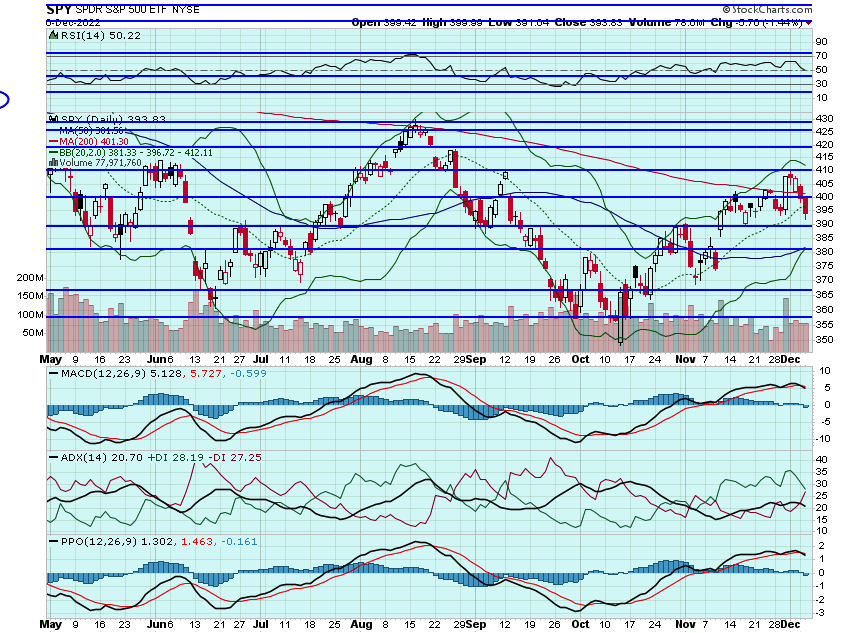

Markets fell again on Tuesday, with the S&P losing 1.44% and closing down for the 4th session in a row. Asia markets tumbled overnight while Europe indexes are in the red this morning. U.S. futures are pointing to another lower open, the Dollar is in the red while Yields, Oil, and Gold are higher.

It was another rough session for markets on Tuesday. Stocks opened lower and melted for most of the day before a small bounce came at 3:30 into the close. The S&P is now down over 3% this week and the negative headlines are heating up. Seems it always comes when the market is under pressure. Not saying its a contrarian signal but do think there will be a bounce of some sort in the next few days. That $390 on the SPY is a big spot. If that fails to hold have to think the 50dma at $380 will be a magnet:

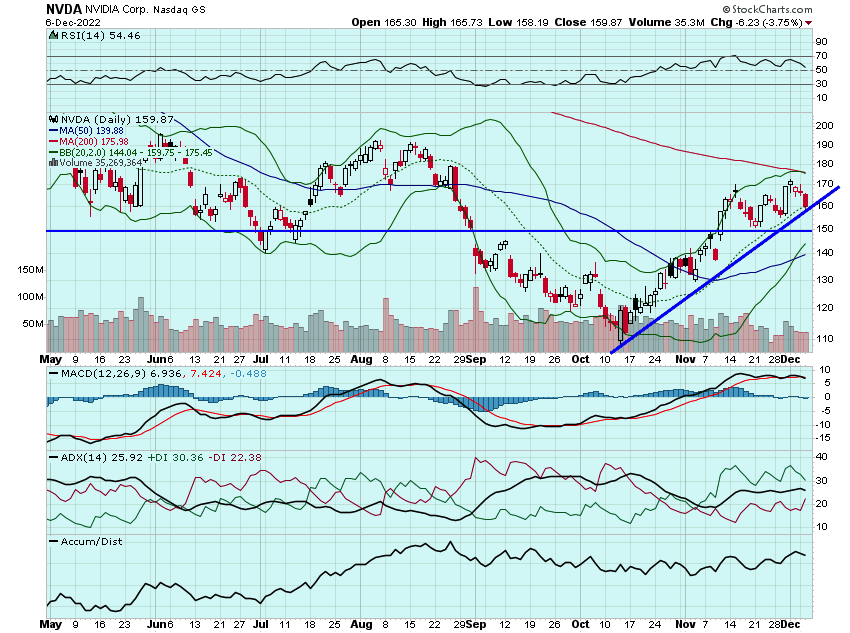

With markets failing to find a bid yesterday, I went looking for a hedge for more downside. NVDA is up nearly 50% since mid-October and was holding up well during the past few sessions so figured it offered a decent risk/reward for some puts. I added some $152.50s and was able to close them out for a nearly 250% gain on average. If the market fails to find any footing today may revisit puts, likely the $150s this time. Certainly at key support right now, so if that breaks $150 will come quick:

