It's on to another Chapter in the Year that was 2014. If you missed the first chapter here is the link for it. A Brief synopsis of the first three months of 2014.... stocks went down, they went back up, and then they started to go down again. This next move lower from the end of March into April I call the Tech Wreck of 2014. The Dow Jones Industrial Average hung in there while tech and momentum stocks got killed.

Barrons had a few interesting front pages during this decline, one calling for the Tech Bubble to continue to pop, and the other saying the bull was tired. In each case I penned a response.

The Nasdaq was putting in a wonderful bullish chart pattern. One that would lead to significantly higher prices. Oddly enough there was still tremendous skepticism at the time.

The $QQQ blasted out of the broadening descending wedge that I highlighted on the blog and at http://www.stocktwits.com.

Simply put I thought a break of the wedge would send the $QQQ much higher.

The $QQQ is up well over 18% from those prices after being up over 20% earlier this month. The Tech Wreck of 2014 was, like all other dips, a great buying opportunity.

A couple of excellent posts from April/May 2014

Honey I Shrunk the Investment Account

and my call on the bottom for $BIDU this year

As the month of April ended stocks were still working their way back from the Tech Wreck of 2014 sell off. The HI projections came out and again accurately predicted where the market would head moving into the summer.

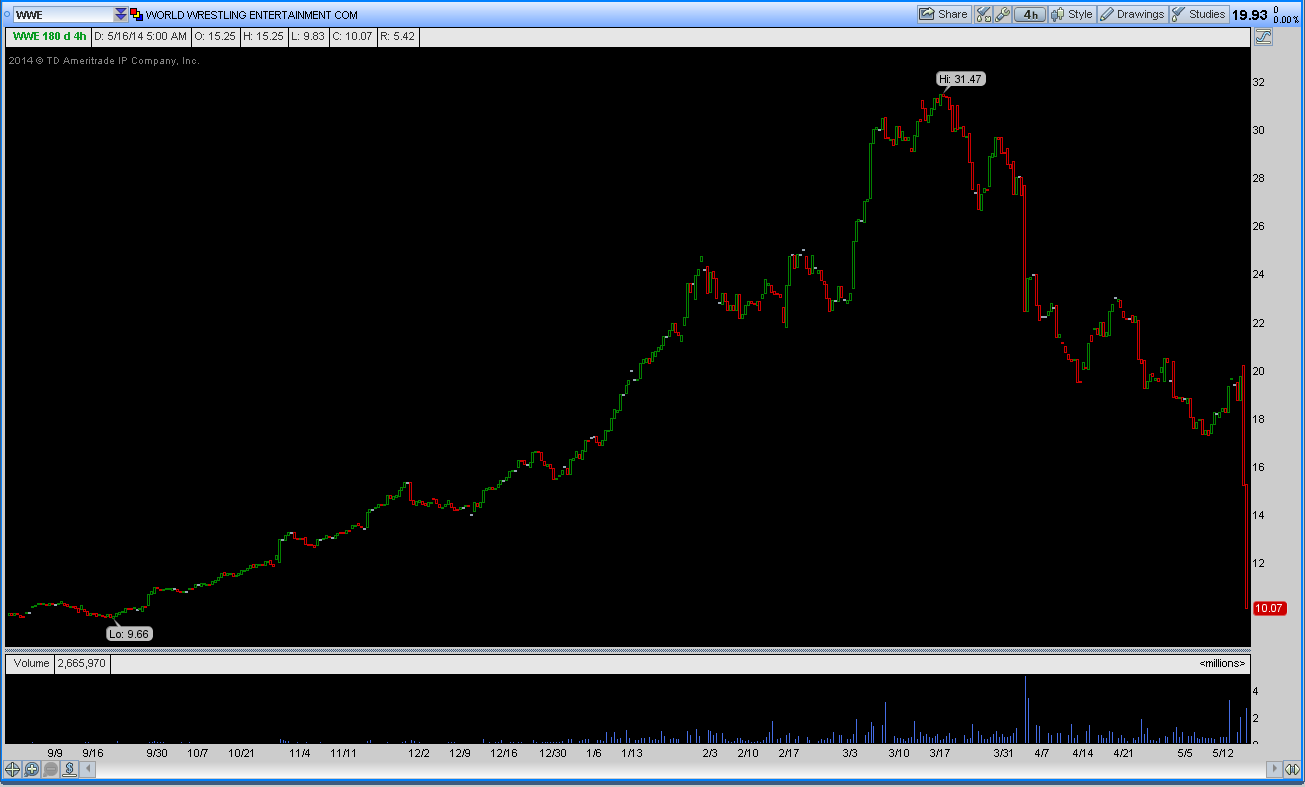

As May moved on stocks continued to head higher, although one stock notably lagged. A yearly high flier into Wrestlemania completely fell on its face dropping some 40% in one session alone. Right about now is historically a great time to get back into $WWE, but the action from last Spring probably has a lot of investors once bitten twice shy.

Some more great articles from May:

Is the Market Headed Higher (Part II)

From the end of May until August stocks slowly grinded higher hitting fresh record high stock prices until the August pull back that brought the bears out of hibernation.

At the end of May there still was not an abundance of bulls. The market top callers and crash prognosticators resumed their swan calls.

As May ended the ECB was on tap for its biggest meeting since the Eurozone crisis.

They were to announce The Nuclear Option

The ECB came and went, stocks continued on the path of least resistance a path that led to frequent record high prices. The slow and methodical price action of the market coupled with the dissipation of headwinds, led to a market that was trading without worry. This led to the VIX falling and the price of stock options falling right along with it. The low VIX and complacency in the market was a recurring item on the financial networks. The VIX bottomed at the end of July.

It was at the start of June when I made a trade that shows exactly why we risk capital to trade out of the money stock options. I had bought some call options earlier in the week in anticipation of a move higher in shares of $AMZN. That move came later in the week. One contract I was in went from $.19 to over $10. That is potentially $190 into $10,000 in two days. The next day those options went to $14 or $190 into $14,000 at the highs.

I covered it here in this AMaZiNg post.

The summer started with some Bear Dancing, Big Bets, and finally a massive call by Jimmybob ---- The Buyout of Opentable.

In his previous weeks webinar JB said Opentable was a rpime buyout candidate. He bought and alerted his buy via private twitter of Opentable calls.

From there the summer really started to heat up. Stocks were about to fall into a new bear market.... at least according to some highly followed twitter tweeters and market pundits.

I'll cover that and more in Part III of Stock Options a Year in Review (Part II)

Come join our community of experienced, energetic, and friendly traders in our chat room. Experinece live audio market commentary, exclusive live webinars, as well as archived videos, posts, charts, and more.

Gain access to the private twitter account where we post what trades we are making in real time.

Free Trial Offer Good Until the end of 2014.

Send an email to optionmillionaires@gmail.com and tell them the Grinch sent you.

(SPOILER ALERT: My 2015 Short Term Chart Perspective is Below)