Markets soared on Wednesday, with the S&P adding 3.89% while the Nasdaq rallied over 4%, as Powells comments at the Brookings institute painted a picture of the fed scaling back on rate hikes,. Asia markets closed higher overnight while Europe indexes are in the green this morning U.S. futures are pointing to a higher open, the Dollar and Yields are lower while Oil and Gold are higher.

And this is what UPB is reading this morning: https://www.optionmillionaires.com/morning-reads-151/

It was a monster rally for stocks on Wednesday, as Powell's comments at the Brookings Institute could be construed as dovish. The SPY finally broke and closed above that 200dma. A great sign. As I have been saying, there is not much in the way of catalysts until the CPI and Fed mid-December so think the path of least resistance is to the upside and a possible test/break of $415.

I was able to lock some of my U calls in for some nice gains yesterday and held the rest into today. Call me crazy, but think this can trade into the mid-$40s before the week is out. Will use the $39 handle as a stop:

PTON rallied over 8% yesterday, Think once that $12 handle falls, $13+ comes quick. Will look to close some of my calls out cover costs and ride the rest:

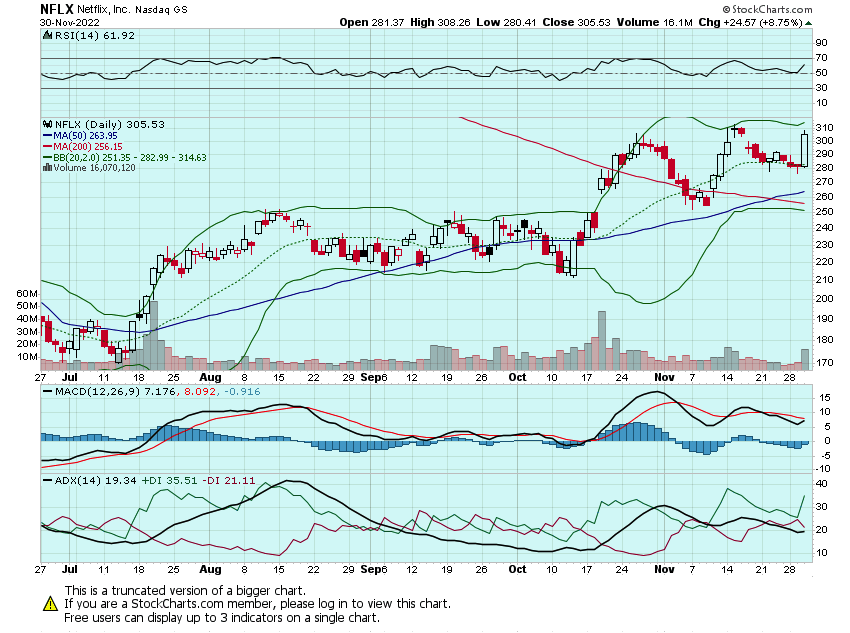

That NFLX golden-cross is playing out with the stock finishing yesterday up nearly 9%. Not gong to chase but do think NFLX can test that $320 handle. May look at some spec calls today:

SAM has yet to breakout after its golden-cross so definitely one I will be watching today:

And still eyeing ROKU, SPOT, BIIB, and SAGE for some possible upside calls.

Here are the analyst changes of note for today:

| Salesforce price target lowered to $230 from $240 at Jefferies |

| Jefferies analyst Brent Thill lowered the firm's price target on Salesforce to $230 from $240 and keeps a Buy rating on the shares after the company reported total revenue growth in-line with the Street along with billings and CRPO growth that missed Street estimates. Co-CEO Bret Taylor's departure "caught us by surprise and is showing the co-CEO model isn't working" with two departures in three years, added Thill in his post-earnings recap note. Due to limited visibility, management did not provide an initial FY24 outlook, as it has historically, but he is lowering his top line growth estimate to 8% from 10%, Thill added. |

| Costco price target lowered to $557 from $559 at Truist |

| Truist analyst Scot Ciccarelli lowered the firm's price target on Costco to $557 from $559 and keeps a Buy rating on the shares. The company's November sales were "modestly below trend", but this is likely to be temporary, the analyst tells investors in a research note. Ciccarelli adds that investors should be "aggressive buyers" of Costco on any pullback in the stock price |

| AutoZone price target raised to $2,792 from $2,533 at Truist |

| Truist analyst Scot Ciccarelli raised the firm's price target on AutoZone to $2,792 from $2,533 and keeps a Buy rating on the shares ahead of its earnings next week. The analyst is citing the positive reads from the proprietary Truist credit card data as well as bullish management meetings |

| Johnson & Johnson price target raised to $178 from $170 at Morgan Stanley |

| Morgan Stanley analyst Terence Flynn raised the firm's price target on Johnson & Johnson to $178 from $170 and keeps an Equal Weight rating on the shares as he refreshed his sum-of-the-parts valuation ahead of the company separating its Consumer Health segment into an independent company, to be called "Kenvue," in the second half of 2023. J&J has previously indicated that many different separation pathways are being considered, including a potential spin or IPO, and he expects more details later this year or in early 2023. The "RemainCo" will be made up of J&J's Pharma and Medtech segments, noted Flynn, who projects the value of Pharma and Medtech at about $152 per share and sees about $26 per share in value for the Consumer business |

| Five Below price target raised to $200 from $178 at Craig-Hallum |

| Craig-Hallum analyst Jeremy Hamblin raised the firm's price target on Five Below to $200 from $178 and keeps a Buy rating on the shares. The analyst notes comp trends accelerated far better than whispers, leading to an impressive beat and raise for Five Below in Q3 with traffic improving in the holiday season |

| Salesforce price target lowered to $200 from $235 at RBC Capital |

| RBC Capital analyst Rishi Jaluria lowered the firm's price target on Salesforce to $200 from $235 but keeps an Outperform rating on the shares. The company's Q3 results disappointed relative to a "low bar", while deteriorating macro conditions are driving a Q4 cRPO growth guide of just 7%, which is below both sell-side and buy-side expectations, the analyst tells investors in a research note. Salesforce continues to compound cRPO growth in the teens and there are many avenues to sustain growth however, including monetizing organic innovation on the core front-office clouds as well as accelerating the growth of acquired assets through cross-sell and bundling, Jaluria adds. |

And here is what I am watching today: PTON, ULTA, NFLX, SAM, ROKU, DKS, BURL U, SPOT, TWLO, WING, CMG, and DPZ.

Let's have a great day!

-JB