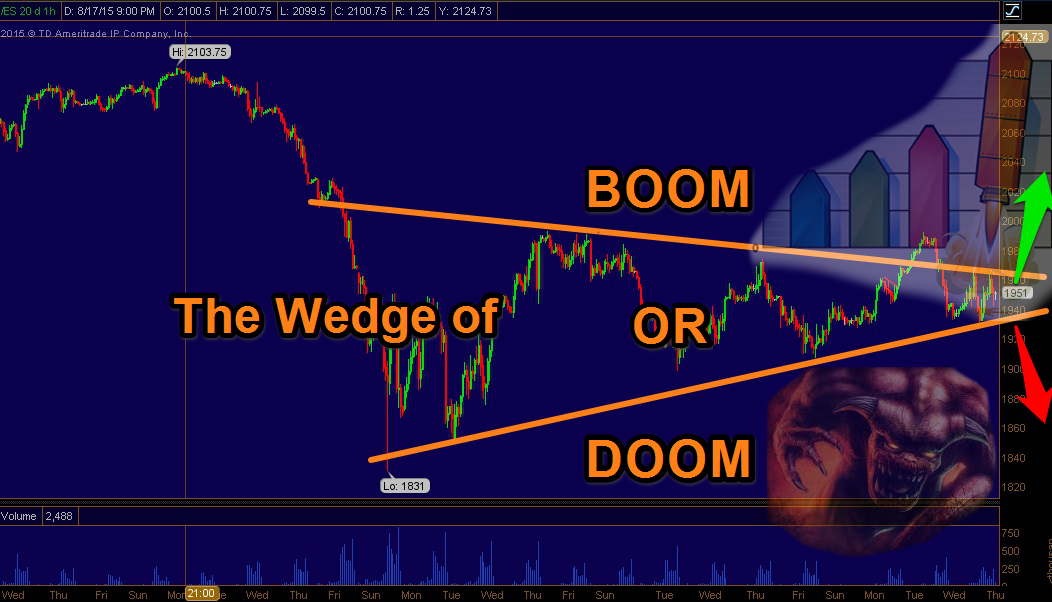

I was just asked in the chat room if I have turned bearish on this market. I've been very bullish on this market for many years. I wish it started on March 9th 2009, but it didn't. I took my time coming over to the bullish camp. I didn't belive the green shoots either. But here we are, and yes, I think for the short to medium term (or until we get that flush to the recent market crash lows) I am a bear. I think prices are heading lower. Judging from the action this week, the downside move is not going to be easy to time.

The support is strong with this one.... young option trader: but if support breaks today... look out below -

Of course the bears still have more headwinds for downside than the market had for upside the last 6+ years... if that makes any sense.

But you can feel the winds of change starting to blow. Late last week was the defining moment for the market.. in my view. The heavy, relentless selling. The complete absence of any substantial bounce or counter rally.

Also note that if prices start to rise the hand of the FED will be forced. They've had the luxury of a near deflationary environment the last 6+ years. If inflation spikes, oh my...... and everyone has been so worried about just how deflated everything is....

I know many think it the FED next week that will break this massive wedge. And we may just keep smacking around in a tight range until then, but I think the break is coming in the next trading session or two.

One headline that has me thinking this morning, is from China.

The Central Banks will stop at nothing to keep the status quo. And it's why it is so much easier siding with the team that has the unlimited credit card. And why these corrections and pull backs are incredibly difficult to trade.

Remember the years when sports teams used to win and lose. When, as a child, if you didn't finish in the top 3 you DIDN'T get a medal. Now everyone gets a medal. The world we live in today does not condone losing. As such, when the market finally starts to lose... your going to get a lot of crying and disbelief. And likely the Central Banks will start issuing medals to appease the herd, as they've done on any big pull back.

As such, I am 'frustratingly bearish' on the market in the short to medium term, but realize no matter what happens with this market I finished in first place... because everyone should get a medal.