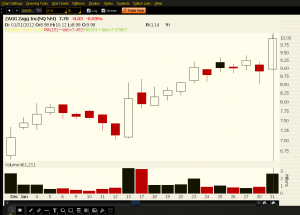

I have started to accumulate some $7 and $8 calls for $ZAGG as I see the stock running up to $10 into its late February earnings report. If you look at last January the stock has a powerful rally into the end of the month as it rallied from current prices to $10.00 a share.

If we get this type of rally the calls will return a very nice profit. However if the stock falls I will look at the $6.50 long term support level as the line in the sand as far as opening any more positions.

What does ZAGG do? ZAGG Inc is a leading mobile device accessories and technology company with products that protect, personalize and enhance a consumer's mobile experience. ZAGG differentiates itself as the preferred brand by offering creative product solutions through targeted global distribution channels, with the broadest product offering in its sector. With a brand portfolio that includes ZAGG® and iFrogz™, the company manufactures and markets a complete line of products to improve the functionality of portable gadgets, including keyboards, cases, audio and protective films, through direct, retail, specialty and international channels.

Why do I like this stock? First lets start with the bad. ZAGG's CEO stepped down last August after selling company stock to cover margin calls. A possible class action lawsuit has clouded the future of the company and this could cap gains until this is resolved. Class action suits can be costly and time consuming.

Now on to the good. The company is growing at a very healthy clip with revenue up 30% last quarter. The earnings report coming next month is usually the company's strongest quarter (it includes the holiday shopping season) and last year the stock rallied over 20% prior to its release.

The company announced a $10 million share buy back last month, which amounts to almost 5% of the current outstanding shares. They also favorably refinanced their debt reducing their interest expense by $2,000,000 annually. The stock rallied over 12% on the heels of this news in December, and while the stock has since fallen back to the mid $7.00's , this is good news for ZAGG shareholders.

ZAGG's January in the money options trade with very little extrinsic value and that is good for an option trader. For instance the $7 strike that I currently own trades within $.05 of the price of ZAGG. I think we could see a nice gain on the calls in January and February as the stock ZIG ZAGGS its way to higher prices.