Today a Seeking Alpha article said investors are getting fooled again. Again? The only investors getting fooled are the shorts. The stock is up over 200% the last 52 weeks, 35% this year, and over 20% this week. Fool me over and over and over again, I'll take those gains any day of the week!

There is no denying it.... Unipixel is a battleground stock. Many investors feel $UNXL will trade over $40 in the coming months and $100+ down the road. On the other side are those who think $UNXL is headed for an implosion, its "in peril", and heading "down the abyss".

Unipixel is a speculative stock. Their recently rebranded InTouch Sensors™ Powered by Kodak have yet to post $1 of revenue. The bears think it will never ship. They are betting on complete failure, and point to the October 1 "drop dead date" as a line in the sand. Guess what? Its still September! Wednesdays release stated "we look forward to making the commercial rollout of InTouch Sensors a success over the weeks and months ahead." Days, weeks..... No matter how you skew it, revenue is coming.

Over three weeks ago Cowen & Co.’s Robert Stone reiterated an Outperform rating and a $46 price target after taking a tour of the company’s manufacturing line in Lufkin, Texas, which reassured him manufacturing of UniPixel’s “mesh” technology is on track. “We visited the TX operations (8/30/13) and believe progress continues toward Q4 volume production,” writes Stone. The average analyst target is $45.50 for $UNXL with significant revenue and EPS growth projected over the next three years.

I ,unlike the shorts who live day to day, look at $UNXL from a longer term perspective. One day will not make or break this stock. I look at Wednesday's press release as a confirmation that the company has tremendous growth potential going forward. $UNXL has yet to ship product, but is already looking to expand its production capabilities. They are in discussions with several manufacturing companies in Asia that have expressed strong interest in setting up manufacturing capabilities for InTouch Sensors in their respective countries. That speaks volumes. You can look at $UNXL as a day to day trade, watch it go up 15% one day down 5% the next. I look at it as a stock that is undervalued, one that has the potential to trade into the triple digits next year.

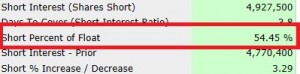

Anyone watching the trading action on Wednesday saw how quickly $UNXL rallied. There was no revenue announced. No sales, yet the stock rocketed 20% higher. The sellers of the last few months have been the shorts, bringing the stock down as they borrow stock and sell it into the market, hoping to capitalize on a downward move for $UNXL. We had record short interest numbers out last week. Over 50% of the tradeable shares have been borrowed to be sold short. A massive borrowing and selling of stock artificially decreased the share price of $UNXL. What happens when that artificial selling stops? The shorts have crammed themselves into a very crowded trade.

On Wednesday with the stock rallying, the shorts weren't selling, and when the shorts aren't selling there isn't anyone to buy from. It's easy to dump borrowed shares onto a bid, but what happens when the sellers vanish? We had a brief glimpse of that on Wednesday with $UNXL roaring 20% higher. I can only imagine what will happen down the road when revenue starts rolling in.

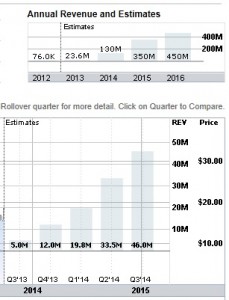

Speaking of revenue:

Analysts are expecting $130 million in revenue next year, $350 million in 2015, $450 in 2016.

Analysts are expecting an EPS of $3.14 for next year, $4.60 in 2015, and $5.95 in 2016

Amazing numbers heading into the next few years. If the company follows through on its plans $UNXL will demand a very high p/e ratio. Couple that with the massive bearish bets being placed on this stock and you have the ingredients for a spectacular move to the upside. Like I did this week when I bought the $16.50 calls for $.40 and sold them on Wednesday as they hit $2.90, I aim to be a buyer of calls on any dip. I am looking farther out to capitalize on the potential move I see coming to the upside.

I think being short here is a foolish trade. Money was made on the ride down in the spring, but with the stock down 60% from those levels the shorts have not given up. They continue to dump borrowed shares into the market and pray that $UNXL does not succeed. While reaching out to god on a daily basis is a good thing, its not a sound investment strategy. I think $UNXL will succeed and this stock will be another one that trades well above anyone's expectations... and this fool will take his profits again and again and again.

Based on those eps estimates even with a ridiculously low p/e pf 10 makes this a 31 dollar stock