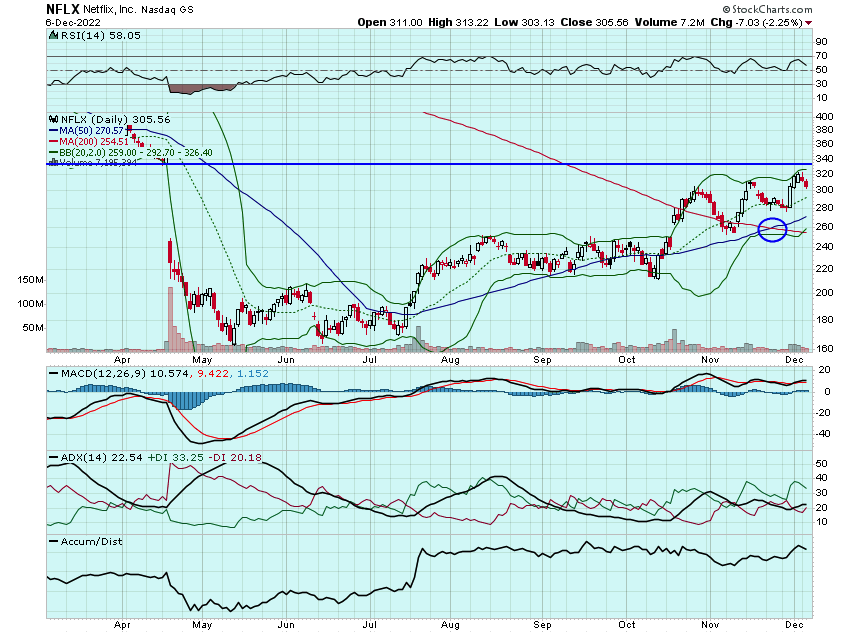

Once I closed my NVDA puts I added some NFLX calls. I almost added NFLX calls on Monday with the stock at $320 but the premiums were insane. Yesterday was not the case. Think if the market pulls a red to green move NFLX will outperform and revisit $320+:

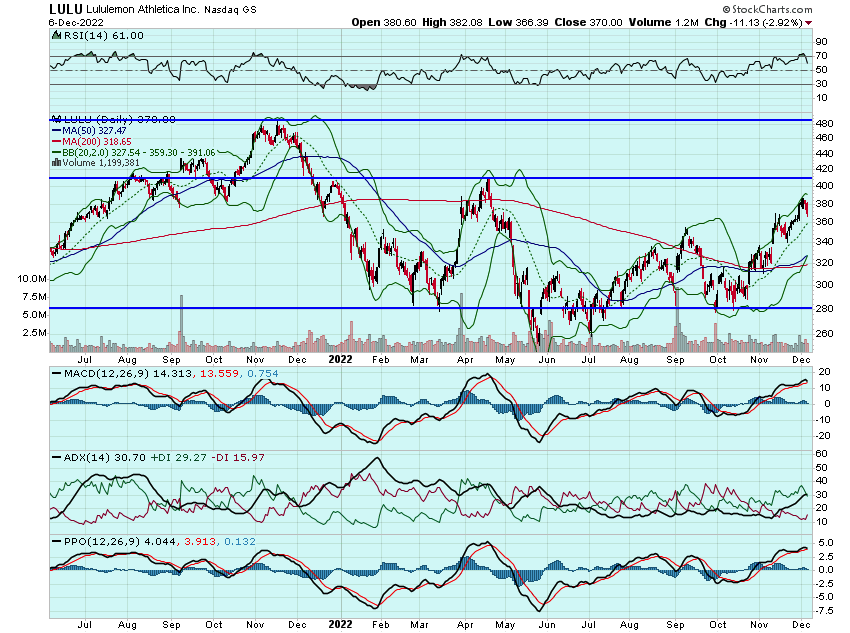

Still eyeing LULU calls for premium build into earnings tomorrow. The stock was weak yesterday so I passed but it received a PT upgrade this morning so maybe it will be the kick it needs. The good thing is the calls are cheaper so will be watching again today for a possible entry:

SAM closed down 5% yesterday after a downgrade. It likely would have closed lower anyway with the market but disappointing to say the least. Will need a huge catalyst for my December calls to recover.

