Tonight, the Australian jobs numbers completely missed expectations and the Aussie was pummeled. In the past this would be risk off for the stock market, but now everything is risk on. Bad jobs report = more Central Bank Manipulation. Good jobs report = Continued Central Bank manipulation.....they aren't turning off the presses until inflation starts picking up and right now inflation remains tame.

The labor force participation rate over in Australia dropped to an 8-year low. How is the Australian stock market reacting to this terrible news? By rallying over 1%, of course, because this is fabulous news for stocks.

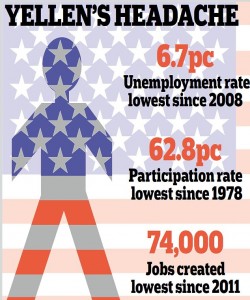

Here in the U.S., the labor force participation rate hasn't been this bad in 35+ years...yet stocks closed today at record levels. It seems the less people this world has working the higher equity prices go. Back in October, the U.S. government shut down for almost two weeks. This shutdown was supposed to cripple our economy, but it instead had the opposite affect. We came to learn that the shutdown didn't have the side affects that most were calling for. Millions of additional people not working? This is bullish for the market. Stocks soared into the end of the year.

Fire them all.

I think it's truly time to consider firing everyone. Keep the 1% working, fire everyone else. Less jobs is bullish for our country. Corporations can borrow money at record low rates to keep their company and massive paychecks afloat. Who needs to pay those blue collar workers that actually produce the goods? Why sell anything when you can just borrow money?

What's that? The debt market dried up? Well, a secondary offering is a quick fix for that. With stocks at record prices, there's plenty of room for corporations to sell fresh stock to a thirsty market.

The rest of us can just live off the government. Obamacare, unemployment checks, government assisted living...ahh, 'tis the life. And the few that own stocks will reap the rewards of a market that triples in value.

Need extra cash? Have a blindfolded ape pick a stock for you to buy. Trust me, you'll be just fine.