Futures are pointing to a lower start to the week, with the S&P set to open down .50% as I write this. Asia markets soared overnight as China eased covid restrictions while Europe indexes are in the red this morning. The Dollar and Gold are lower while Yields and Oil are higher.

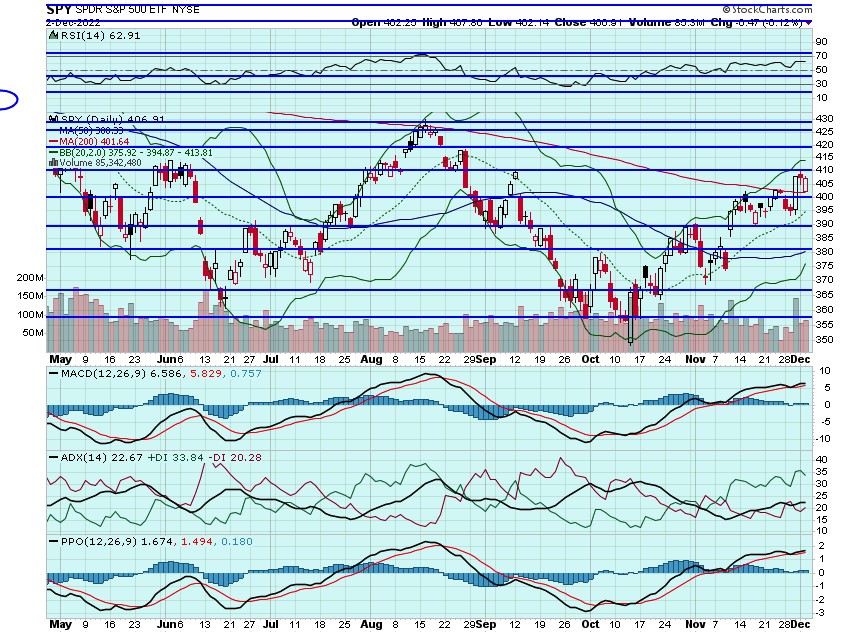

Stocks are set to give back some of last weeks gains ahead of a somewhat quiet week. There are still some earnings with names like LULU, COST, and ORCL reporting and on Friday there is the PPI data which can give a hint on what the CPI number next Tuesday may look like - and don't forget we get the Fed next Wesdneday. The SPY was able to reverse morning lows on Friday to close above that 200dma for the third session in a row. Still think we are setting up for a move to $415 or so:

RARE rallied over 6% on Friday and I was able to close some of my calls out for nearly 100% to cover costs. Will hold the rest for a possible move to $45+ in the coming days with that $42.50 level being the next resistance. Also a good sign that it broke thru that 50dma with strength:

