Markets soared to start the week, with the S&P jumping .77% to close at another record high. Asia markets closed mostly higher overnight while Europe stocks are in the green this morning. U.S. futures are up again this morning, the Dollar is lower, while Yields, Oil, and Gold are all slightly higher.

And this is what UPB is reading this morning : https://www.optionmillionaires.com/tuesday-morning-reads-75/

DSW reported monster earnings and raised guidance this morning. Their mix is different then SCVL but still bodes well for the sector and for SCVL's earnings after the close. Still bidding the Oct $45s but won't pay more than .60 for them.

---- UPB taking over here ---

Analyst comments:

- LASR -5.6% (initiated with a Sell at The Benchmark Company; tgt $17)

- SBGL -4% (downgraded to Underperform from Neutral at Macquarie)

- AMSWA -2.9% downgraded to Neutral at B. Riley FBR)

- CTRL -2.1% (downgraded to In-line at Imperial Capital)

- HMY -1.7% (downgraded to Underperform from Neutral at Macquarie)

- AMAT -1.4% (downgraded to Neutral from Buy at BofA/Merrill)

- LRCX -1.1% (downgraded to Neutral from Buy at BofA/Merrill)

- COTY +5.9% (upgraded to Overweight from Equal-Weight at Morgan Stanley)

- XLNX +3.1% (upgraded to Outperform from Neutral at Robert W. Baird)

- EL +2.1% (upgraded to Overweight from Equal-Weight at Morgan Stanley)

- AM +1.6% (upgraded to Buy from Hold at Stifel)

- RH +1.1% (upgraded to Accumulate from Hold at Gordon Haskett)

- FMS +0.6% (upgraded to Buy from Hold at HSBC Securities)

- Other news:

- AFMD +162.5% (announces collaboration with Genentech to develop novel NK cell engager-based immunotherapeutics for multiple cancer targets; Affimed will receive $96 million upfront and committed funding and is eligible for up to an additional $5.0 billion including milestone payments, and royalties on sales)

- LSCC +13.1% (appoints Jim Anderson CEO, effective September 4)

- AMD +3.6% (names Saeid Moshkelani as SVP of Client Compute Group; Darren Grasbya named SVP of global Computing and Graphics sales, replacing Jim Anderson who leaves to pursue other opportunities)

- ALNY +2.1% (following AKCA / IONS CRL news)

- ILMN +1.4% (receives approval of MiSeqDx System in China)

- AKCA -26.5% (Akcea Therapeutics and Ionis receive Complete Response Letter for WAYLIVRA from FDA)

- IONS -12.5% (Akcea Therapeutics and Ionis receive Complete Response Letter for WAYLIVRA from FDA)

- WMGI -4.1% (prices offering of 18,248,932 of its ordinary shares at $24.60 per share)

- EDIT -2.5% (Chief Medical Officer Gerald Cox, M.D., Ph.D. will be stepping down from the Company at the end of the year

Here is some of the news and headlines from overnight, Europe and Asia ->

News:

- The Hong Kong Monetary Authority sold U.S. dollars to defend the currency peg for the fourth time since the end of July.

- South Korean press reported that plans for a September meeting between South Korea's President Moon Jae-in and North Korea's Supreme Leader Kim Jong-un remain in place.

- Japan's BoJ Core CPI +0.5% year-over-year (expected 0.3%; last 0.4%)

- South Korea's August Consumer Confidence 99 (last 101)

Equity indices in the Asia-Pacific region ended Tuesday on a modestly higher note. Japan's Finance Minister Taro Aso said he expects dialogue with China to set the stage for Prime Minister Shinzo Abe's visit to China later this year. South Korean press reported that plans for a September meeting between South Korea's President Moon Jae-in and North Korea's Supreme Leader Kim Jong-un remain in place. The Hong Kong Monetary Authority sold U.S. dollars to defend the currency peg for the fourth time since the end of July.

- Economic data was limited:

- Japan's BoJ Core CPI +0.5% year-over-year (expected 0.3%; last 0.4%)

- South Korea's August Consumer Confidence 99 (last 101)

---Equity Markets---

- Japan's Nikkei added 0.1%, but spent the session in a steady retreat from its opening high. JGC, Komatsu, Yokohama Rubber, Fanuc, Mazda Motor, Hitachi Construction, Bridgestone, Hino Motors, Honda Motor, TDK, and Toyota Motor gained between 0.9% and 3.2%.

