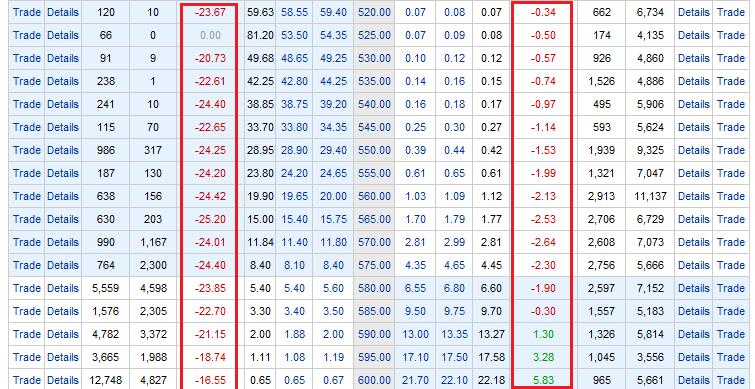

For the only the 2nd time in 39 quarters AAPL missed revenue and profit expectations. The stock promptly dropped over 5% last evening and today. As I said in my last post AAPL would need a rather large move for out of the money option traders to profit. Even this 5% move to the downside was not enough to prevent option traders from getting wiped out.

Any option bought under the $600 strike, save the $595 (15% gain) and $590 puts (10% gain), ended up being, so far, a losing trade. The farther down you go the bigger the loss. For those new to trading stock options it is, hopefully, a lesson on trading earnings that can be applied for future earnings.