We head into 2015 with the S&P up 6 years in a row, and many expecting it to be 7 after this one is in the books. I have been somewhat bullish throughout that time, finally giving up a short thesis in the fall of 2011, and fully embracing this bull market. My most recent call, was for the S&P to cross the 2k level in 2014, and it did. You can read my thoughts here : https://www.optionmillionaires.com/market-headed-higher-part-2/

Since that time, I have become more and more cautious. Not that I think the market is set to crash - I am not naive enough to think I can predict that - but because the reasons I have been bullish changed. Here is one of my posts before Octobers sell-off : https://www.optionmillionaires.com/equities-perched-edge-cliff/

The answer to the 'Who is buying U.S. Equities' question seemed pretty obvious to me in 2014, yet not so obvious to start 2015. At the same time, I don't think folks came into 2015 eager to pull the trigger, after what seemed like a rough 2014 for most fund managers.

I have been adding puts this week, and will continue to look for opportunities to play for downside. I think the end of the 'V" bottom rallies are over.

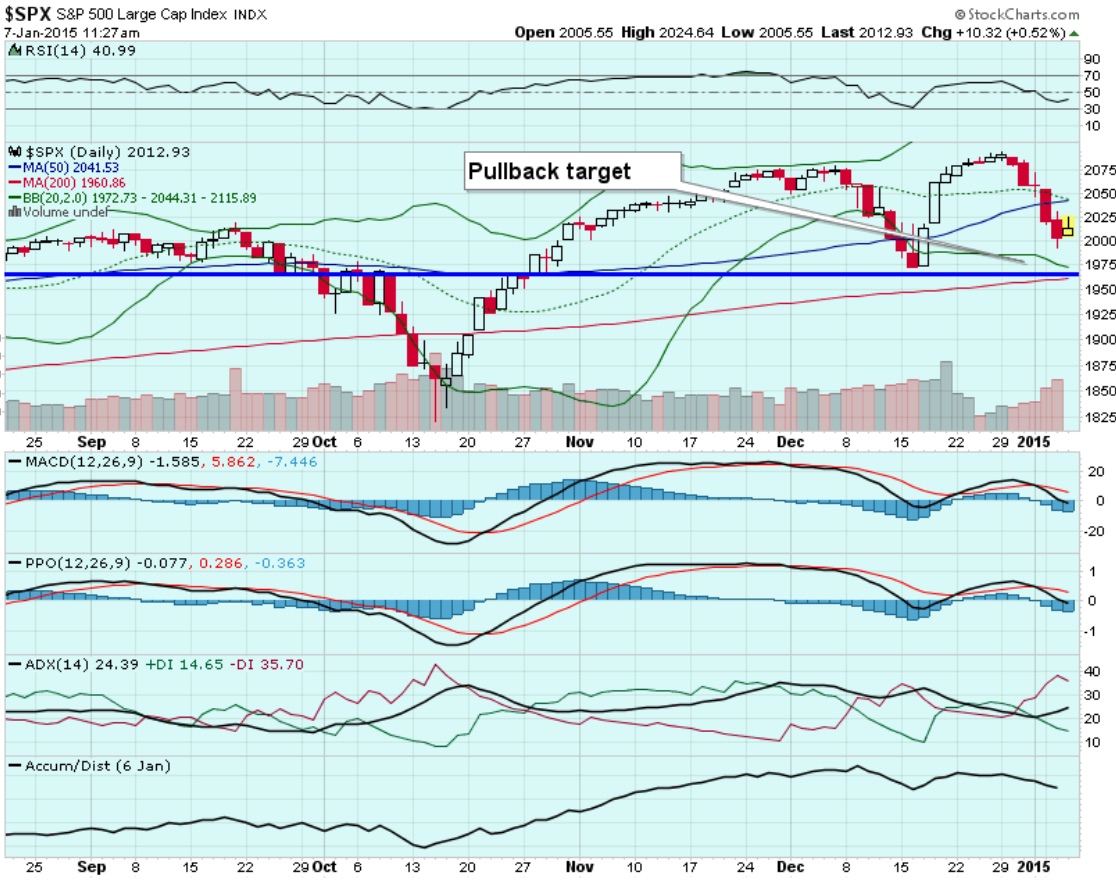

The S&P is currently at 2016, and I will be watching the 1960 area as potential support. A close back above the 50 day moving average of 2041 may nullify my bear case.

I will also have more on why I think we are setting up for more downside in a later post. (Members can watch my 2015 video here https://www.optionmillionaires.com/webinar-top-5-themesstocks-2015/) .

Happy Trading!

- JB