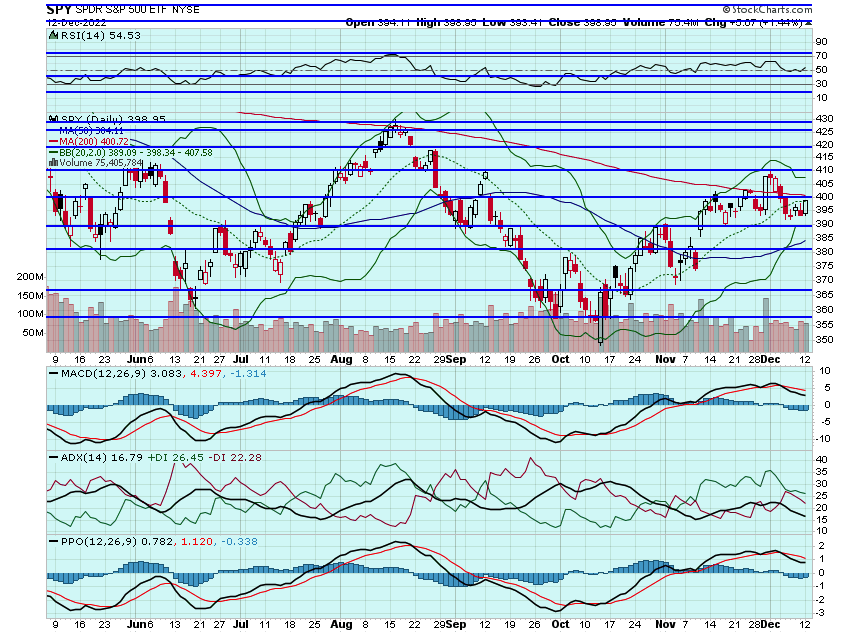

Markets closed higher on Monday, with the S&P adding 1.4%. Asia markets closed in the green overnight while Europe indexes are higher this morning. U.S. futures are soaring this morning, the Dollar and Yields are lower while Oil and Gold are higher.

And this is what UPB is reading this morning: https://www.optionmillionaires.com/morning-reads-157/

Futures are rallying this morning after the November CPI number came in cooler than expected. Tomorrow we get the Fed decision. A .50% hike should set the market up on a crash course with $420 in the coming days:

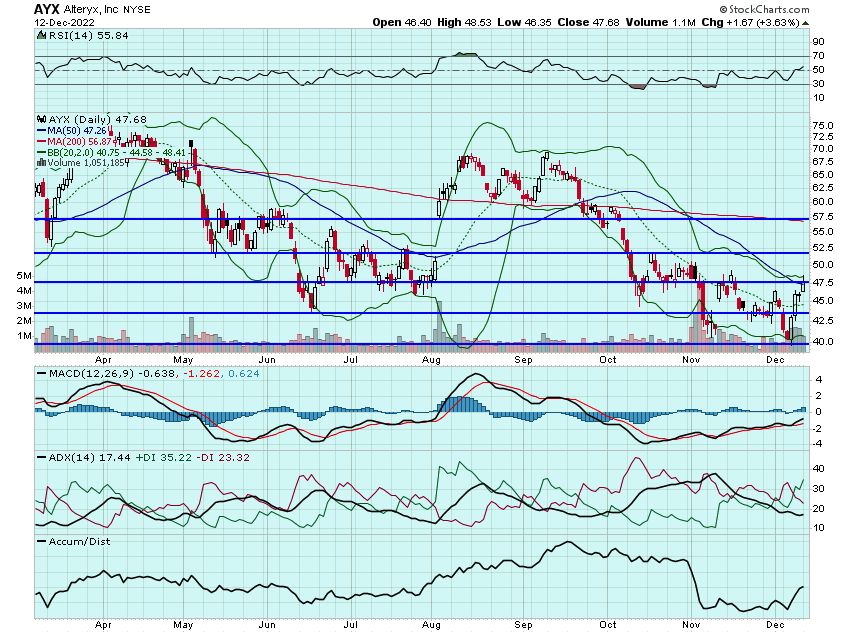

I closed more AYX calls yesterday for 300%+ and then went and added some January strikes. Think AYX is into the $50s in the coming days and likely higher. I accidently had put RARE as my entry. Think RARE will trade into the $50s as well so both trades should pay nice. Will look to close the rest of my AXY Dec calls and hold the January strikes. AYX is gapping this morning and should be into the $50s before the week is out:

