Stocks put an end to their losing streak with the S&P closing up .75% on Thursday. Asia markets rallied overnight while Europe indexes are also in the green this morning. U.S. futures are pointing to a red open, the Dollar and Yields are lower while Oil and Gold are higher.

And this is what UPB is reading this morning: https://www.optionmillionaires.com/morning-reads-156/

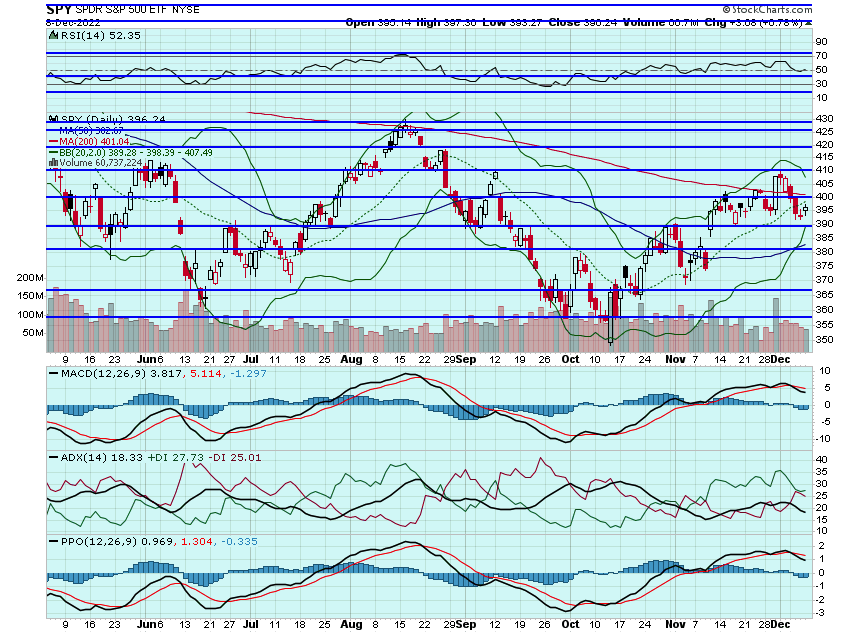

Stocks rallied on Thursday, with no true catalyst to speak of outside of the continued sell-off in Oil. Futures are pointing to a lower open this morning after PPI data came in hotter than expected. This cycle of good news is bad news for markets continues .Next week we get CPI data on Tuesday and the Fed on Wednesday - to say it will be a huge week is an understatement. That 200dma at $401 looms large and that $390 handle looks like key support:

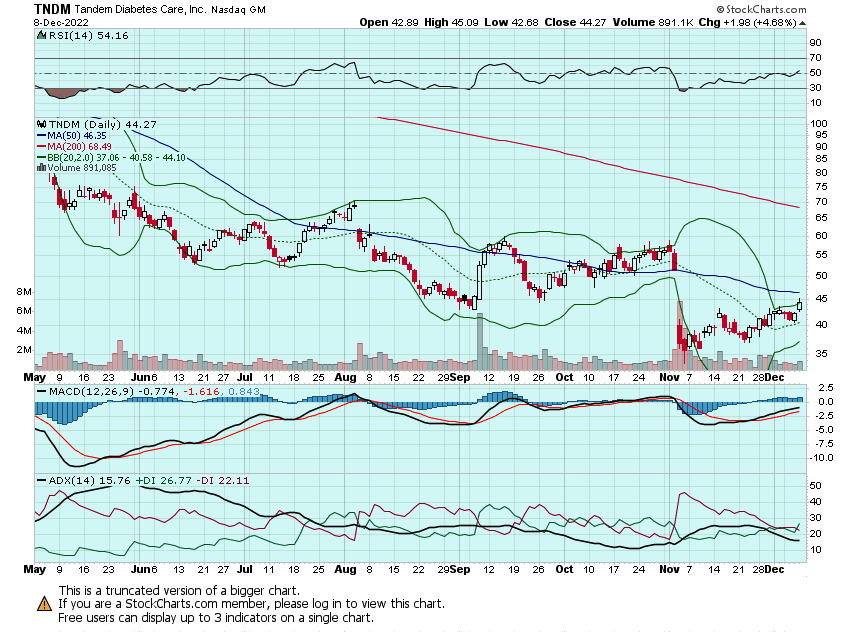

I went and added TNDM calls yesterday. The stock has been reversing course as of late and think it will continue its rally up to $50 and beyond:

