Stocks closed mostly lower on Wednesday, with the S&P falling .19% while the Dow squeezed out a small gain. Asia markets closed mixed overnight while Europe indexes are slightly lower this morning. U.S. futures are pointing to a bounce, the Dollar is lower while Yields, Oil and Gold are all higher.

And this is what UPB is reading this morning:https://www.optionmillionaires.com/morning-reads-155/

It was another choppy session for stocks on Wednesday, with markets trying to find some footing. Every time the S&P looked to breakout, sellers came in with quick reversals to the downside. Will be interesting to see how today plays out. The S&P has now closed lower for 5 straight sessions. Maybe we head to $380 in the next few days but have to think a bounce comes at some point. That $390 area sure looks like the line in the sand so would want to see that hold if we reverse today and I would look for some put hedges if that $390 handle breaks:

I went and added some BURL calls yesterday. Looks to be setting up for a move into the $220s at minimum. May look to add some more strikes into next week today on strength:

I also went and added some U calls in the morning with the stock trading in the green. Sure enough, it reverses the gains to close red. This morning it received a downgrade. I think this can rally regardless of the downgrade and may look for some calls into next week to play for a move back over $40:

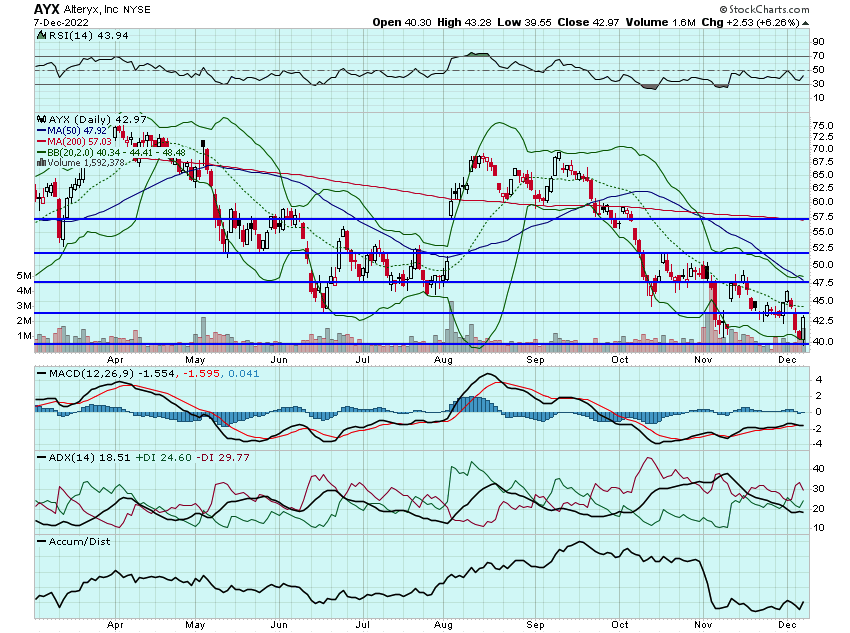

AYX hit multi-year lows on Tuesday and started to reverse yesterday. AYX is a great story and is a victim of the overall market sell-off. Think it offers a great opportunity here and trades north of $50 in the coming days. I went and added some $50 calls and may look for some other strikes to play for that move:

