Most daytraders close out their positions before the close. Making a living trading stocks is all about controlling your risks, and obviously there is more risk when you hold an equity overnight. Who knows what type of news can come out before the market opens that may impact your holdings. Better to lock-in the gain or loss before the close, and wait for the next trading day. That is, unless you are an option trader. Why? Well some of the most Epic moves come from holding a position over a few days.

Lets use todays move on LinkedIn(LNKD) as an example.

Stocks like LinkedIn (LNKD) are susceptible to volatile moves which is caused by the varying opinions of the 'proper' valuation of the stock. There are those who think a stock with a P/E ratio of 800 is a bubble and then the ones with the foresight(like myself) who are more forward looking, and think LinkedIn (LNKD) is undervalued. Bulls and bears squared off today. With Greece grabbing the headlines again (puke) causing a market sell off, LinkedIn(LNKD) fell over 8% to $101.53.

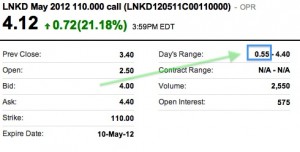

Its at that moment when option traders start to salivate. Not more then 3 trading days ago, LinkedIn (LNKD) traded over $120, now it sat almost 20% off its highs. CALLS! Buying the calls today at that moment would have resulted in some huge returns. But it those who hold for another day or two that may reap the big rewards. Take a look at the possible return today on the LinkedIn (LNKD) $11o calls. $550 into $4,400 possible.

But if you have read our blog, your know we are extremely bullish on LinkedIn(LNKD). Todays action maybe a prelude to the stock trading firmly above $120, which would result in those calls being up substantially more. Time will tell.

Where is the market headed tomorrow? We have used the VIX the last few months as a forward looking indicator, along with some other signals. The VIX pushed through the upper bollie, only to fall back through it. We think this is a key reversal signal. Take a look at the chart below:

The great thing about options is, you only need to be right a few times out of 10 to make some serious cash. Check back after tomorrow and let us know how we did.

You guys millionaires yet? lmao That’s why you need to charge people for your chat room.

Charging for our chat (and other site services) does tend to keep the riff raff out. Riff raff…You know the kind…the scammy scummy pumpy types that like to bring their short-lived friends into low float deathtraps. Thanks for dropping by. — van