MORNING READS

- Seems Set to Avoid Recession

- Western Allies Aim to Agree on Russian Oil Price Cap Wednesday

- A $300 Billion Bond Market Holds the Key to Solving the Climate Crisis

- ECB Must Narrow Interest-Rate Gap With Fed, OECD Says

- Spanish Banks Set to Sign Up to Mortgage Relief Package

- US Mortgage Rates Plunge for a Second Week, Hit Two-Month Low

- Billions of Dollars at Stake in a Puzzling Holiday Shopping Season

- FTX Flipped One Trading Firm’s Risk Obsession. Disaster Followed

- Inside Sam Bankman-Fried’s Quest to Win Friends and Influence People

- Tesla’s Stock Slump Has Gone Too Far, Morgan Stanley Says

- After Swift Return, Iger Faces Disney’s Long-Term Challenges

- Videogame Companies Brace for Lackluster Holiday Season

- Big Shareholder Signals Opposition to News-Fox Combination

- Dubuque? We Don’t Fly There Anymore

- Printer of King Charles III Banknotes Plunges on Profit Warning

- Sam Bankman-Fried Ran FTX Like ‘Personal Fiefdom’

Options

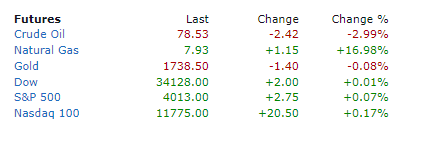

Futures

PREMIUM

PREPPER

The trend of layoffs in the tech sector continues. The axe is falling at HP (HPQ). And while it might be a slow, prolonged cut, it's going to be noticeable nonetheless.

HP's announcement that it will shed between 4,000 and 6,000 jobs by the end of its 2025 fiscal year wasn't something that Chief Executive Enrique Lores was happy to disclose after Tuesday's market close. But Lores admitted that after a difficult fiscal fourth quarter, and not-so-great outlook, cutting potentially more than 10% of HP's workforce was necessary. Lores said the job cuts are part of a strategy to create a "Future Ready" HP.

"Wage growth data indicates that highest wage earnings saw the largest decline in real wages, whereas lowest earners’ wage growth largely matched inflation," BofA added. "As a result, companies are seeing high-income consumers trading down for cheaper goods/services - mentions of 'trade down' during earnings calls soared to a record level, topping the GFC level."

Speaking on a conference call to discuss HP's results and outlook, Lores said that the "ultimate goal" of the company is to develop its product portfolio and "operational capabilities to drive sustainable growth" and save as much money as possible during what is expected to be a prolonged period of economic uncertainty, inflation and some declines in customer demand.

To that end, Lores, and CFO Marie Myers said that the job cuts were part of a plan that would cut costs and generate "run rate savings" of at least $1.4B by the end of HP's 2025 fiscal year. "We take (job) reductions very seriously," Myers said, and added that the steps HP was taking were "critical to the long-term health" of the long-time PC and printing technology leader. But, in the meantime, factors such as "headwinds to long-term growth" are going to be around for a while.

Pressure building: "Layoff announcements are not a reliable guide to jobless claims in the short term," Pantheon Macro said. "But we cannot ignore the upward trend in recent months; claims likely will follow."

"Layoff pressure is building, with a weekly record number of layoff news on Bloomberg, following the notable headlines from META and AMZN," BofA said. "Monthly new job postings have plummeted YTD, down 30% for the S&P 500 (SPY) YTD, led by high-paying jobs in Tech (XLK) and Financials (XLF): Comm. Svcs. (XLC) -63%, Tech -47%, and Financials -34%." (18 comments)

Manchester United on the block

Manchester United (MANU) has confirmed its board has launched a process to "explore strategic alternatives" for the club.

An earlier report of a strategic exploration that could range all the way to selling the club ended up sending MANU stock up 14.7% on the session, a day where it hit its highest point since last December. "As part of this process, the Board will consider all strategic alternatives, including new investment into the club, a sale, or other transactions involving the Company," Man United said.

The process will mean assessing several initiatives, including stadium and infrastructure redevelopment as well as expanding commercial operations globally.

"Throughout this process we will remain fully focused on serving the best interests of our fans, shareholders, and various stakeholders," Executive co-Chairmen and Directors Avram Glazer and Joel Glazer said. That news comes after longtime fan discontent with ownership. MANU stock dipped slightly earlier after the club confirmed it was parting ways with star Cristiano Ronaldo after he gave a controversial interview. (2 comments)

The risk of a rail strike in December is growing after some unions voted down the deal that the White House brokered in September. Even a strike of just a few days could impact the supply of fuel, automobiles, chemicals, and consumer products, while a longer strike would have the potential to cut into Q4 GDP.

Evercore ISI analyst Jonathan Chappell warned that U.S. equities are acting like there is no chance of a strike when the probability is not zero. The firm's D.C. policy team still believes Congress will not act as quickly as hoped if the four unions that voted not to ratify the labor deal play hardball. Based on the performance of stocks tied closest to rail transport, investors expect the issue to be resolved without a strike. (37 comments)

President Joe Biden said that he'll extend the pause on federal student loan payments while his administration defends in court his ability to cancel portions of student debt.

"I'm confident that our student debt relief plan is legal," he said. Last week, a U.S. appeals court kept in place a block on the plan to cancel hundreds of billions of dollars in student loan debt while six Republican-led states seek to stop the program on grounds that the White House's plan averts congressional authority.

While the case proceeds in court, Education Secretary Miguel Cardona will extend the payment pause to June 30, 2023, he said. Stocks that may be affected by the student loan forgiveness plan include: SoFi Technologies (NASDAQ:SOFI), Navient (NASDAQ:NAVI), Nelnet (NYSE:NNI), and SLM Corp. (NASDAQ:SLM). (159 comments)

Today's Markets

In Asia, Japan closed. Hong Kong +0.57%. China -0.27%. India +0.15%.

In Europe, at midday, London +0.57%. Paris +0.01%. Frankfurt +0.11%.

Futures at 6:30, Dow +0.09%. S&P +0.12%. Nasdaq +0.02%. Crude -0.83% to $80.25. Gold -0.20% to $1736.65. Bitcoin +5.41% to $16.561.2.

Ten-year Treasury Yield flat at 3.75%

Today's Economic Calendar

7:00 MBA Mortgage Applications

8:30 Durable Goods

8:30 Initial Jobless Claims

9:45 PMI Composite Flash

10:00 New Home Sales

10:00 Consumer Sentiment

10:30 EIA Petroleum Inventories

12:00 PM EIA Natural Gas Inventory

1:00 PM Baker-Hughes Rig Count

2:00 PM FOMC Minutes

Companies reporting earnings today »

What else is happening...

Tesla (TSLA) sputters as investors weigh China demand, recalls and Twitter distraction.

EU sets natural gas price cap proposal well above current levels.

Bankman-Fried treated crypto exchange FTX as his 'personal fiefdom', lawyer says.

Want to bet on Black Friday and Cyber Monday results?

High performance e-bike maker Zapp to go public through merger with SPAC CIIG (CIIG).

Trump SPAC DWAC (DWAC) gain after holders approve deal extension.

Cathie Wood’s ARKK Innovation ETF (ARKK) steady despite drop in Zoom (ZM), its top holding.