- Hong Kong's Hang Seng rose 0.3%. Want Want China rallied 2.8% while Sunny Optical Tech, CNOOC, Link Reit, SHK Properties, BoC Hong Kong, Henderson Land, and Bank of China gained between 0.3% and 2.2%.

- China's Shanghai Composite shed 0.1%. Wuhan East Lake High Technology Group, China Grand Automotive Services, Shanghai Broadband Technology, Sichuan Minjiang Hydropower, and Cred Holding lost between 3.0% and 4.8%.

- India's Sensex gained 0.5%. Adani, Reliance Industries, Maruti Suzuki, Tata Steel, and Coal India posted gains between 0.7% and 2.2%.

|

European Summary

Yields Mixed

|

The Market continues to grind to new highs. Many are looking for a pull back. I love this tweet, just about sums it up -->>

Me waiting for a correction pic.twitter.com/mP62AHe7FY

— Ramp Capital♿️ (@RampCapitalLLC) August 28, 2018

I look at the S&P500 as just breaking out from the January highs. A test perhaps of former resistance will come at some point. But I think the market it likely to head even higher first.

$GME got clobbered yesterday down 11% at points. This doesnt change my view of the stock and will likely add calls today.

$MOS broke out yesterday, after respecting 5 year resistance, now support, last week.

$FSLR I think is ready to break higher. The timing of which is the only question. That $50 level is key and a break through that negates my upside perspective.

$SWCH continues to grind higher, I think the earnings gap at $14 will get filled.

$VSI continues to consolidate. I think $15+ into the fall has a good chance of occurring.

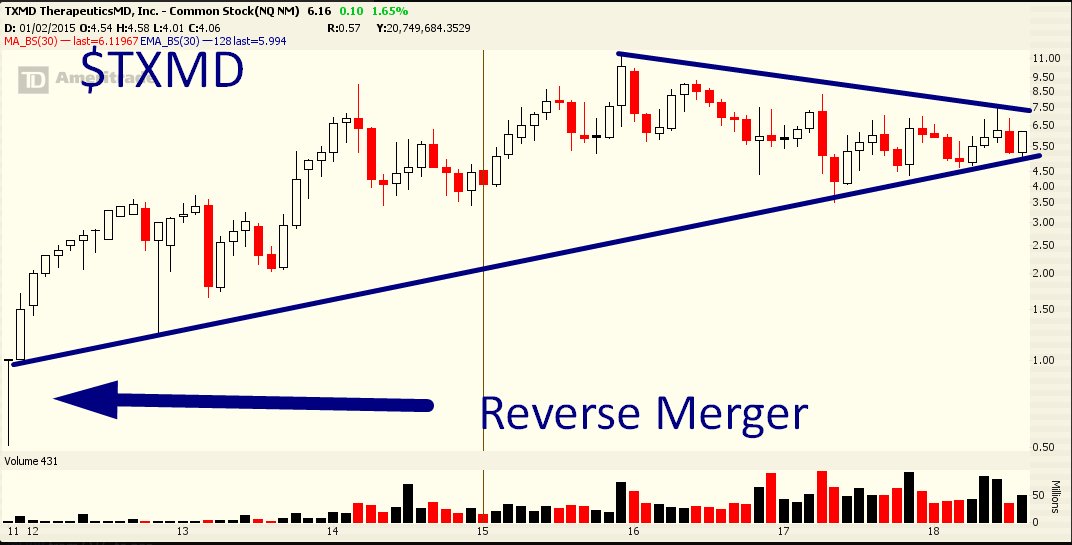

and finally $TXMD. I love this stock into the fall and 2019. I added Dec calls yesterday to my October. My next step is to look out into 2019.

FWIW JB will be in and mostly out for today. Mention @jb in the chat room and he will be able to see those messages and respond when he can.

The market will have a nice pull back at some point. I said it a few weeks ago when everyone thought Turkey and the 1.6% decline was the end of the bull market.

I think $SPY $300 $QQQ $200 and $IWM $190-195 are coming before any top.

However my view about a market top and recession is starting to change a little, and I do think we are in the latter stages of this rally. Although it's not the 9th inning just yet.

See you in the chat room have a great day!