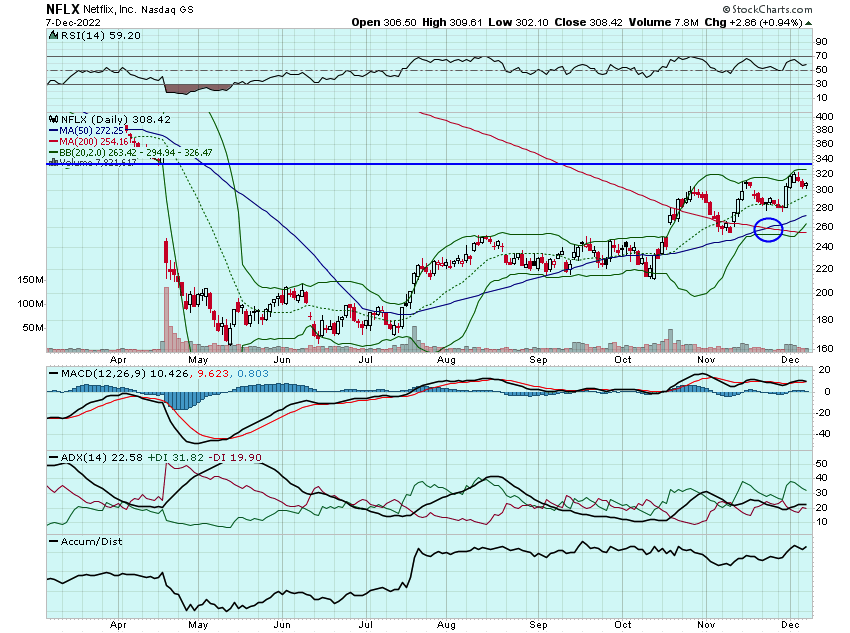

NFLX is gapping over that $310 handle this morning. Call me crazy, but think it trades above $320 today:

Still eyeing LULU but tough to trade ahead of its earnings after the close, though do think it can push into the $420+ area on a strong report. Also still eyeing WYNN, which is gapping higher this morning.

Here are the analyst changes of note for today:

| Block price target lowered to $66 from $67 at Morgan Stanley |

| Morgan Stanley analyst James Faucette lowered the firm's price target on Block (SQ) to $66 from $67 and keeps an Equal Weight rating on the shares. He sees 2023 as likely a weaker environment for credit and within his payments coverage universe he expects the weakening environment to impact companies with direct credit exposure, while expecting the impact to overall consumer spending to be "more nuanced and less material," Faucette tells investors. In that context, he is trimming estimates at Block, Affirm (AFRM) and NerdWallet (NRDS) to reflect weakening credit forecasts and a more difficult environment for low end consumers |

| C3.ai price target lowered to $12 from $13 at Morgan Stanley |

| Morgan Stanley analyst Sanjit Singh lowered the firm's price target on C3.ai to $12 from $13 and keeps an Underweight rating on the shares. C3.ai beat revenue and margin expectations in Q2 as several deals that had slipped in Q1 were closed, noted Singh. While implied Q3 revenue growth of negative 7% to 10% "certainly appears conservative," there remains risk around the timing and magnitude of existing customer's renewals and an overhang remains due to the model transition and lack of visibility on accelerating top-line growth, Singh tells investors |

| Piper Sandler sees 2023 as 'pivotal year' for Monday.com |

| Piper Sandler analyst Brent Bracelin sees 2023 as "pivotal year" for Monday.com where it "could blossom into a no-code automation platform." Meetings last week with management strengthen his confidence and positive bias that the company can build a profitable software franchise with a 90% gross margin model capable of scaling to $1B revenue by 2025. After the 67% year-to-date selloff, growth investors willing to underwrite at least a one year investment should revisit Monday.com, Bracelin tells investors in a research note. He keeps an Overweight rating on the shares with a $138 price target |

| Lovesac price target lowered to $50 from $55 at Canaccord |

| Canaccord analyst Maria Ripps lowered the firm's price target on Lovesac to $50 from $55 and keeps a Buy rating on the shares. The analyst said they reported solid 3Q results, with both revenue and profitability coming in slightly ahead of expectations despite a challenging operating environment and he continues to feel that the company's unique product platform and omnichannel strategy will help it weather near-term retail headwinds |

FedEx price target lowered to $184 from $192 at JPMorgan |

| JPMorgan analyst Brian Ossenbeck lowered the firm's price target on FedEx to $184 from $192 and keeps a Neutral rating on the shares. The analyst previously expected a weak peak season and normalization of freight rates across the supply chain, but says conditions have weakened faster than anticipated over the last three months. His fiscal 2023 and 2024 forecasts declined by 9% and 8% respectively and he's "mindful that FedEx guidance was cut multiple times during the last global freight cycle." Ossenbeck is cautious on FedEx into the fiscal Q2 earnings release on December 20, as he expects the current quarter will miss guidance and the Q3 outlook will fall short of consensus |

And here is what I am watching: U, NFLX, WYNN, LULU, BURL, NVDA, COST, SPOT, ROKU, DIS, DKS, U, TWLO, WING, CMG, and DPZ.

Let's have a great day!

-JB