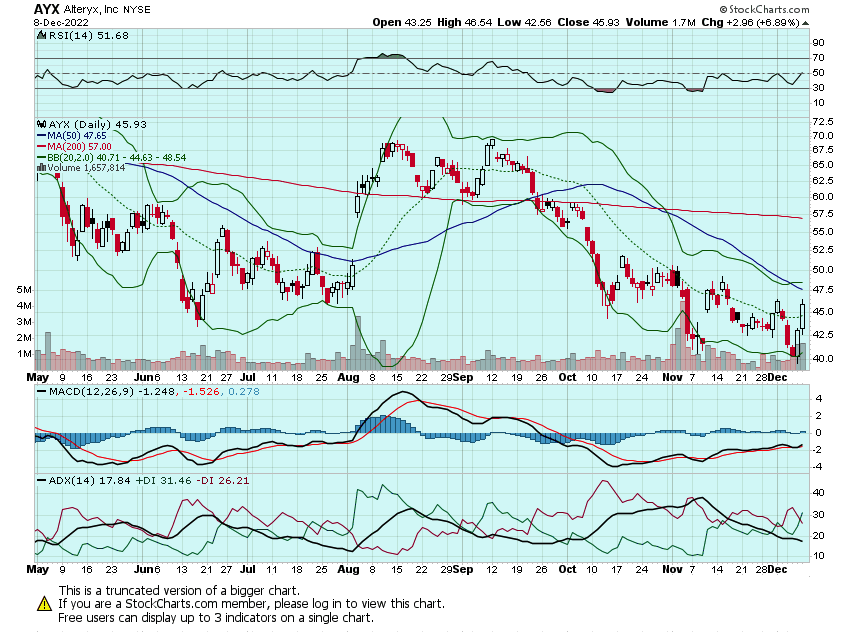

AYX closed up over 6% on Thursday, and I was able to close some of my calls out for 200% and 300%. Will hold the rest for a possible test of $50 in the coming days:

RARE rallied over 4% and I was able to close more of my calls for over 300%. Think the stock could trade north of $45 in the coming days so will hold the last of my calls for that outcome:

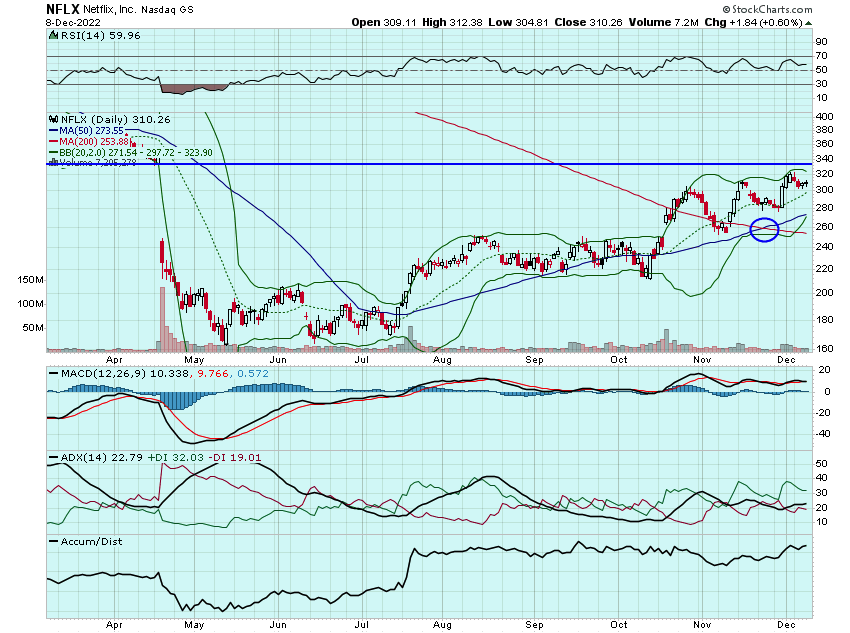

NFLX received a few upgrades this morning and the stock is gapping higher in the pre-market. Going to need a big move for my calls but may look for some other strikes to play for a move over $330 next week. Feels like there has been a sentiment shift on the name - finally - and that the addition of ads will open a bigger addressable market:

