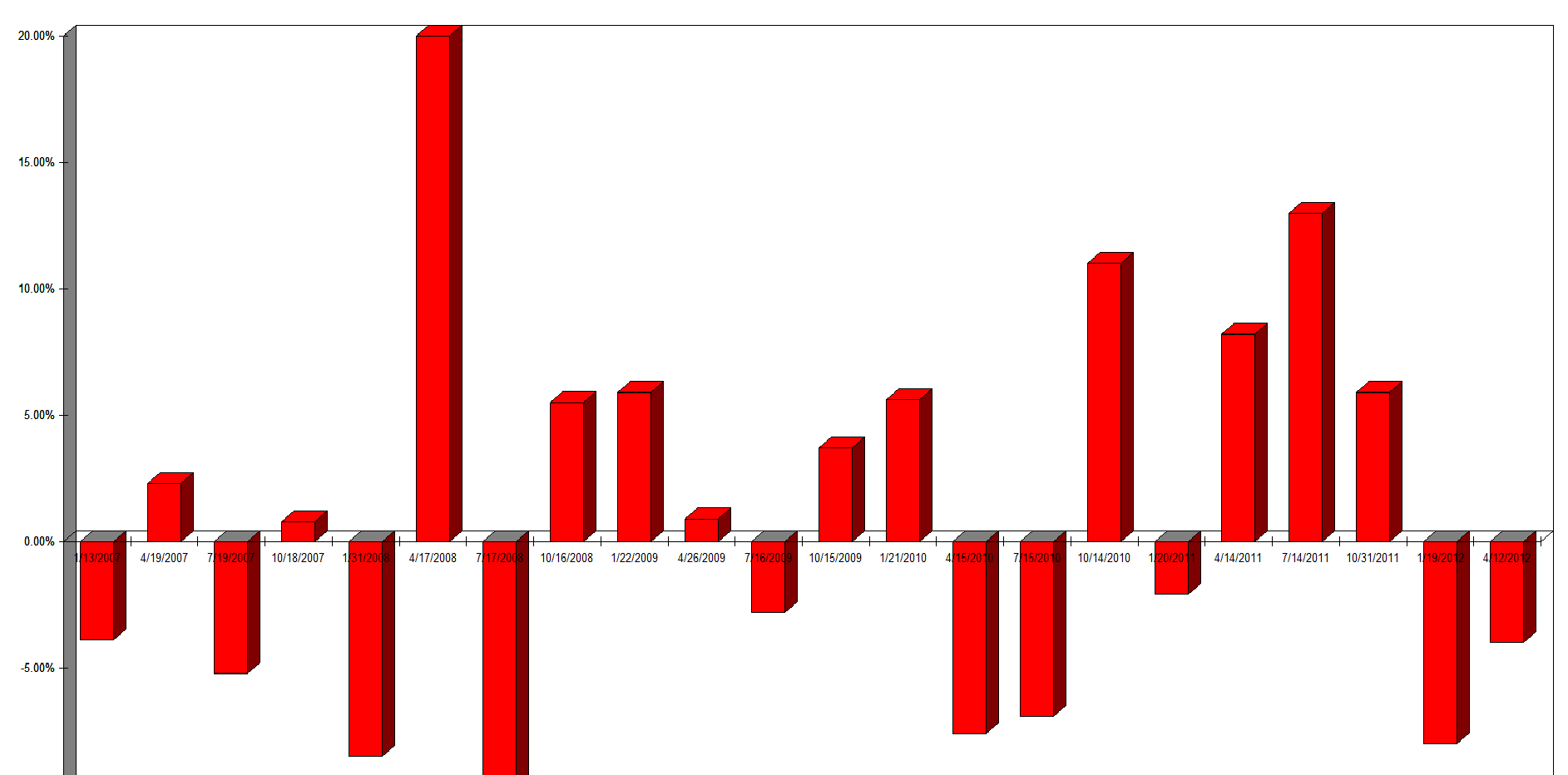

GOOG is generally one of the more highly anticipated earnings reports of the season. Why? For an options trader GOOG has offered some fairly strong returns for those positioned properly before earnings in the past. Back on April 17th 2008 GOOG blew away estimates and the next day the stock rose over 20%.

GOOG moved almost $100 higher that day and call holders hit paydirt. The $490 strike that was selling for $.50 hit $57 the next day. $500 into $57,000 in less than a full trading day! Will GOOG post a move like that again this earnings season?

I have charted GOOG's earnings moves the last 6 years.

Four of the last 5 July's has seen GOOG decline the day after reporting earnings, however last JULY GOOG surged some 13% post earnings. A new trend perhaps?

I highlighted a few trades in my Live earnings presentation tonight. With GOOG one strategy is to trade it the day of earnings and not ride through earnings. Last quarter buying puts the day after earnings was a big money maker. I'm sure we will see another big move for GOOG in the range of 5-7% and I am leaning toward the calls.