RARE has blue skies until the mid-$50s:

ROKU is soaring this morning after the CPI data. Think $60+ is in the cards this week but will look to take some off to cover costs today:

TNDM announced an acquisition this morning and the market is punishing the stock for some reason. Definitely going to put a hurt on my calls though still think the stock trends higher over the coming months:

SQ received an upgrade this morning. Could be a name that runs in the coming days. Will be looking at calls for a move into the mid-high $70s:

The Fed can certainly put a wrench in the market, even with a big rally today... definitely something to me aware of tomorrow.

Here are the analyst changes of note for today:

| Northland starts FormFactor at Outperform with $33 price target |

| As previously reported, Northland analyst Gus Richard initiated coverage of FormFactor (FORM) with an Outperform rating and $33 price target. Delays of Intel (INTC) products, China export bans, and weakness in the DRAM market have impacted FormFactor's revenue in the second half, noted Richard, who sees the proliferation of advanced packaging driving demand for probe cards in 2023. His calendar 2023 estimates are "slightly above consensus" and he believes "there is likely more upside than risk to our estimates," the analyst noted |

| Corning price target lowered to $35 from $36 at Morgan Stanley |

| Morgan Stanley analyst Meta Marshall lowered the firm's price target on Corning to $35 from $36 and keeps an Equal Weight rating on the shares as she rolled her valuation forward to calendar year 2024 estimates in conjunction with a 2023 preview note for the North American Telecom & Networking Equipment space. In general for the group, Marshall said she leans cautious until estimates come down, adding that estimate revisions are more likely to come late in the first half as backlogs clear and the demand picture becomes clearer |

Nutanix price target raised to $30 from $26 at Morgan Stanley |

| Morgan Stanley analyst Meta Marshall raised the firm's price target on Nutanix to $30 from $26 and keeps an Equal Weight rating on the shares as she rolled her valuation forward to calendar year 2024 estimates in conjunction with a 2023 preview note for the North American Telecom & Networking Equipment space. In general for the group, Marshall said she leans cautious until estimates come down, adding that estimate revisions are more likely to come late in the first half as backlogs clear and the demand picture becomes clearer |

| Oracle price target raised to $75 from $72 at Stifel |

| Stifel analyst Brad Reback raised the firm's price target on Oracle to $75 from $72 and keeps a Hold rating on the shares following the company's "solid" fiscal Q2 results. Management reiterated last quarter's expectation for 30%-plus constant currency organic cloud revenue growth in FY23, noted Reback, who expects consistent short-term results given the near-term Cerner tailwinds and existing Oracle customers lifting and shifting on-premise work loads to the Oracle Cloud |

| Home Depot price target raised to $379 from $350 at Cowen |

| Cowen analyst Max Rakhlenko raised the firm's price target on Home Depot to $379 from $350 and keeps an Outperform rating on the shares. The analyst said they exemplify best-in-class retail execution with leading Pro share and an accelerating flywheel that should serve the company well into a challenging macro backdrop into 2023 |

| Lumentum price target lowered to $66 from $75 at Morgan Stanley |

| Morgan Stanley analyst Meta Marshall lowered the firm's price target on Lumentum to $66 from $75 and keeps an Equal Weight rating on the shares as she rolled her valuation forward to calendar year 2024 estimates in conjunction with a 2023 preview note for the North American Telecom & Networking Equipment space. In general for the group, Marshall said she leans cautious until estimates come down, adding that estimate revisions are more likely to come late in the first half as backlogs clear and the demand picture becomes clearer |

And this is what I am watching today: SQ, SPOT, ROKU, NFLX, RARE, BURL, WYNN, NVDA, COST, DIS, DKS, U, TWLO, WING, CMG, and DPZ.

Let's have a great day!

-JB