U was gapping higher this morning before the PPI data. Will need a big move there along with a rally in BURL. Still like BURL here for a bull-flag breakout and may look at some strikes into next week:

LULU reported earnings after the close that missed estimates. Thankfully I was not able to find any decent strikes. Will likely take the name off the watchlist for now an revisit.

And lastly, may look to play some lotto ROKU calls in sympathy with the NFLX move. Think a test of $55 is possible.

Here are the analyst changes of note for today:

| Domo price target lowered to $23 from $25 at Lake Street |

| Lake Street analyst Eric Martinuzzi lowered the firm's price target on Domo to $23 from $25 and keeps a Buy rating on the shares after the company reported its Q3 results. Domo did not give formal FY24 guidance, but did say it believes 10% revenue growth "is a good place to start," noted Martinuzzi, who was previously modeling 15% growth. While "pleased" with Q3, he was "disappointed in the FY24 growth expectation" and has lowered his own forecasts, added the analsyt. |

| Vroom price target lowered to $1.10 from $1.30 at Jefferies |

| Jefferies analyst John Colantuoni lowered the firm's price target on Vroom (VRM) to $1.10 from $1.30 and keeps a Hold rating on the shares. Recent press reports indicate that a group of the Carvana's (CVNA) bondholders that collectively hold $4B, or 70%, of its unsecured debt have signed a cooperation agreement and Colantuoni thinks Carvana's potential restructuring could signal a further deterioration in the operating environment for used auto e-commerce, he tells investors |

Carvana price target lowered to $5 from $10 at Jefferies |

| Jefferies analyst John Colantuoni lowered the firm's price target on Carvana to $5 from $10 and keeps a Hold rating on the shares following the recent press reports indicating that a group of the company's bondholders that collectively hold $4B, or 70%, of its unsecured debt have signed a cooperation agreement. His model has Carvana running out of cash in Q1 of 2023 without an additional infusion and his lower target reflects the view that the restructuring process is "likely to negatively impact the value of existing equity," Colantuoni said |

| Lululemon price target raised to $387 from $343 at Morgan Stanley |

| Morgan Stanley analyst Alex Straton raised the firm's price target on Lululemon to $387 from $343 and keeps an Overweight rating on the shares. EPS in Q3 came in about 1% ahead of Street expectations and above the high-end of guidance, making for Lululemon's tenth consecutive quarter surpassing consensus estimates, noted Straton, who thinks after-hours stock pressure can be attributed to the stock's recent run and high pre-print expectations. However, strong quarter-to-date commentary "stands out to us," said Straton, who thinks the company's Q4 guidance "leaves room" for another raise. |

Edwards Lifesciences price target lowered to $92 from $98 at Morgan Stanley |

| Morgan Stanley analyst Cecilia Furlong lowered the firm's price target on Edwards Lifesciences to $92 from $98 and keeps an Overweight rating on the shares following the company's annual investor day. Edwards' initial 2023 outlook was about in-line with estimates and appears "realistic," according to Lewis, who said the reiteration of the 2028 long-range outlook frames "a path to recovery and growth," but adds that "signs of recovery are still needed to instill confidence |

| Costco price target lowered to $555 from $600 at BMO Capital |

| BMO Capital analyst Kelly Bania lowered the firm's price target on Costco to $555 from $600 but keeps an Outperform rating on the shares. The company's Q1 results were in line with expectations as it seems to be "reinvesting gas margin upside", the analyst tells investors in a research note. Bania adds however that while big-ticket discretionary weakness weighted on November comps, she recommends that investors use the weakness in Costco shares during this macro cycle to build positions in this "best-in-class retailer |

And here is what I am watching today: NFLX, ROKU, BURL, WYNN, NVDA, COST, SPOT, DIS, DKS, U, TWLO, WING, CMG, and DPZ.

Let's have a great day!

-JB