Morning Reads

- Plunge in China’s Markets Intensifies as Yuan Hits One-Year Low

- Expat Bankers Fleeing Hong Kong See No Easy Escape to Singapore

- Russian Oligarchs’ Billions Prove Hard for Investors to Shake Off

- Budweiser Brewer Pulls Out of Russia as Multinationals Weigh Options

- Ukraine Sounds Alarm on Chinese Drones, Opening Skies to U.S. Startups

- As Europe Approves New Tech Laws, the U.S. Falls Further Behind

- Dollar’s Rally May Be Nearing ‘Tipping Point’ As Fed Readies Big Hikes

- Fed’s Powell Seals Expectations of Half-Point Rate Rise in May

- Fewest Americans Collecting Jobless Aid Since 1970

- Disney to Lose Special Tax Status in Florida Amid ‘Don’t Say Gay’ Clash

- CNN+ Streaming Service Will Shut Down Weeks After Its Start

- Musk Tears Up Buyout Playbook With $46.5 Billion Twitter Financing

- Companies Try to Sell Videogaming as the Next Big Advertising Channel

- What You Don’t Know About Amazon

- Netflix, Facing Reality Check, Vows to Curb Its Profligate Ways

- France Issues International Arrest Warrant for Carlos GhosnDebt Woes Across Developing World

FUTURES:

PREMIUM:

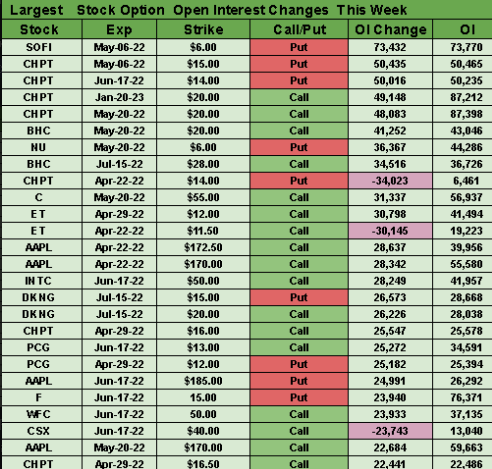

OPTIONS

Prepper

Seventy-five basis points is the new 50 basis points. A relentlessly hawkish Federal Reserve is ramping up market expectations for big interest rate hikes that would have been considered unthinkable (and market crippling) just two months ago.

Nomura says today that the FOMC will hike the fed funds rate by 75 basis points in June and July after a 50-basis point rise in May. That would bring the rate up to 2.25%, a phenomenal amount of tightening given that the Fed was still easing by buying assets as recently as March.

The shift in market expectations for even more tightening came after Fed Chairman Jerome Powell said at an IMF debate Thursday that a 50-basis-point hike in March was "on the table." Perhaps even more pertinent to the markets, he said there was some merit in front-loading tightening with the current upside risks to inflation and a historically tight labor market.

Traders quickly priced in more aggressive hiking as Powell spoke, with CME FedWatch now pricing in an 85% chance the benchmark rate will rise to a range of 1.5%-1.75% after the June meeting. That would mean a 75-basis point hike in June if May gets the expected half-point boost.

Chatter of a hike of as much as 75 basis points started last week when St. Louis Fed President James Bullard said that he wouldn't rule one out. Before Powell spoke yesterday, San Francisco President Mary Daly added some fuel to the fire, saying she would be talking to colleagues about whether a hike of 25, 50 or 75 basis points was needed.

In fed funds futures, the market is now pricing in about 270 basis points of tightening for 2022, topping the 250 seen in 1994, with expectations now for the rate to hit 3% by March 2023, according to Deutsche Bank.

Deutsche Bank's chief economist said yesterday that the Fed could hike rates to as high as 5% by the time it's done tightening, a level not seen since 2006.

“Our U.S. team has changed their Fed call,” Rob Subbaraman, Nomura head of global markets research, wrote in an email seen by Bloomberg. “They now expect the FOMC to be even more front-loaded with rate hikes, in order to get the funds rate back to neutral as expeditiously as possible to avoid a wage-price spiral.”

“We recognize Fedspeak has not outright endorsed a 75 basis point hike yet, but in this high inflation regime we believe the nature of Fed forward guidance has changed - it has become more data dependent and nimble,” he said.

"We are in a new environment, dancing to a new tune, and the incremental mean reversing way of thinking about inflation and rates is likely to be misleading," Deutsche Bank chief economist David Folkerts-Landau said. "Inflation is seeping into expectations, and labor markets are historically tight."