BURL has a possible bull-flag here that could put the stock near $230 or some in the coming week or two. Will be watching for a possible weekly speculative trade or later dated strikes for that move:

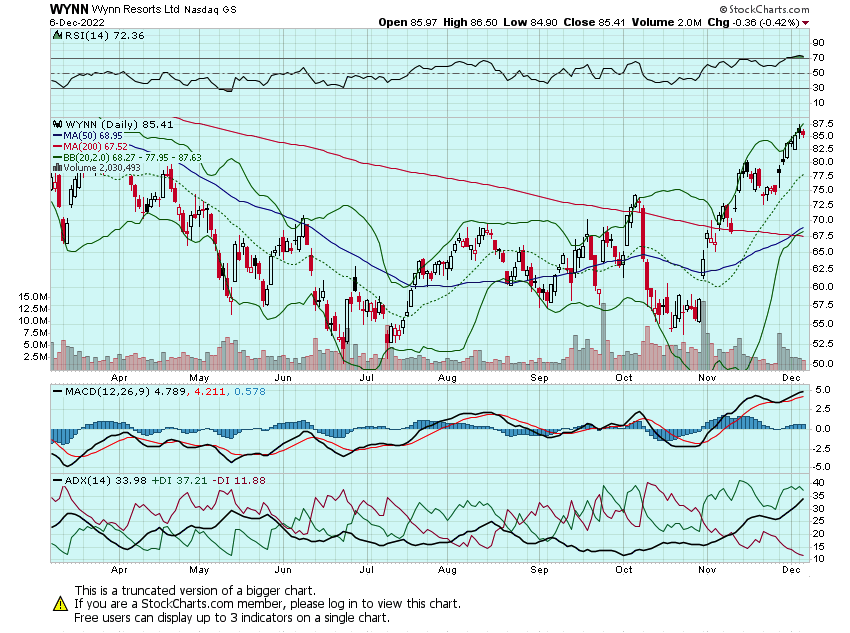

And lastly, adding WYNN to the watchlist. Covid restrictions being eased in Macau should help keep the stock bid with a possible visit of $90 in the coming days. Not to mention there is always buy-out chatter with this one:

Here are the analyst changes of note for today:

Wynn Resorts price target raised to $109 from $85 at Stifel |

| Stifel analyst Steven Wieczynski raised the firm's price target on Wynn Resorts (WYNN) to $109 from $85 and keeps a Buy rating on the shares, citing his continued belief that Wynn "represents one of the most compelling ideas under our coverage given the massive underperformance over the last 24 months coupled with benign investor expectations." He believes Macau-centric stocks such as Wynn and Las Vegas Sands (LVS) could present investors with "an interesting way to play the China reopening story" moving into 2023, Wieczynski said |

| PepsiCo price target raised to $206 from $195 at Argus |

| Argus analyst John Staszak raised the firm's price target on PepsiCo to $206 from $195 and keeps a Buy rating on the shares. The company is well-managed, offers a valuable brand portfolio, and continues to generate solid growth amid weak demand for many consumer staples, the analyst tells investors in a research note. Staszak adds that he expects cost cutting to continue to benefit earnings and looks for PepsiCo to achieve its goal of $1B in annual cost savings |

| AutoZone removed from 'Tactical Outperform' list at Evercore ISI |

| Evercore ISI analyst Greg Melich is removing AutoZone from the firm's "Tactical Outperform" list, noting that the stock is up 1% since he put on the call on November 10 versus the S&P being flat and the SP Retail Index being up 1%. Melich has an In Line rating on AutoZone with a $2,440 price target, down from a prior $2,520. The lower target reflects "the reality that even" AutoZone do-it-for-me business "can't escape the law of large numbers, with growth moderating to LDD-Mid-teens vs. the prior 20%+ run-rate," Melich stated |

| MongoDB price target lowered to $225 from $330 at Needham |

| Needham analyst Mike Cikos lowered the firm's price target on MongoDB to $225 from $330 to reflect "broader degradation" in market multiples but keeps a Buy rating on the shares after its Q3 earnings beat. The company delivered a solid quarter, materially outperforming estimates and investor sentiment heading into the print, the analyst tells investors in a research note. Cikos adds that MongoDB management's tone also sounded better on the earnings call, reflecting improvements to Atlas Consumption trends |

Boeing price target raised to $190 from $165 at BofA |

| BofA analyst Ronald Epstein raised the firm's price target on Boeing (BA) to $190 from $165 and keeps a Neutral rating on the shares. His higher target mainly reflects more positive sentiment on Commercial Aero since the investor day in early November turned out to be "a pleasant surprise," noting a reported potential 100 plane order from United (UAL) for 787s and the expectation for the 737-7 and 737-10 to ultimately get Congress' approval. However, he keeps a Neutral rating on the shares as he thinks there are some execution challenges ahead, the analyst noted |

| Five Below resumed with an Outperform at William Blair |

| William Blair analyst Phillip Blee resumed coverage of Five Below with an Outperform rating and no price target. The company reported results for Q3 with both sales and earnings above the Street's expectations and management's prior guide, Blee tells investors in a research note. The analyst says the company's momentum is continuing into the holiday |

And here is what I am watching today: BURL, LULU, WYNN, NVDA, COST, SPOT, ROKU, DIS, DKS, U, TWLO, WING, CMG, and DPZ.

Let's have a great day!

-JB