Stocks tumbled on Tuesday, with the S&P falling 1.58% and the Nasdaq dropping nearly 2%, as First Republics Bank's earning shed light on how dire things are for them, with a 41% drop in deposits. Worries of contagion are back... Asia markets closed mixed overnight while Europe indexes are in the red this morning. U.S. futures are pointing to a green open, the Dollar and Oil are lower while Yields and Gold are higher.

And this is what UPB is reading this morning: https://www.optionmillionaires.com/morning-reads-246/

It was a nasty session for stocks on Tuesday, with markets gapping lower at the open and failing to find any meaningful bids at all, to close right at session lows. The S&P has now given back all of its April gains and is down .81% for the month. First Republic seems to be the major catalyst as folks now worry if there will be more contagion once again:

Small caps also took it on the chin yesterday, with the Russell closing down 2.47%. The dreaded death-cross is now in play:

The last death cross happened at the start of 2022 and preceded a large decline... different this time? Certainly something to watch. Earnings after the close yesterday from GOOGL and MSFT came in much better than expected with MSFT posting a blow-out quarter. GOOGL's results came in better than expected and they upped their stock buyback authorization but the stock is lagging in the pre-market. This earnings season continues to be filled with solid reports and could provide a backdrop for a rally soon, as long as this First Republic fiasco is put into the rear-view mirror. The 50dma on the SPY is $401.84, so would want to see that area held if somehow we reverse today. After the close today we get earnings from META and then tomorrow it is AMZN. More solid reports and markets should find some footing:

I went and added some SPOT lotto calls after the open. The stock has a tendency for some outsized moves after earnings and thought its report from yesterday was better than expected and should put a bid in the stock above $150. It tried to rally, testing $145, before pulling back to close at $138.20. It was a huge volume/churn day and think it bodes well for more upside. Won't add anything just yet, but if it breaks $145 today, may look to add some strikes into next week:

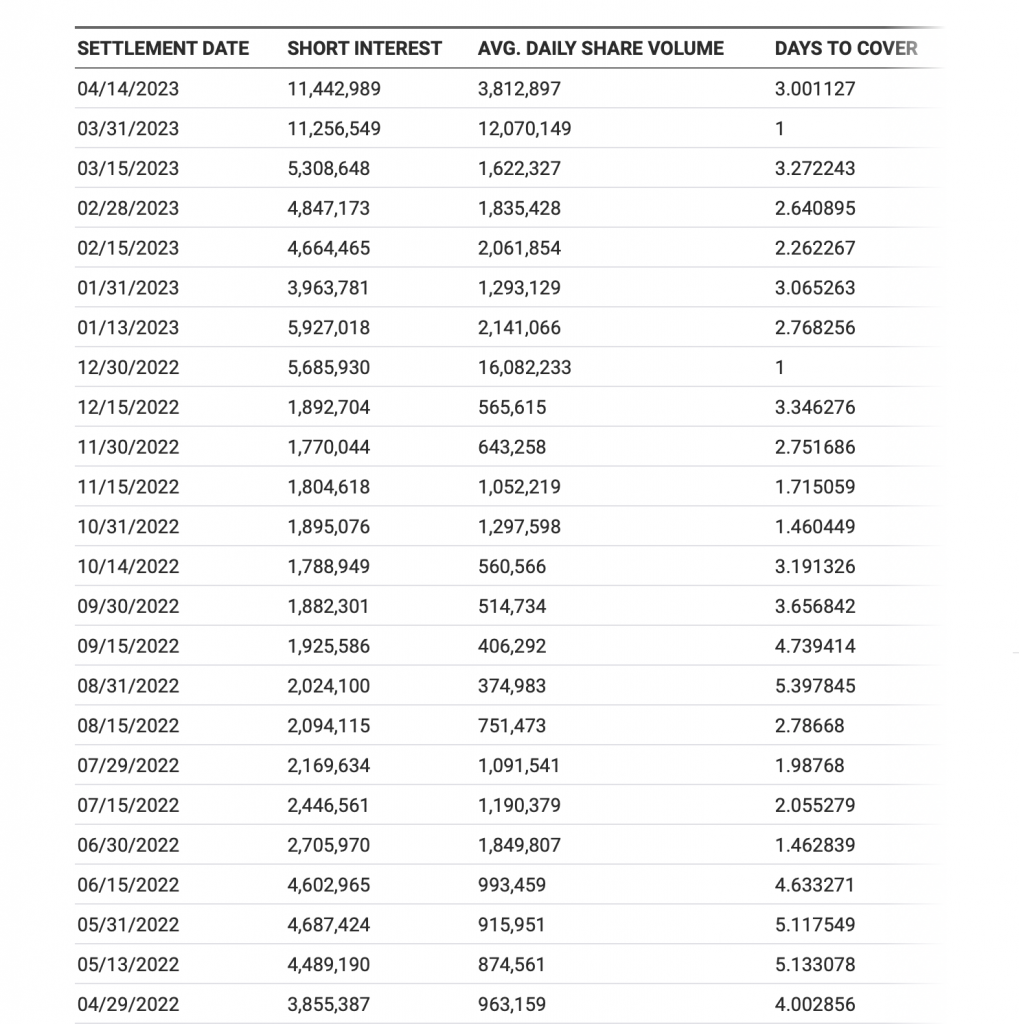

It is a big day for VKTX, with the company set to report earnings after the close. VKTX is still an early-stage bio with no revenues, so all eyes will be on their cash position, and any updates on their studies. Hopefully no surprises here and the stock can resume its move up to the mid-$20s and beyond. Likely will wait until tomorrow to add anymore strikes. For what it is worth, the short interest just went up another 200k shares:

SAGE held up well yesterday despite the market weakness. Potential bull-flag is setting up. They report earnings next week. Think $50+ comes soon, and then $60+:

Another red day for WW. Looks like $7 provided some support. If it finds green today I may look at some later dated calls, they report earnings next Thursday:

ILMN posted a nice beat yesterday. The stock has churned between $175 and $225 for nearly a year now. One of these reports sends it. If it can hold $220 I may look to add some calls to play for a move to $240+ in the coming weeks:

May look at some far out-of-the-money lotto calls on ALGN and also look at CMG for some speculative calls today after their monster reports yesterday,

And this is what I am watching today: ILMN, VKTX, ALGN, CMG, SPOT, WW, SAGE, SHW, ABBV, ABT, GLD, ALGN, SAM, EDIT, MASI, BLK, SITE, SMG, FAZ, EXAS, ULTA, YOU, SRS, BLK, SQ, SAGE, ICPT, U, TRIP, and AYX.

Let's have a great day!

-JB