What this means for stocks and bonds: The selloff in Treasury bonds accelerated as expectations for even more hawkish policy rose.

The 10-year Treasury yield (TBT) (TLT) hit 2.95% at the high of the day Thursday and is back up at that level this morning. The 2s10s curve flattened and the 2-year yield (SHY) is up 7 basis points to 2.76% in early trading today.

Stocks started Thursday with a rally, but the big rise in rates (especially real rates) reversed the trend and the S&P (SP500) (SPY) fell 1.5%, while the Nasdaq 100 (NDX) (QQQ) lost 2%.

Worries will increase in the equities market if the Fed slams on the brakes as Nomura predicts.

Investors "are in a new investing world," eToro strategist Ben Laidler said. "The sharp and never-ending repricing of Fed interest expectations and high-for-longer inflation has driven bond volatility twice that of equities, and a tightening US financial conditions index."

"This drives lower valuation and a Growth to Value rotation," he added. "Equities are being stress-tested by surging bond yields. But there is a limit to how high yields will go. The Fed has more yield control now with its huge balance sheet runoff, whilst high debt levels, and wide yield gap with global markets are constraints." (6 comments)

Florida's Republican-led House gave its approval to a bill that would put an end to Walt Disney's (DIS) special tax district, which grants the theme-park owner heavy autonomy over its land.

That 70-38 vote follows Wednesday's Florida Senate passage by a vote of 23-16 - quick action after Florida Gov. Ron DeSantis said Tuesday that he was adding the effort to the legislature's special session. The measure now heads to DeSantis for signature. Disney shares fell to a new 52-week low in response, dropping below $122. (786 comments)

GameStop-shorting fund is done?

Melvin Capital, the hedge fund that was crushed by the GameStop (GME) short squeeze last year, is said to be considering a plan to return investors their capital, while giving them the ability to invest in a new fund.

Under the plan being discussed by Melvin Capital founder Gabe Plotkin, the hedge fund would shut at the end of June, according to a CNBC report. The fund fell 21% at the end of the first quarter. Melvin would start a new fund on July 1 with the money his investors decide to reinvest. (60 comments)

Elon Musk is said to be in talks with private-equity firm Thoma Bravo about partnering on a potential Twitter (TWTR) takeover bid. Twitter is up 1% in premarket trading.

Thoma Bravo executives are said to be mixed on a potential partnership due to Musk's behavior and controversial politics, according to a New York Post report.

The report comes after Musk earlier Thursday said he will explore a potential tender offer for Twitter, having secured $46.5B committed financing for the deal. Musk's filing says entities related to him have received commitment letters committing to about $46.5B. (25 comments)

The word of the day for Snap (SNAP) is "challenging": CEO Evan Spiegel made his description of the operating environment as challenging front and center in his remarks on the earnings call, and Chief Financial Officer Derek Andersen used the word to describe why the company expects a 30% run rate in business growth quarter-to-date to likely fade as the quarter rolls on.

He also highlighted the impact of the war in Ukraine, saying the company could expect additional campaign pauses or advertiser budget reductions. A large number of advertisers paused their ad campaigns in the days following Russia's invasion of Ukraine in late February - and while the majority of advertisers resumed their campaigns, many remained concerned about inflation and continuing geopolitical risk, he said. (7 comments)

Today's Market

In Asia, Japan -1.63%. Hong Kong -0.21%. China +0.23%. India -0.98%.

In Europe, at midday, London -0.59%. Paris -1.18%. Frankfurt -1.29%.

Futures at 6:20, Dow -0.18%. S&P -0.16%. Nasdaq -0.09%. Crude -1.94% to $101.78. Gold -0.20% to $1944.26. Bitcoin -3.57% to $40,453.

Ten-year Treasury Yield +3.8 bps to 2.955%.

Today's Economic Calendar

9:45 PMI Composite Flash

1:00 PM Baker-Hughes Rig Count

Companies reporting earnings today »

What else is happening...

Carl Icahn says large asset managers should back him in McDonald's (MCD) fight.

Heavily shorted name Redbox (RDBX) gains 29% on heavy volume.

Australia's financial regulator unveils cryptocurrency policy roadmap.

Boston Beer Company (SAM) serves up skunked earnings.

Solar stocks slide after NextEra (NEE) cites tariff probe for project delays.

U.S. oil services firms push for revamped Venezuela license.