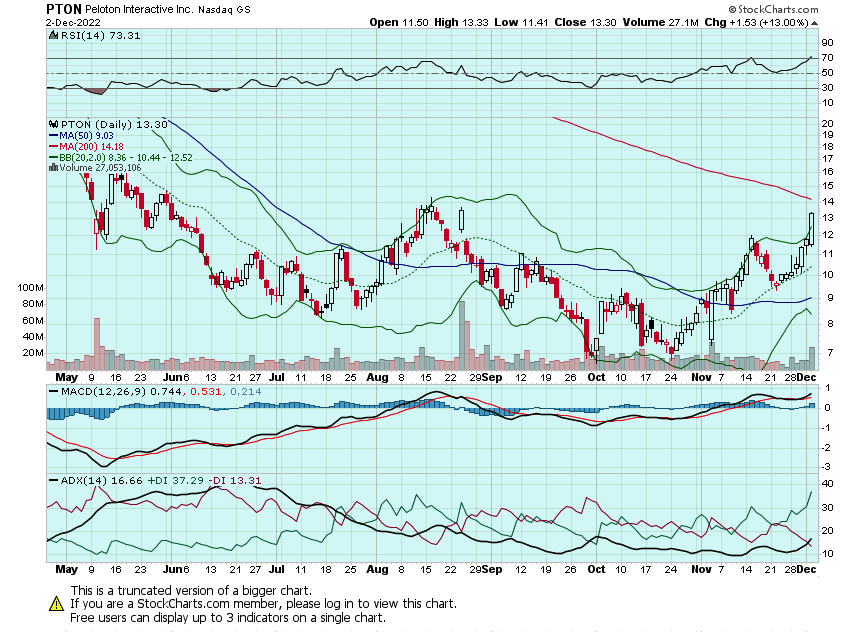

PTON rallied 13% on Friday and I was able to close more of my calls for 400%. The 200dma is at $14 so it will be the next key level of resistance to break. Will use $12 as a possible stop area:

I also added some speculative SAM calls on Friday with the stock showing a golden-cross. Think this gains some steam on a $400 break:

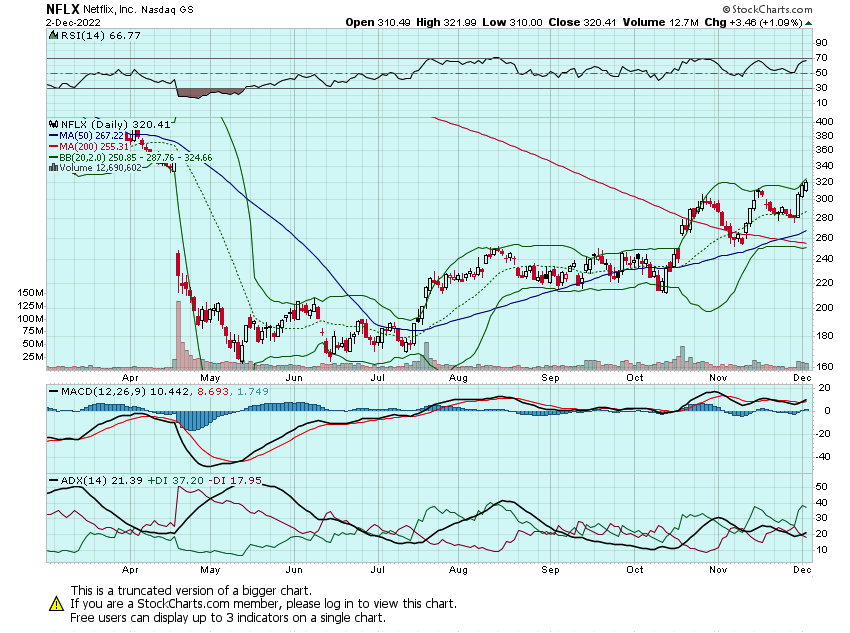

NFLX rallied over 10% in 3 days last week after its golden-cross break. Hoping the same type of move comes here on SAM:

