Last month’s covered call ideas were largely successful as FB, AAPL, TSLA and GOOGL were all full profits while WYNN broke-even. As we head into the next month, the big issue with covered calls is the earnings risk. In navigating this risk I have put together a mix of low and high risk covered calls to average out at around 1-2% return. With the implied volatility very cheap here as the VIX is very low, it is hard to make great returns on covered calls. In high volatility environments it is much easier to make 4-5% a month but at the same time the risks are greater because stocks have crazier moves.

Covered call Trade #1:

FB 110 August Call @$10.70 (with stock price at $119.37)

The return on this trade is a little over 1% with a break even around 108.50. There are a few reasons I like this trade.

- Fundamentally FB is a strong growth name, should FB fall on its earning report it is a name I am comfortable being long come expiration

- $108 represents the Brexit low, which in turn means it is a strong support level. Even if FB misses earnings I anticipate it will bounce from this level and the trade will still be profitable.

- While 1% is not a big return for 1 month, it is a high probability trade given that you would need greater than a 1% drop to lose on this trade

Covered Call Trade #2:

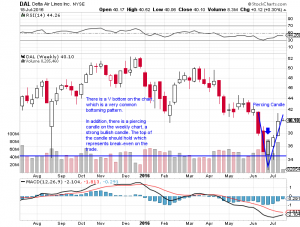

DAL August 37 call @$3.60 (with stock price at $40.10)

The return on this trade is around 1.5% with a breakeven at $36.50

The airlines as a whole are very cheap and couple that with a positive technical picture and I would be more than comfortable buying on a 10% pullback in 1 month.

Why I am bullish technically:

- The MACD on the weekly chart has been negative all year (except for two weeks) and is finally starting to curl back up into positive territory

- Made a high volume bounce three weeks ago around $34, a move down to $36 would retrace 61.8% of the move, a level I think you would see DAL bounce from, at least temporarily

- There is a piercing candle on the weekly chart, which is one of the most bullish candlestick patterns and is many times a reversal signal.

Here is a link for more details on this candlestick pattern: http://www.onlinetradingconcepts.com/TechnicalAnalysis/Candlesticks/PiercingPattern.html

Covered Call Trade #3:

M August 32 call @$3.75 (with the stock price at $35.25).

The return on this trade would be 1.5% with a breakeven at $31.60

All of the retail names have been hit very hard over the last year. M seems to be bottoming out and I do not see it breaking $32 even if it has a bad miss on earnings. A lot of bad news is baked in this name and with the call more than 10% ITM I like the odds of this trade. In addition the MACD is back to positive on the weekly chart. While it is possible M is forming a bear flag on the daily chart, the 32.5 level has held multiple times (Jun, Jul of this year and Nov,Dec of last year).

Covered Call Trade #4:

TSLA $190 covered call at $36.40 (with stock at $226.25).

The return on this trade would be 2% with a breakeven is $186.50

Given how TSLA has bounced from every piece of bad news over the last month I cant imagine an earning report that would send it falling more than 15% over the next month. The stock simply does not want to sell off yet and with these short calls over 15% ITM and a return of 2% I find the r/r very attractive. $190 also represents a post Brexit low, which is key support and is also the level of the lower Bollinger band, which is key support. In addition it is the 38.2% retracement of the rally from February to April. Technically, there are a lot of reasons to want to be a buyer at this level.

CELG August 95 call at $8.80 (with stock at $102.70)

The return on this trade would be 1% with a breakeven at $94.

CELG is one of the highest quality biotech names and has solid earnings growth. Given this, I am comfortable holding the name should it fall on ER. Even better is that it has held $95 the entire year. Given this I would be very happy to have the stock at this price and would consider it a gift. Therefore, I love the r/r on this trade because as long as it holds this level that it has held all year, I will collect 1%.