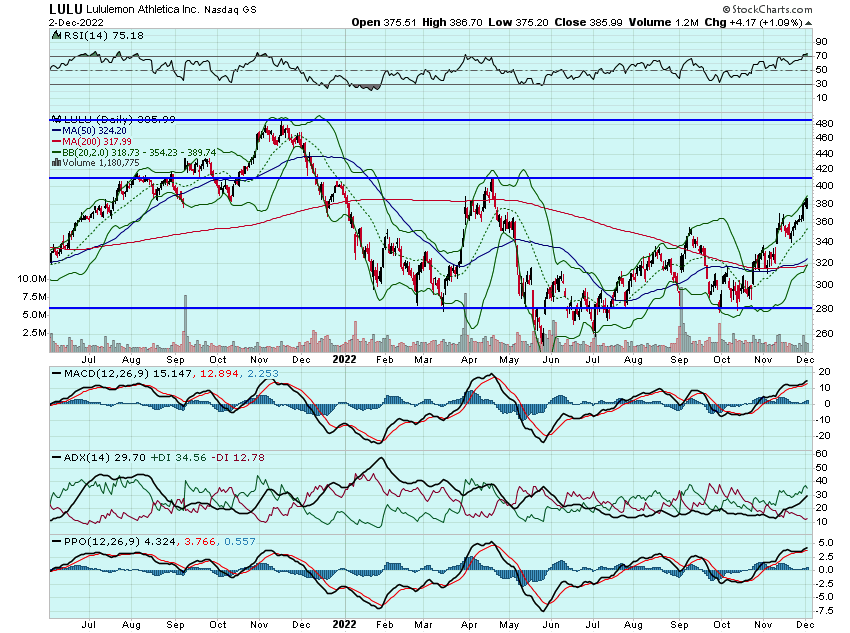

I may look to add some LULU calls for premium build into earnings Thursday. Some of these high quality retail names have been reporting strong results. If LULU posts a beat and raise it likely trades north of $480:

Also still have my eyes on SPOT, ROKU, and possibly may look at DIS. Certainly not going to be aggressive at the open with this gap lower - will wait for some bids to come in.

Here are the analyst changes of note for today:

Advance Auto Parts price target lowered to $185 from $220 at Argus |

| Argus analyst Taylor Conrad lowered the firm's price target on Advance Auto Parts to $185 from $220 but keeps a Buy rating on the shares. The company's earnings have recovered from the impact of the pandemic, and both revenue and earnings are now in growth mode, the analyst tells investors in a research note. Conrad adds that while Advance Auto Parts faces inflationary and currency headwinds, the auto parts sector has historically outperformed in times of economic hardship |

Intuitive Surgical price target raised to $316 from $247 at BTIG |

| BTIG analyst Ryan Zimmerman raised the firm's price target on Intuitive Surgical to $316 from $247 and keeps a Buy rating on the shares as part of a broader research note on Medical Technology. 2023 is set to be a better year for the industry following 2022 underperformance due to rising oil prices, a challenging supply chain, currency headwinds, inflation, and staffing shortages, the analyst tells investors in a research note. Lower oil prices, improving inflation, strong employment, and improving procedure recovery form the basis for his better outlook in MedTech in 2023, Zimmerman adds |

| Lululemon price target raised to $450 from $400 at Stifel |

| Stifel analyst Jim Duffy raised the firm's price target on Lululemon to $450 from $400 and keeps a Buy rating on the shares ahead of the company's fiscal Q3 report on Thursday, December 8, telling investors that he expects "revenue led upside" to results in the second half of the fiscal year. U.S. checks show promotions in Q3 and Q4-to-date to be below both Q2 and 2019 despite elevated inventory, Duffy said in his earnings preview note |

| DocuSign price target lowered to $52 from $65 at UBS |

| UBS analyst Karl Keirstead lowered the firm's price target on DocuSign to $52 from $65 and keeps a Neutral rating on the shares ahead of its Q3 results this week. The analyst is citing the risk of a guide-down in January quarter outlook |

| SolarEdge price target raised to $360 from $309 at Cowen |

| Cowen analyst Jeffrey Osborne raised the firm's price target on SolarEdge to $360 from $309 and keeps an Outperform rating on the shares. The analyst said they are well positioned to benefit from secular solar demand driven by policy and higher electricity rates, and shares trade at over a 40% discount to Enphase on 2023 earnings |

| Evolent Health price target raised to $44 from $33 at Piper Sandler |

| Piper Sandler analyst Jessica Tassan raised the firm's price target on Evolent Health to $44 from $33 and keeps an Overweight rating on the shares. The analyst says a large total addressable market, "deep competitive moats," high visibility into profitable double-digit growth, a "compelling" catalyst path, upside to deal synergies and a discounted valuation make Evolent a top pick for fiscal 2023 |

And here is what I am watching today: LULU, COST, SPOT, ROKU, DIS, DKS, BURL U, TWLO, WING, CMG, and DPZ.

Let's have a great day!

-JB